We have given these Accountancy Class 12 Important Questions and Answers Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner to solve different types of questions in the exam. Go through these Class 12 Accountancy Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner Class 12 Important Questions and Answers Solutions & Previous Year Questions to score good marks in the board examination.

Reconstitution of Partnership Firm: Admission of a Partner Important Questions Class 12 Accountancy Chapter 3

Question 1.

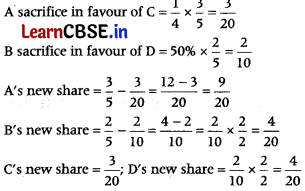

A and B were partners in a firm sharing profits in the ratio of 3 : 2. C and D were admitted as new partners. A sacrificed \(\frac { 1 }{ 4 }\)th of his share in favour of sacrificed 50% of his share in favour of D Calculate the new profit sharing ratio of A, B, C and D. (All India 2019)

Answer:

New ratio = 9 : 4 : 3 : 4

Question 2.

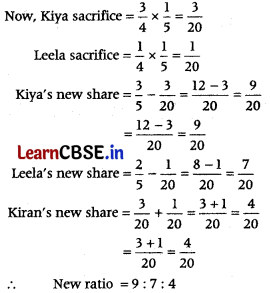

Kiya and Leela are partners sharing profits in the ratio of 3 : 2. Kiran was admitted as a new partner with \(\frac { 1 }{ 5 }\)th share in the profits and brought in ₹ 24,000 as her share of goodwill premium that was credited to the capital accounts of Kiya and Leela respectively with ₹ 18,000 and ₹ 6,000. Calculate the new profit sharing ratio of Kiya, Leela and Kiran. (All India 2019)

Answer:

Premium for goodwill ₹ 24,000 brought in by new partner Kiran was distributed among old partners was ₹ 18,000 and ₹ 6,000, i.e. in the sacrificing ratio of 3 : 1.

Question 3.

Atul and Neera were partners in a firm sharing profits in the ratio of 3 : 2. They admitted Mitali as a new partner. Goodwill of the firm was valued at ₹ 2,00,000. Mitali brings her share of goodwill premium of ₹ 20,000 in cash, which is entirely credited to Atul’s capital account. Calculate the new profit sharing ratio. (Delhi 2019)

Answer:

Firms goodwill = ₹ 2,00,000

Premium for goodwill brought in by new partner Mitali = ₹ 20000

So, Mitali s share = \(\frac { 20000 }{ 200000 }\) = \(\frac { 1 }{ 10 }\)

Premium for goodwill is entirely credited to Atul’s capital account means only Atul sacrifice.

So, Arid’s sacrificing ratio = \(\frac { 1 }{ 10 }\)

∴ Atuls new share = \(\frac{3}{5}-\frac{1}{10}=\frac{6-1}{10}=\frac{5}{10}\)

Neera’s new share = \(\frac{2}{5} \times \frac{2}{2}=\frac{4}{10}\)

Mitali’s new share = \(\frac { 1 }{ 10 }\) = \(\frac { 1 }{ 10 }\)

New Ratio = 5 : 4 : 1

![]()

Question 4.

Amit and Beena were partners in a firm sharing profits and losses in the ratio of 3 : 1 Chaman was admitted as a new partner for \(\frac { 2 }{ 5 }\)th share in the period. Chaman acquired \(\frac { 2 }{ 5 }\)th of his share from Amit. How much share did Chaman acquire from Beena? (CBSE 2018)

Answer:

Chaman’s share = \(\frac { 1 }{ 6 }\)

Share acquired from Amit = \(\frac{2}{5} \times \frac{1}{6}=\frac{2}{30}\)

Share acquired from Beena = Chaman’s share – Share acquired from Amit

Share acquired from Beena = \(\frac{1}{6}-\frac{2}{30}=\frac{5-2}{30}=\frac{3}{30}\)

Question 5.

A and B were partners in a firm sharing profits and losses in the ratio of 5 : 3. They admitted C as a new partner. The new profit sharing ratio between A, B and C was 3 : 2 : 3. A surrendered \(\frac { 2 }{ 5 }\)th of his share in favour of C. Calculate B’s 1 sacrifice. (All India 2017)

Answer:

Calculation of B’s Sacrifice

B’s Sacrifice = Old Share – New Share

= \(\frac{3}{8}-\frac{2}{8}=\frac{3-2}{8}=\frac{1}{8}\)

Question 6.

Durga and Naresh were partners in a firm. They wanted to admit five more members in the firm. List any two categories of individuals other than minors who cannot be admitted by them. (All India 2017)

Answer:

The individuals other than minors who cannot be admitted by the them are

(i) Person of unsound mind

(ii) Person disqualified by law

Question 7.

A and B were partners in a firm sharing profits and losses in the ratio of 4 : 3. They admitted C as a new partner. The new profit sharing ratio between A, B and C was 3 : 2 : 2. A surrendered 1/4 of his share in favour of C. Calculate B’s sacrifice. (Delhi 2017)

Answer:

Solve as Q no. 5 on page 97, B’s sacrifice = \(\frac { 1 }{ 7 }\)

Question 8.

Gupta and Sharma were partners in a firm. They wanted to admit two more members in the firm. List the categories of individuals other than minors who cannot be admitted by them. (Delhi 2017)

Answer:

Refer to Q no. 6 on page 97.

Question 9.

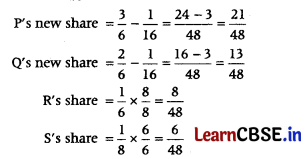

P, Q and R were partners in a firm sharing profits in the ratio of 3 : 2 : 1. They admitted S as a new partner for \(\frac { 1 }{ 8 }\)th share in the profits which he acquired \(\frac { 1 }{ 18 }\)th from P and \(\frac { 1 }{ 16}\)th from Q. Calculate new profit sharing ratio of P, Q, R and S. (Delhi: All India 2016)

Answer:

Profit sharing ratio of P : Q : R = 3 : 2 : 1

S is admitted for \(\frac { 1 }{ 8}\)th share which he acquires \(\frac { 1 }{ 16}\)th from P and \(\frac { 1 }{ 16}\)th from Q.

New profit sharing ratio of P : Q : R : S is 21 : 13 : 8 : 6

Question 10.

Nishtha and Anshu were partners sharing profits in the ratio of 3 : 2. They admitted Jyoti as a new partner for 3/10th share which she acquired 2/10th from Nishtha and 1/10th from Anshu. Calculate the new profit sharing ratio of Nishtha, Anshu and Jyoti. (All India (C) 2016)

Answer:

Solve as Q no. 9 on page 97.

New profit sharing ratio of Nishtha : Anshu : Jyoti = 4 : 3 : 3

Question 11.

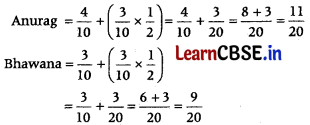

Anurag and Bhawana entered into partnership on 1st April, 2014. On 1st January, 2015 they admitted Monika 3 as a new partner for \(\frac { 3 }{ 10}\)th share in the profits which she acquired equally from Anurag and Bhawana. The new profit sharing ratio of Anurag, Bhawana and Monika was 4 : 3 : 3. Calculate the profit sharing ratio of Anurag and Bhawana at the time of forming the partnership. (Foreign 2015)

Answer:

New ratio = 4 : