We have given these Accountancy Class 12 Important Questions and Answers Chapter 7 Issue and Redemption of Debentures to solve different types of questions in the exam. Go through these Class 12 Accountancy Chapter 7 Issue and Redemption of Debentures Class 12 Important Questions and Answers Solutions & Previous Year Questions to score good marks in the board examination.

Issue and Redemption of Debentures Important Questions Class 12 Accountancy Chapter 7

Question 1.

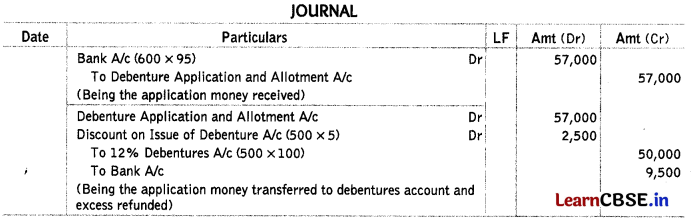

What is meant by ‘Issue of Debentures as Collateral Security’ ₹ (All India 2019: CBSE 2018)

Answer:

When a company issues debentures to the lender as secondary or collateral security, such an issue of debenture is known as debenture issued as collateral security.

![]()

Question 2.

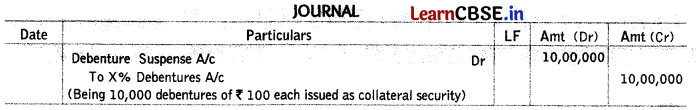

X Ltd invited applications for issuing 500, 12% debentures of ₹ 100 each at a discount of 5%. These debentures were redeemable after three years at par. Applications for 600 debentures were received. Pro-rata allotment was made to all the applicants. Pass necessary journal entries for the issue of debentures assuming that the whole amount was payable with application. (All India 2017)

Answer:

Question 3.

X Ltd invited applications for issuing 1,000, 9% debentures of ₹ 100 each at a discount of 6%. Applications for 1,200 debentures were received. Pro-rata allotment was made to all the applicants.

Pass necessary journal entries for the issue of debentures assuming that the whole amount was payable with application. (Delhi 2017)

Solve as Q no. 2 on page 349.

Discount on Issue of Debentures = ₹ 6,000; Amount Refunded = ₹ 18,800

Question 4.

Give the meaning of ‘debenture’. (Delhi 2014)

Or

What is meant by debenture ₹ (Delhi 2014)

Answer:

It means a document showing a company’s indebtedness, issued under the seal of the company and containing a contract for the repayment of the principal sum at a specified date with interest at a fixed rate.

Question 5.

Give the meaning of a bond. All India (C) 2014

Answer:

Bond is an instrument of acknowledgement of debt, but it does not carry a pre-determined rate of interest.

Question 6.

Give the meaning of issue of debentures as collateral security. (All India 2011)

Or

What is meant by issue of debentures as a collateral security ₹ (All India 2014, 2013(C))

Answer:

When a company issues its own debentures to the lenders as a secondary security in addition to some other asset already pledged or mortgaged, it is called issue of debentures as collateral security.

Question 7.

Pass the necessary journal entry when 10,000 debentures of ₹ 100 each are issued as collateral security against a bank loan of ₹ 8.00.000. (Delhi 2011)

Answer:

Question 8.

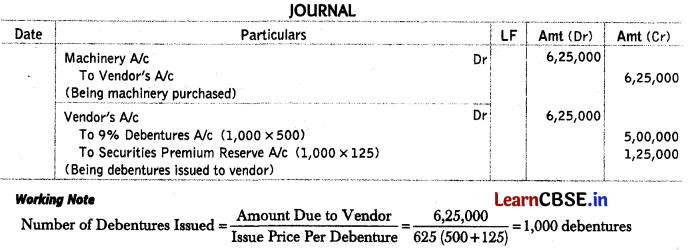

Beta Ltd issued 5,000, 9% debentures of ₹ 500 each. Pass the necessary journal entries for the issue of debentures in the books of the company in the following case. When debentures are issued at a premium of 25% to the vendors for machinery purchased for ₹ 6,25,000. (Delhi 2011)

Answer:

Question 9.

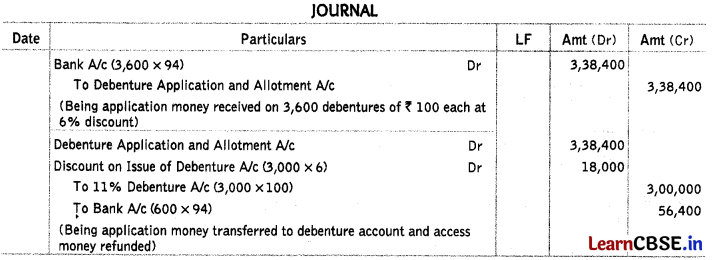

Garvit Ltd invited applications for issuing 3,000, 11% Debentures of ₹ 100 each at a discount of 6%. The full amount was payable on application. Applications were received for 3,600 debentures. Applications for 600 debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applicants. Pass the necessary journal entries for the above transactions in the books of Garvit Ltd. (Delhi 2019)

Answer:

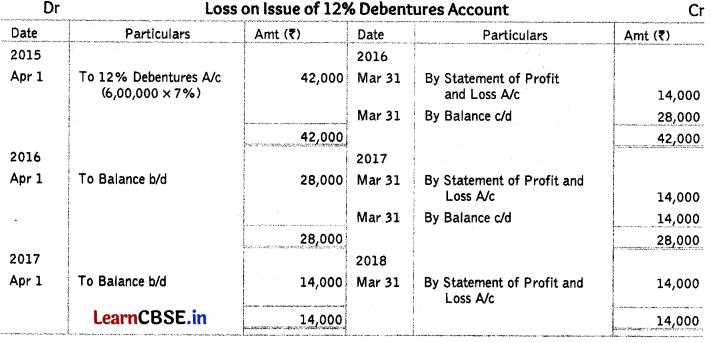

Question 10.

On 1st April, 2015, P Ltd issues 6,000, 12% Debentures of ₹ 100 each at par redeemable at a premium of 7%. The debentures were to be redeemed at the end of third year. Prepare loss on issue of 12% Debentures Account. (Delhi 2019)

Answer:

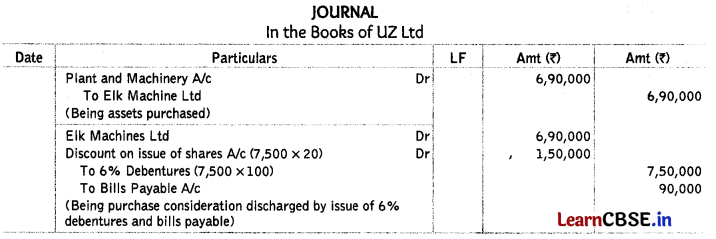

Question 11.

UZ Ltd purchased plant and machinery from Elk Machine Ltd for ₹ 6,90,000. Elk Ltd was paid by accepting a draft of ₹ 90,000 payable after three months and the balance by issue of 6% debentures of ₹ 100 each at a discount of 20%. Pass necessary journal entries for the above transactions in the books of UZ Ltd. (All India 2019)

Answer:

Working Notes:

Number of debentures Issued = \(\frac{6,00,000}{100-20}\) = 7,500 debentures

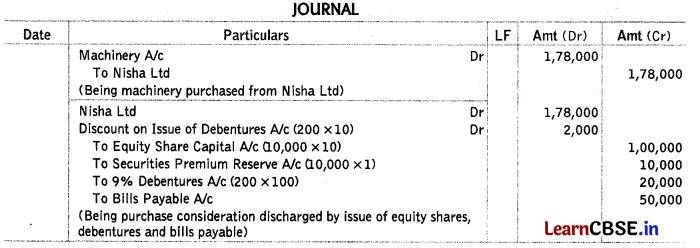

Question 12.

Disha Ltd purchased machinery from Nisha Ltd and paid to Nisha Ltd as follows

(i) By issuing 10,000, equity shares of ₹ 10 each at a premium of 10%.

(ii) By issuing 200, 9% debentures of ₹ 100 each at a discount of 10%.

(iii) Balance by accepting a bill of exchange of ₹ 50,000 payable after one month.

Pass necessary journal entries in the books of Disha Ltd. For the purchase of machinery and making payment to Nisha Ltd. (All india 2017)

Answer:

Working Note:

Purchase Price = (10,000 × 11) + (200 × 90)+50,000 = 1,10,000 + 18,000 + 50,000 = ₹ 1,78,000

Question 13.

Z Ltd purchased machinery from K Ltd, Z Ltd, paid K Ltd as follows

(i) By issuing 5,000 equity shares of ₹ 10 each at a premium of 30%.

(ii) By issuing 1,000, 8% debentures of ₹ 100 each at a discount of 10%.

(iii) Balance by giving a promissory note of ₹ 48,000 payable after two months.

Pass necessary journal entries for the purchase of machinery and payment to K Ltd in the books of Z Ltd. (Delhi 2017)

Answer:

Solve as Q no. 12 on page 352.

Purchase Consideration = ₹ 2,03,000

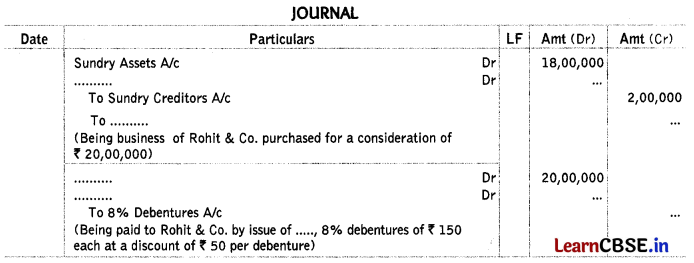

Question 14.

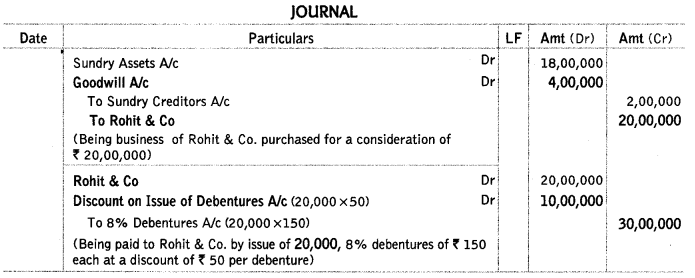

Fill in the blanks in the following case. (All India (C) 2016)

Answer:

Working Notes:

Number of debentures Issued = \(\frac{20,00,000}{150-50}\) = 20,000 debentures

![]()

Question 15.

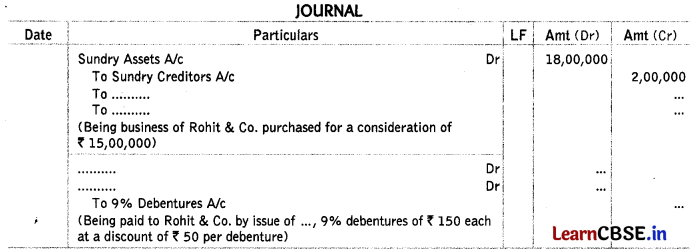

Fill in the blanks in the following case. (Delhi (C) 2016)

Answer:

Solve as Q no. 14 on page 353; Number of Debentures Issued = 15,000; Capital Reserve = ₹ 1,00,000

Question 16.

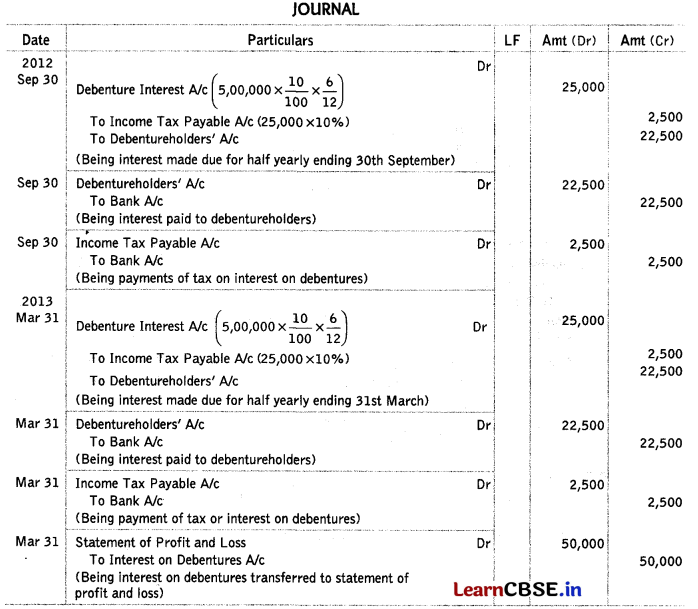

Tata Ltd issued 5,000, 10% debentures of ₹ 100 each on 1st April, 2012. The issue was fully subscribed. According to the terms of issue, interest on debentures is payable half yearly on 30th September and 31st March and tax deducted at source is 10%.

Pass the necessary entries related to the debenture interest for the half yearly ending on 31st March, 2013 and transfer of interest on debentures to statement of profit and loss. (All India 2014)

Answer:

Question 17.

BG Ltd issued 2,000, 12% debentures of ₹ 100 each on 1st April, 2012. The issue was fully subscribed. According to the terms of issue, interest on the debentures is payable half yearly on 30th September and 31st March and the tax deducted at source is 10%. Pass necessary journal entries related to the debenture interest for the half-yearly ending 31st March, 2013 and transfer of interest on debentures of the year to the statement of profit and loss. (Delhi 2014)

Answer:

Solve as Q no. 16 on page 354.

Interest on Debenture Transferred to Statement of Profit and Loss = ₹ 24,000

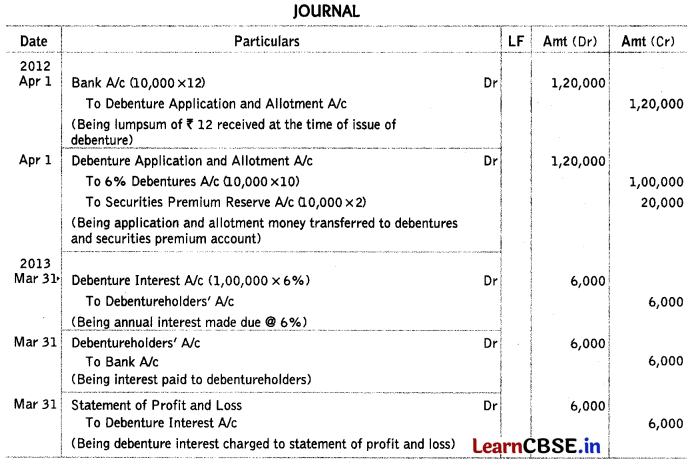

Question 18.

Sargam Ltd issued ₹ 1,00,000, 6% debentures of ₹ 10 each at a premium of ₹ 2 per on 1st April, 2012. The issue was fully subscribed. Interest will be paid at the end financial year. Pass necessary journal entries for the year 2012-13. (All India 2014)

Answer:

Question 19.

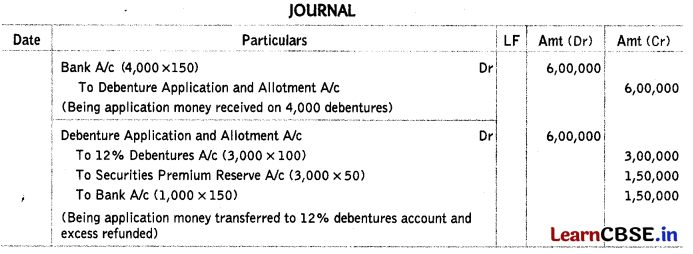

Nav Lakshmi Ltd invited applications for issuing 3,000, 12% debentures of ₹ 100 each at a premium of ₹ 50 per debenture. The full amount was payable on application. Applications were received for 4,000 debentures. Applications for 1,000 debentures were rejected and application money was refunded. Debentures were allotted to the remaining applicants.

Pass necessary journal entries for the above transactions in the books of Nav Lakshmi Ltd. (All India 2012)

Answer:

Question 20.

Narain Laxmi Ltd invited applications for issuing 7,500, 12% debentures of ₹ 100 each at a premium of ₹ 35 per debenture. The full amount was payable on application.

Applications were received for 10,000 debentures. Applications for 2,500 debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applicants.

Pass necessary journal entries for the above transactions in the books of Narain Laxmi Ltd. (Delhi 2012)

Answer:

Solve as Q no. 19 on page 355.

Question 21.

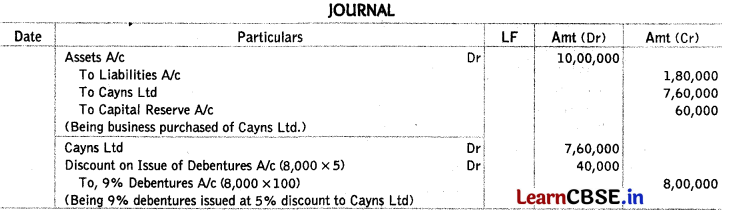

Venus Ltd is a real estate company. To discharge its corporate social responsibility, it decided to construct a night shelter for the homeless. The company took over assets of ₹ 10,00,000 and liabilities of ₹ 1,80,000 of Cayns Ltd for ₹ 7,60,000. Venus Ltd issued 9% debentures of ₹ 100 each at a discount of 5% in full satisfaction of the purchase consideration in favour of Cayns Ltd.

Pass necessary journal entries in the books of Venus Ltd. for the above transactions. (Comportment 2018 Modified)

Answer:

Working Notes:

Number of debentures Issued = \(\frac{7,60,000}{100-5}\) = 8,000 debentures, 9% debentures

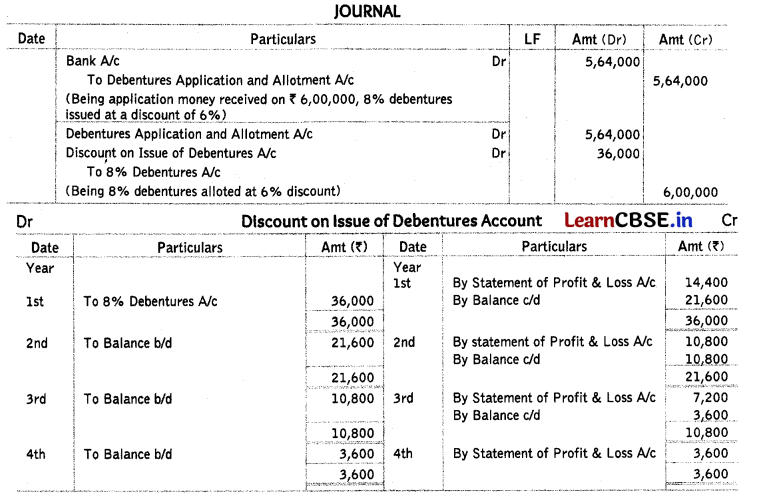

Question 22.

Boots Ltd issued ₹ 6,0,000, 8% debentures at a discount of 6%. The debentures were redeemable in four equal annual instalments. Pass necessary journal entries for issue of debentures and prepare ‘Discount on issue of debentures account’ for four years. Show your workings clearly.

Answer:

Working Notes:

Calculation of amount of discount to be written off every year

Question 23.

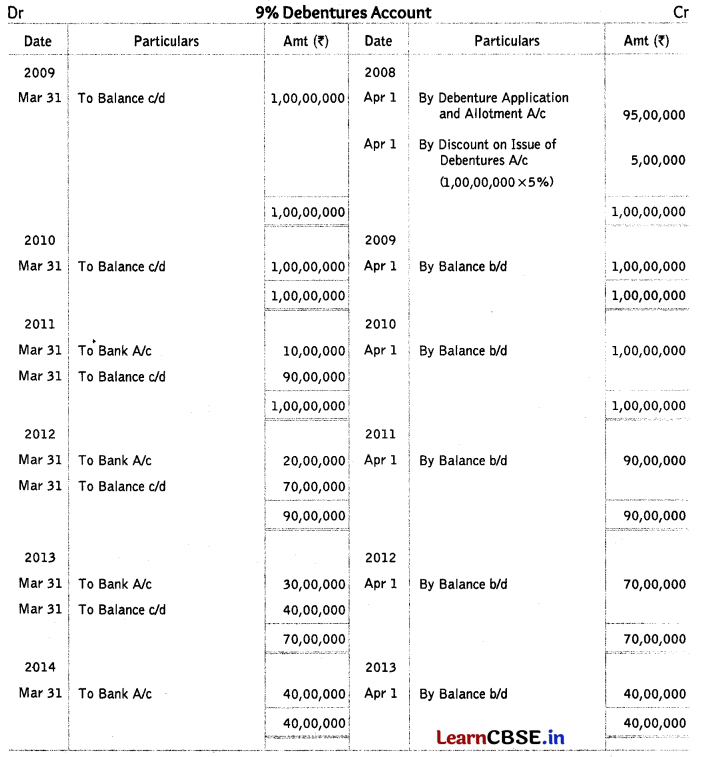

‘Ananya Ltd’ had an authorised capital of ₹ 10,00,00,000 divided into 10,00,000 equity shares of ₹ 100 each. The company had already issued 2,00,000 shares. The dividend paid per share for the year ended 31st March, 2007 was ₹ 30.

The management decided to export its products to African countries. To meet the requirements of additional funds, the finance manager put up the following three alternate proposals before the Board of Directors.

(a) Issue 47,500 equity shares at a premium of ₹ 100 per share.

(b) Obtain a long-term loan from bank which was available at 12% per annum.

(c) Issue 9% debentures at a discount of 5%.

After evaluating these alternatives the company decided to issue 1,00,000, 9% debentures on 1st April, 2008. The face value of each debenture was ₹ 100. These debentures were redeemable in four instalments starting from the end of third year, which was as follows

| Year | Amt (₹) |

| III | 10,00,000 |

| IV | 20,00,000 |

| V | 30,00,000 |

| VI | 40,00,000 |

Prepare 9% debentures account from 1st April, 2008 till all the debentures were redeemed. (All India 2016)

Answer:

Question 24.

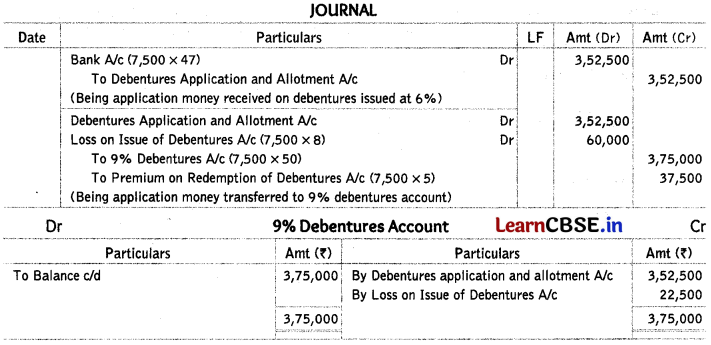

Pass necessary journal entries and prepare 9% debentures account for the issue of 7,500, 9% debentures of ₹ 50 each at a discount of 6%, redeemable at a premium of 10%. (All Indio 2019)

Answer:

Question 25.

X Ltd issued 1,000, 9% Debentures of ₹ 100 each at a discount of 6%. These debentures were redeemable at a premium of 10% after five years.Pass necessary journal entries for issue of debentures and prepare 9% Debentures Account. (All India 2019)

Answer:

Solve as Q. no. 1 on page 360. Loss on Issue of Debentures = ₹ 16,000 9% Debentures Account Balance = ₹ 1,00,000

![]()

Question 26.

On 1st April, 2018, RJ Ltd issued ₹ 10,00,000, 9% debentures of ₹ 100 each at a discount of 10%. These debentures were redeemable at a premium of 5% after four years. Pass necessary journal entries for the issue of debentures and prepare 9% debentures loan account. (All India 2019)

Answer:

Solve as Q. no. 1 on page 360. Loss on Issue of Debentures = ₹ 1,50,000 9% Debentures Account Balance ₹ 10,00,000

Question 27.

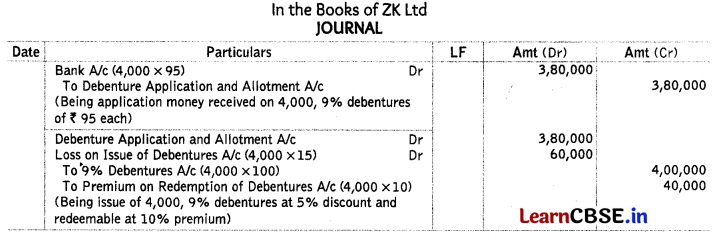

ZK Ltd issued ₹ 4,00,000, 9% debentures of ₹ 100 each at a discount of 5% redeemable at a premium of 10%. Pass necessary journal entries for the above transactions in the books of ZK Ltd. (All Indio 2019)

Answer:

Question 28.

On 2nd March, 2016 L and B Ltd issued 635, 9% debentures of ₹ 500 each. Pass necessary journal entries for the issue of debentures in the following situations

(i) When debentures were issued at 5% discount, redeemable at 10% premium.

(ii) When debentures were issued at 12% premium, redeemable at 6% premium. (All india 2016)

Answer:

Question 29.

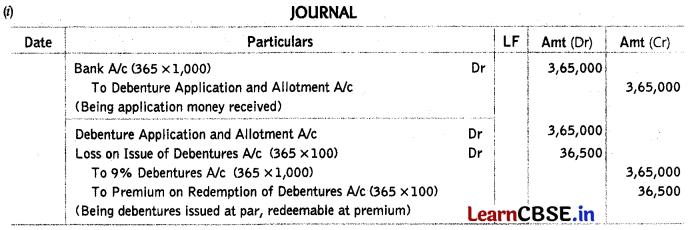

KTR Ltd issued 365, 9% debentures of ₹ 1,000 each on 4th March, 2016. Pass necessary journal entries for the issue of debentures in the following situations

(i) When debentures were issued at par redeemable at a premium of 10%.

(ii) When debentures were issued at 6% discount redeemable at 5% premium. Delhi 2016

Answer:

(i)

Question 30.

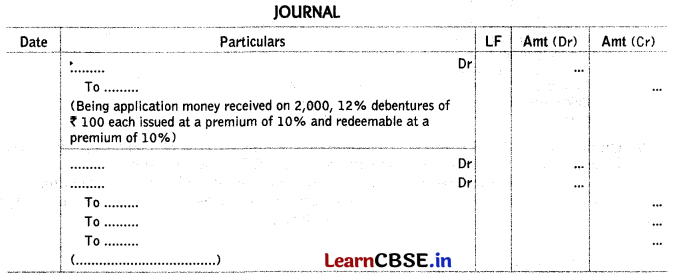

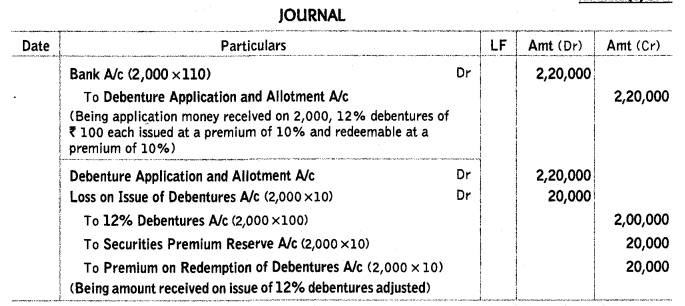

Fill in the blanks in the following case

Answer:

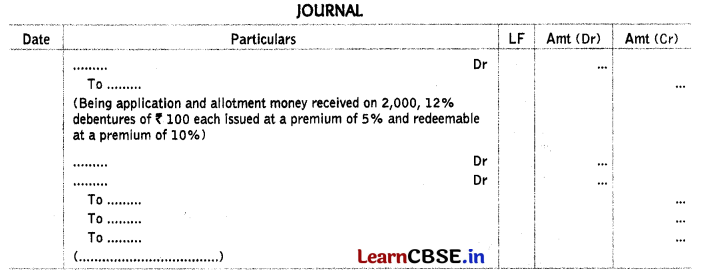

Question 31.

Fill in the blanks in the following case

Answer:

Solve as Q no. 7 on page 362.

Question 32.

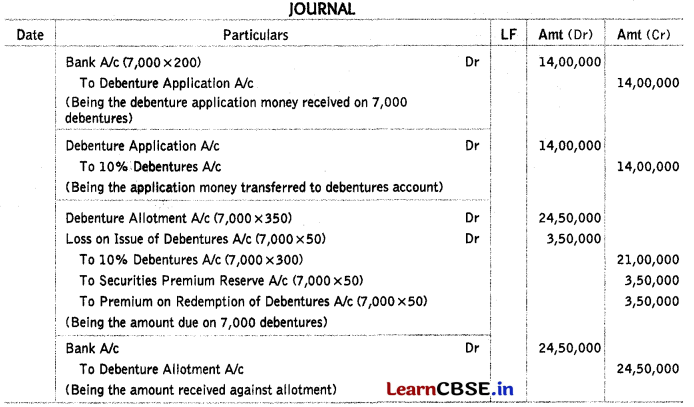

Alok Ltd issued 7,000, 10% debentues of ₹ 500 each at a premium of ₹ 50 per debenture redeemable at a premium of 10% after 5 years. According to the terms of issue, 200 was payable on application and balance on allotment. Record necessary journal entries at the time of issue of 10% debentures. (All India (C) 2015)

Answer:

Question 33.

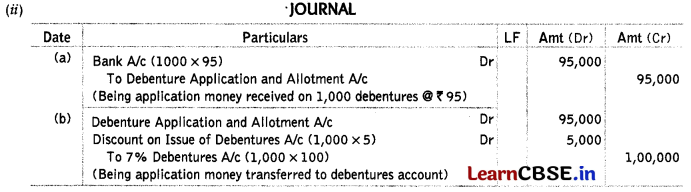

Pass the necessary journal entries for issue of 1,000, 7% debentures of ₹ 100 each in the following cases

(i) Issued at 5% premium, redeemable at a premium of 10%.

(ii) Issued at a discount of 5%, redeemable at par. (Delhi 2013)

Answer:

(i) Solve as Q no. 5 (ii) on page 361.

Question 34.

Pass the necessary journal entries for the issue of debentures in the following cases

(i) ₹ 40,000, 12% debentures of ₹ 100 each issued at a premium of 5% redeemable at par.

(ii) ₹ 70,000,12% debentures of ₹ 100 each issued at a premium of 5% redeemable at ₹ 110. (Delhi 2013)

Answer:

Solve

Question 35.

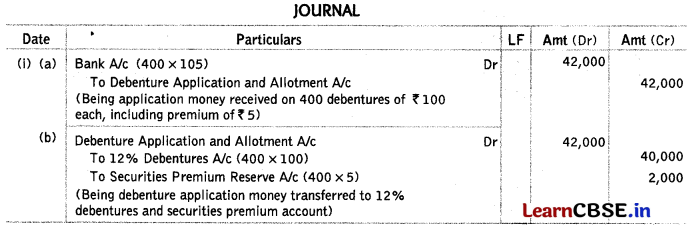

Pass the necessary journal entries for the issue of 7% debentures in the following cases

(i) 200 debentures of ₹ 150 each issued at 10% premium redeemable at ₹ 200 each.

(ii) 200 debentures of ₹ 200 each issued at a discount of 10% redeemable at par. (All India 2013)

Answer:

as

![]()

Question 36.

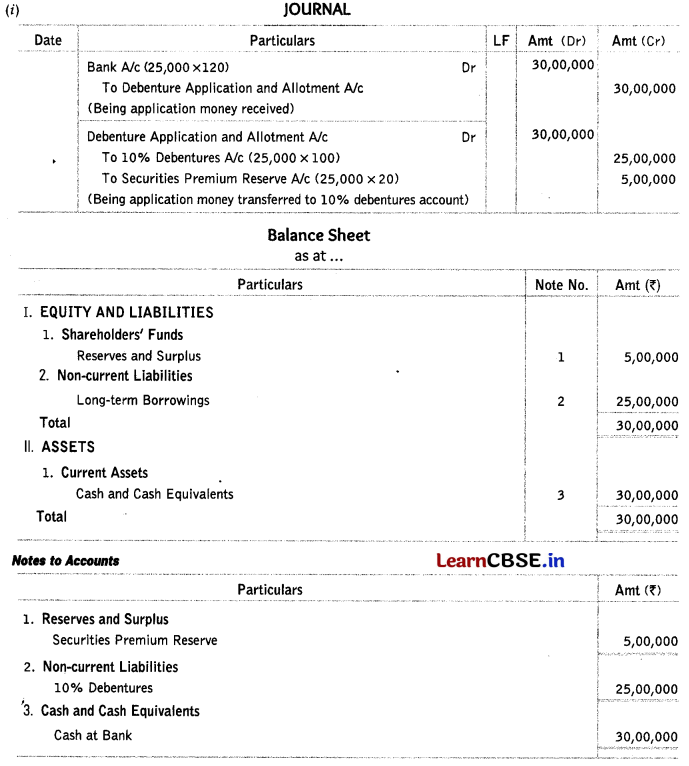

SSS Ltd issued 25,000, 10% debentures of ₹ 100 each. Give journal entries and the balance sheet in each of the following cases when

(i) The debentures were issued at a premium of 20%

(ii) The debentures were issued as a collateral security to bank against a loan of ₹ 20,00,000.

(iii) The debentures were issued to a supplier of machinery costing ₹ 28,00,000 as his full and final payment. (Delhi (C) 2011)

Answer:

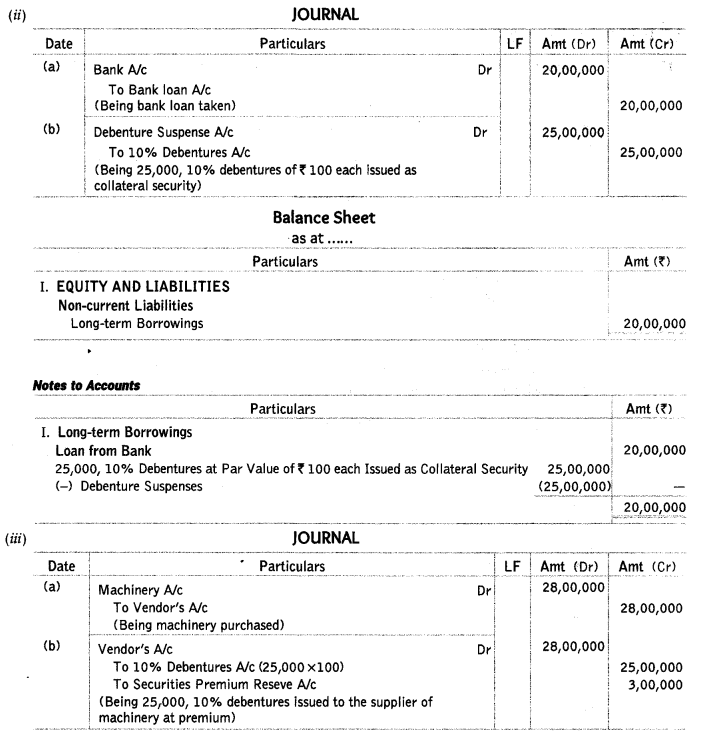

Question 37.

On 1st April, 2015, JK Ltd issued 8,000, 9% debentures of ₹ 1,000 each at a discount of 6%, redeemable at a premium of 5% after 3 years. The company closes its book on 31st March every year. Interest on 9% debentures is payable on 30th September and 31st March every year. The rate of tax deducted at source is 10%. Pass necessary journal entries for the issue of 9% debentures and debenture interest for the year ended 31st March, 2016. (All India 2017)

Answer:

Question 38.

On 1st April, 2015 KK Ltd issued 500, 9% debentures of ₹ 500 each at a discount of 4%, redeemable at a premium of 5% after three years. Pass necessary journal entries for the issue of debentures and debenture interest for the year ended 31st March, 2016 assuming that interest is payable on 30th September and 31st March and the rate of tax deducted at source is 10%. The company closes its books on 31st March every year. (Delhi 2017)

Answer:

Solve as Q no. 14 on page 367 and 368.

Debenture Interest Transferred to Statement of Profit and Loss = ₹ 22,500 (11,250 +11,250)

![]()

Question 39.

State the provisions of Companies Act, 2013 for the creation of debenture redemption reserve. (All India 2019; Delhi 2016)

Answer:

As per Section 71(4) of the Companies Act, 2013 and companies (share capital and debentures) rules, every company issuing debentures is required to create debenture redemption reserve of an amount that is alteast equal to 25% of the nominal (face) value of debentures that are redeemable by it.

Question 40.

Name the account to which the “balance of debenture redemption reserve is transferred after all the debentures have been redeemed. (All India (c) 2015)

Answer:

The balance of debenture redemption reserve is transferred to general reserve, after all the debentures have been redeemed.

Question 41.

When does a company create ‘debenture redemption reserve’? (Delhi (c) 2015)

Answer:

Debenture redemption reserve is a reserve which is created out of profits for the purpose of redemption of debentures.

Question 42.

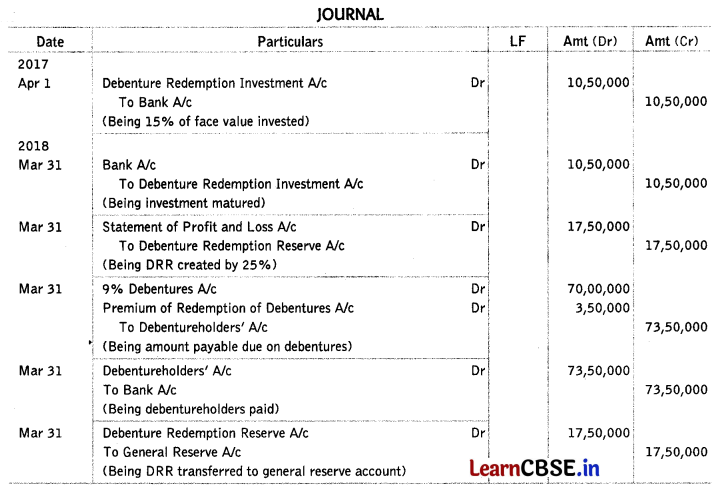

On 1st April, 2013 Anushka Ltd issued ₹ 70,00,000, 9% debentures of ₹ 100 each at par, redeemable at a premium of 5% on 31st March, 2018. The company created the necessary, minimum amount of debenture redemption reserve and purchased debenture redemption reserve investments. The debentures were redeemed on 31st March, 2018.

Pass necessary journal entries for the redemption of debentures, in the books of the company. (Delhi 2019)

Answer:

Question 43.

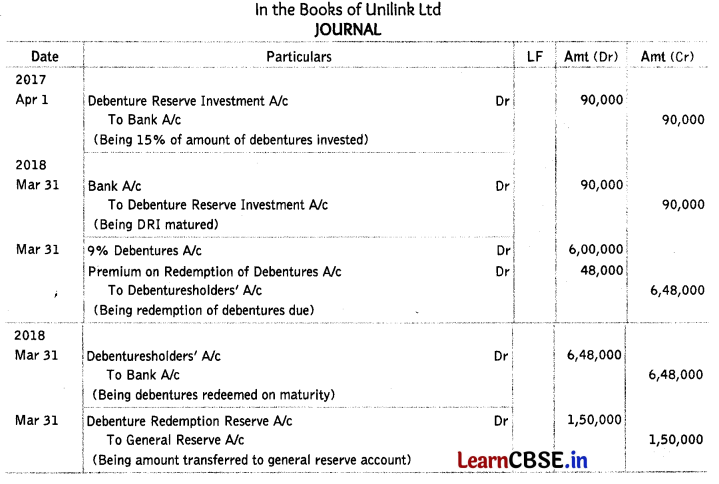

Unilink Ltd had outstanding ₹ 12,00,000, 9% debentures on 1st April, 2014 redeemable at a premium of 8% in two equal annual instalments starting from 31st March, 2018. The company had a balance of ₹ 3,00,000 in Debenture Redemption Reserve on 31st March, 2017. Pass the necessary journal entries for redemption of debentures in the books of Unilink Ltd for the year ended 31st March, 2018. (Delhi 2019)

Answer:

Question 44.

Krishna Ltd had outstanding 20,000, 9% debentures of ₹ 100 each on 1st April, 2014. These debentures were redeemable at a premium of 10% in two equal instalments starting from 31st March, 2018. The company had a balance of ₹ 4,00,000 in Debenture Redemption Reserve on 31st March, 2017. Pass necessary journal entries for redemption of debentures in the books of Krishna Ltd for the year ended 31st March, 2018. (Delhi 2019)

Answer:

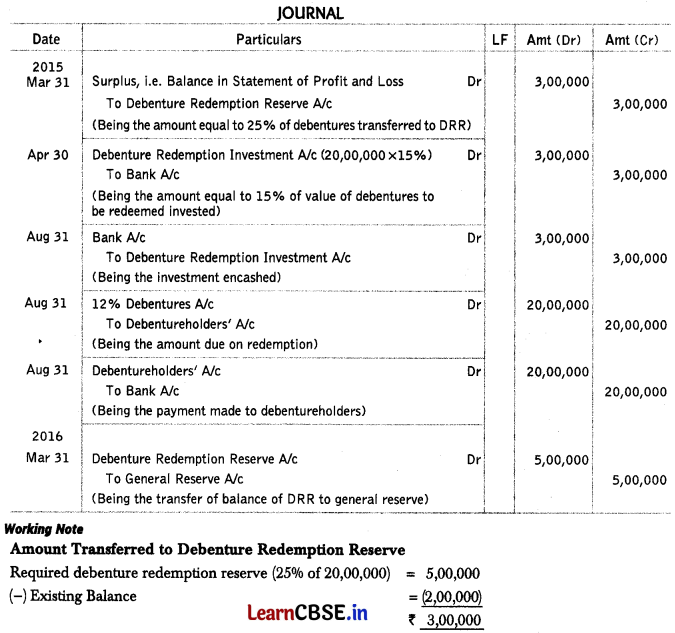

Question 45.

On 1st April, 2013, the following balances appeared in the books of Blue and Green Ltd.

12% debentures (Redeemable on 31st August, 2015) ₹ 20,00,000

Debenture Redemption Reserve ₹ 2,00,000

The company met the requirements of Companies Act, 2013 regarding debenture redemption reserve and debenture redemption investments and redeemed the debentures.

Ignoring interest on investments pass necessary journal entries for the above transactions in the books of company. (All India (C) 2016)

Answer:

Question 46.

Mahima Ltd issued ₹ 38,00,000, 9% debentures of ₹ 100 each on 1st April, 2013. The debentures were redeemable at a premium of 5% on 30th June, 2015. The company transferred an amount of? 9,50,000 to debenture redemption reserve on 31st March, 2015. Investments as required by law were made in fixed deposit of a bank on 1st April, 2015. Ignoring interest on fixed deposit pass necessary journal entries starting from 31st March, 2015 regarding redemption of debentures. (Delhi (C) 2016)

Answer:

Solve as Q no. 7 on page 372 and 373.

Amount Transferred to DRR = ₹ 9,50,000; Debenture Redemption Investment = ₹ 5,70,000

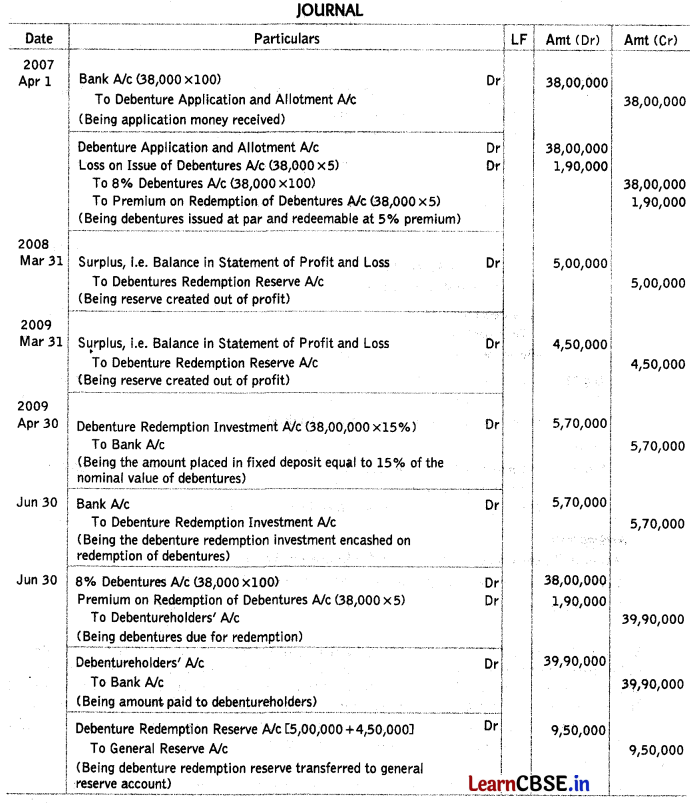

![]()

Question 47.

Manish Ltd issued ₹ 38,00,000, 8% debentures of ₹ 100 each on 1st April, 2007. The terms of issue stated that the debentures were to be redeemed at a premium of 5% on 30th June, 2009. The company decided to transfer out of profits ₹ 5,00,000 to debenture redemption reserve on 31st March, 2008 and ₹ 4,50,000 on 31st March, 2009. Pass necessary journal entries regarding the issue and redemption of debentures, without providing for either the interest or loss on issue of debentures. (All India 2011)

Answer:

Question 48.

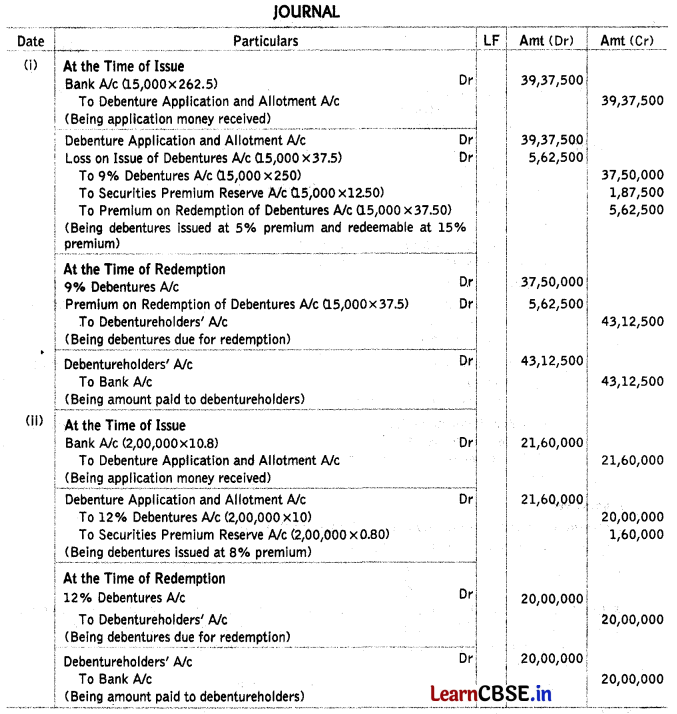

Pass the necessary journal entries for the issue and redemption of debentures in the following cases

(i) 15;000, 9% debentures of ₹ 250 each issued at 5% premium, repayable at 15% premium,

(ii) 2,00,000,12% debentures of ₹ 10 each issued at 8% premium, repayable at par. (All India 2011)

Answer:

Question 49.

Pass the necessary journal entries for the issue and redemption of debentures in the following cases (Delhi 2011)

(i) 10,000, 10% debentures of ₹ 120 each issued at 5% premium, repayable at par.

(ii) 20,000, 9% debentures of ₹ 200 each issued at 20% premium, repayable at 30% premium.

Answer:

Solve as Q no. 10 on page 374 and 375.

Question 50.

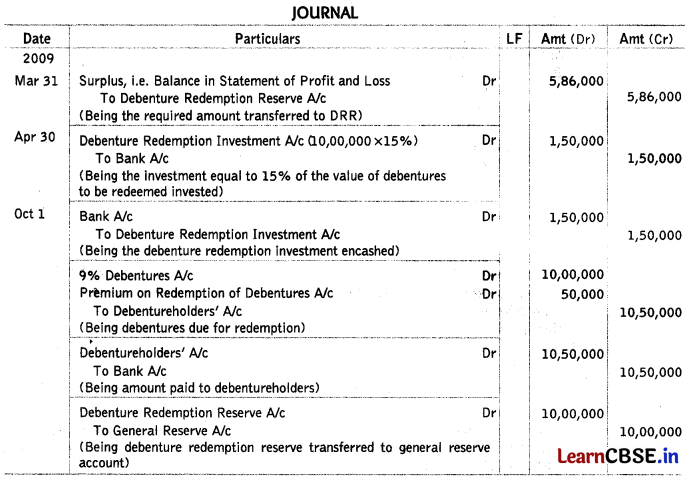

X Ltd has ₹ 10,00,000, 9% debentures due to be redeemed out of profits on 1st October, 2009 at a premium of 5%. The company had a debenture redemption reserve of ₹ 4,14,000. Pass necessary journal entries at the time of redemption. (All India 2010)

Answer:

Working Note:

Amount Transferred to Debenture Redemption Reserve

Required DRR (100% of 10,00,000) = 10,00,000

(-) Existing balance = (4,14,000)

= ₹ 5,86,000

Question 51.

X Ltd had ₹ 8,00,000, 9% debentures due to be redeemed out of profits on 1st October, 2009 at a premium of 5%. The company had a debenture redemption reserve of ₹ 4,14,000. Pass necessary journal entries at the time of redemption. (Delhi 2010)

Answer:

Solve as Q no. 12 on page 375 and 376.

Amount Transferred to Debenture Redemption Reserve = ₹ 3,86,000

Question 52.

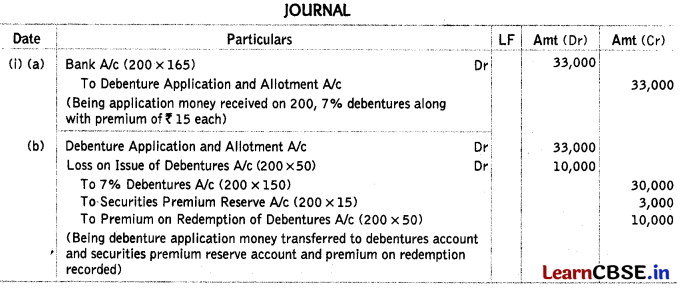

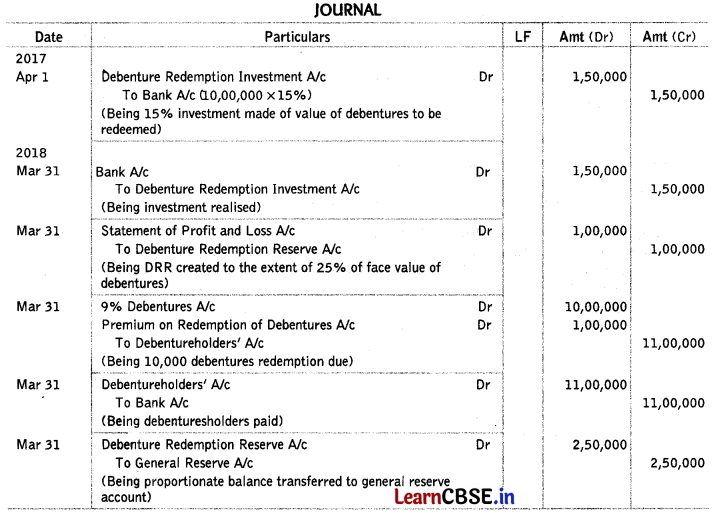

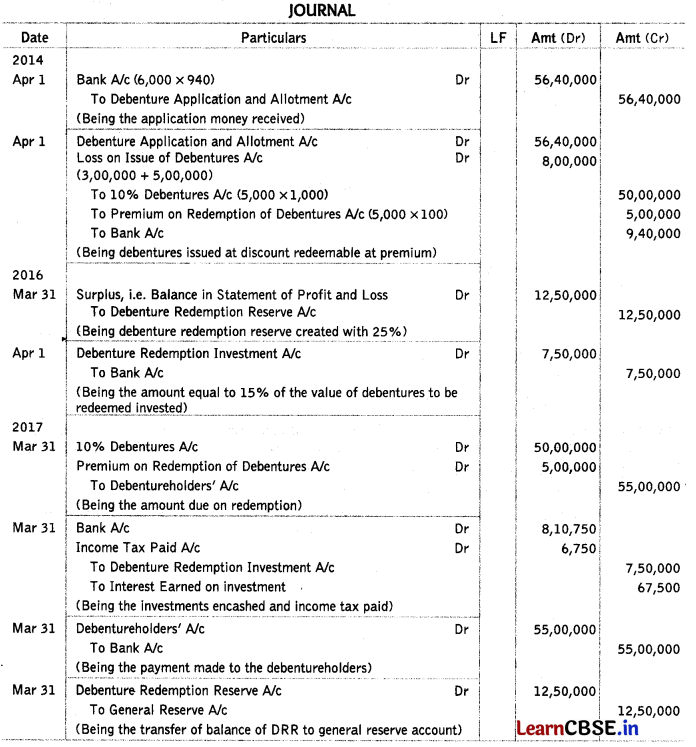

On 1st April, 2014, KK Ltd invited applications for issuing 5,000, 10% debentures of ₹ 1,000 each at a discount of 6%. These debentures were repayable at the end of 3rd year at a premium of 10%. Applications for 6,000 debentures were received and the debentures were allotted on pro-rata basis to all the applicants. Excess money received with applications was refunded.

The directors decided to transfer the minimum amount to debenture redemption reserve on 31st March, 2016. On 1st April, 2016, the company invested the necessary amount in 9% hank fixed deposit as per the provisions of the Companies Act, 2013. Tax was deducted at source by bank on interest @ 10% per annum.

Pass the necessary journal entries for issue and redemption of debentures. Ignore entries relating to writing-off loss on issue of debentures and interest paid on debentures. (CBSE 2018)

Answer:

Working Notes:

1. Calculation of DRR = (5,000 × 1,000) × \(\frac { 25 }{ 100 }\) = ₹ 12,50,000

2. Calculation of DRI = (5,000 × 1,000) × \(\frac { 15 }{ 100 }\) = ₹ 7,50,000

3. Interest earned on investment = 7,50,000 × \(\frac { 9 }{ 100 }\) = ₹ 67,500

4. Tax deducted of source = 67,500 × \(\frac { 10 }{ 100 }\) = ₹ 6,750

![]()

Question 53.

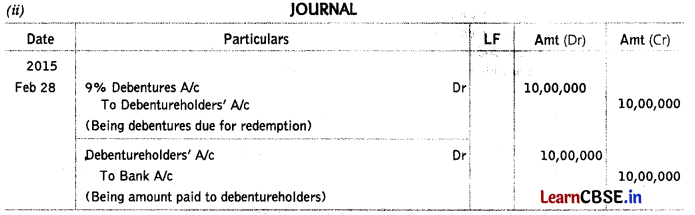

On 1st April, 2013, JMR Ltd had 20,000, 9% debentures of? 100 each outstanding.

(i) On 1st April, 2014 the company purchased in the open market 6,000 of its own debentures for ₹ 98 each and cancelled the same immediately.

(ii) On 28 February, 2015 the company redeemed at par debentures of ₹ 10,00,000 by draw of a lot.

(iii) On 1st March, 2016 the remaining debentures were purchased for immediate cancellation for ₹ 3,99,000.

Ignoring interest on debentures and debenture redemption reserve, pass necessary journal entries for the above transactions in the books of JMR Ltd. (All India 2016)

Answer:

(i) Not in syllabus

Q

Question 54.

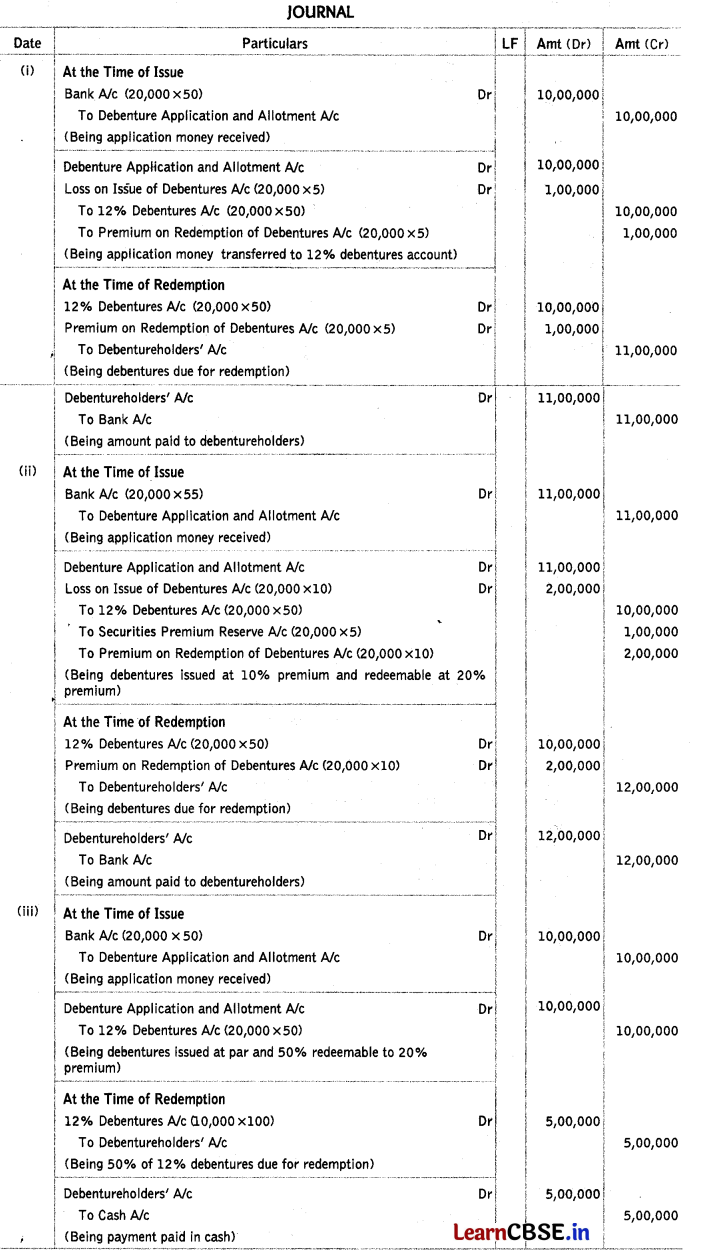

Pass necessary journal entries for the issue and redemption of debentures in the following cases 20,000, 12% debentures of ₹ 50 each were issued and to be redeemed as follows

(i) Issued at par and redeemed at a premium of 10%.

(ii) Issued at a premium of 10% and redeemable at a premium of 20%.

(iii) Issued at par and 50% of the redemption to be made in cash. (All India 2011 Modified)

Answer:

Question 55.

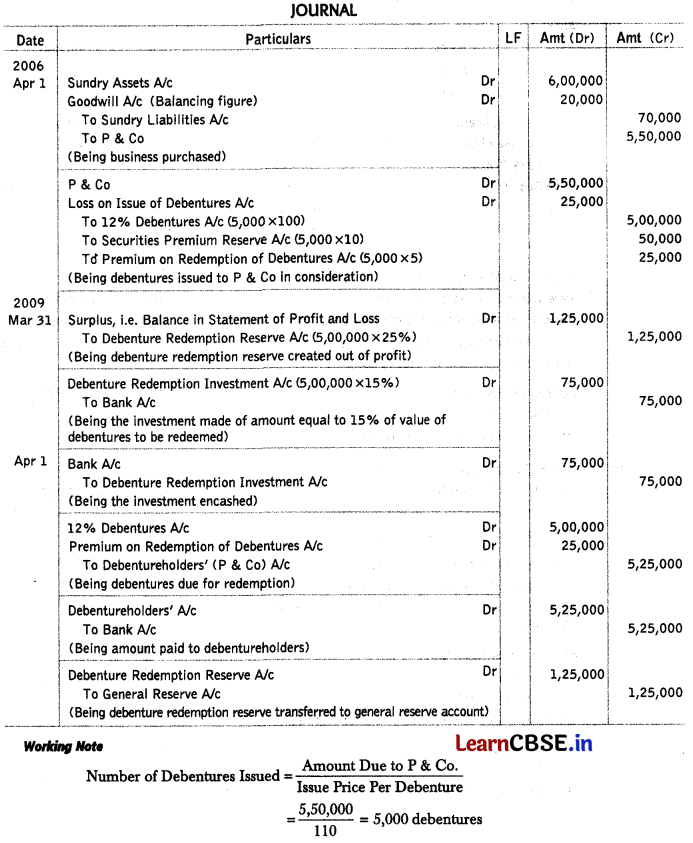

Devi Ltd on 1st April, 2006, acquired assets of the value of ₹ 6,00,000 and liabilities worth ₹ 70,000 from P & Co at an agreed value of ₹ 5,50,000. Devi Ltd issued 12% debentures of ₹ 100 each at a premium of 10% in full satisfaction of purchase consideration. The debentures were redeemable 3 years later at a premium of 5%. Pass journal entries to record the above including redemption of debentures. (Delhi; All India 2010 Modified)

Answer:

Question 56.

Debentures are generally redeemable after a certain period. This period is decided by company which can be

(a) less than 20 years

(b) more than 20 years

(c) more than 25 years

(d) None of these

Answer:

(a) less than 20 years

![]()

Question 57.

A company AB Ltd issued 12% debentures of ₹ 10,p0,000 of ₹ 100 each to public. In the terms of issue, these debentures are redeemable after 10 months ending on 31st January, 2018. Interest is payable on monthly basis. These debentures will be shown in balance sheet as on 31st March, 2017 under the heading

(a) long-term liability

(b) current liability

(c) fixed assets

(d) current assets

Answer:

(b) current liability

Question 58.

Discount on issue of debentures is

(a) capital loss

(b) capital income

(c) revenue loss

(d) revenue income

Answer:

(a) capital loss

Question 59.

When debentures are issued at lumpsum, journalise the acceptance of application of debentures from public.

(a) Bank A/c Dr

To Debenture Application A/c

(b) Debenture Application A/c Dr

To X% Debentures A/c

(c) Debenture Application and Allotment A/c Dr

To X% Debentures A/c

(d) None of the above

Answer:

(c) Debenture Application and Allotment A/c Dr

To X% Debentures A/c

Question 60.

Journalise the writing-off discount on issue of debentures, when company has all reserves and profits required to cover this loss.

(a) General Reserve A/c Dr

To Statement of Profit and Loss

To Discount on Issue of Debentures A/c

(b) Discount on Issue of Debentures A/c Dr

To General Reserve A/c

To Statement of Profit and Loss

(c) Loss on Issue of Debentures A/c Dr

To Statement of Profit and Loss

(d) None of the above

Answer:

(d) None of the above

Question 61.

A Ltd issued 5,000, 10% debentures @ 100 each at a discount of ₹ 10. Amount was payable as follows application ₹ 50, balance on allotment. All amount due were received on time except a holder of 1,000 debentures who did not pay allotment. Journalise the entry for receipt of allotment.

(a) Bank A/c Dr – 2,50,000

To Debenture Allotment A/c – 2,50,000

(b) Bank A/c Dr – 1,60,000

To Debenture Allotment A/c – 1,60,000

(c) Bank A/c Dr – 2,00,000

To Debenture Allotment A/c – 1,60,000

To Discount on Issue of Debentures A/c – 40,000

(d) None of the above

Answer:

(b) Bank A/c Dr – 1,60,000

To Debenture Allotment A/c – 1,60,000

Question 62.

Holder of debentures as a collateral security is entitled to

(a) interest on debentures

(b) dividend

(c) commission

(d) None of the above

Answer:

(d) None of the above

Question 63.

A company ABC Ltd has purchased an asset costing ₹ 11,00,000. Vendor issued 9% debentures of ₹ 100 each at 10% premium as consideration against asset purchased. Calculate number of debentures to be issued?

(a) 10,000 debentures

(b) 11,000 debentures

(c) 12,000 debentures

(d) 13,000 debentures

Answer:

(a) 10,000 debentures

Question 64.

A company has taken a loan of ₹ 20,00,000. The lender took 8% debentures as collateral. The director of the company wants to journalise this collateral. Accountant does not know the exact entry and has passed the following entries. Advise him as to which entry is correct?

(a) Lender Dr – 20,00,000

To 8% Debentures A/c – 20,00,000

(b) Bank Loan A/c Dr – 20,00,000

To 8% Debentures A/c – 20,00,000

(c) Debenture Suspense A/c Dr – 20,00,000

To 8% Debentures A/c – 20,00,000

(d) None of the above

Answer:

(c) Debenture Suspense A/c Dr – 20,00,000

To 8% Debentures A/c – 20,00,000

![]()

Question 65.

S Ltd bought business of R Ltd and purchase consideration is to be decided by net asset value method. Total assets and liabilities which were taken over were ₹ 11,20,000 and ₹ 2,00,000 respectively. ₹ 2,00,000 was paid in cash and for the balance amount, 6% debentures of ₹ 100 each were issued at a premium of 20%. Pass journal entry of issue of debentures in the books of S Ltd.

(a) R Ltd Dr – 7,20,000

To 6% Debentures A/c – 6,00,000

To Security Premium Reserve A/c – 1,20,000

(b) R Ltd Dr – 7,20,000

To 6% Debentures A/c – 7,20,000

(c) R Ltd Dr – 9,20,000

To Cash A/c – 2,00,000

To 6% Debentures A/c – 7,20,000

(d) None of the above

Answer:

(a) R Ltd Dr – 7,20,000

To 6% Debentures A/c – 6,00,000

To Security Premium Reserve A/c – 1,20,000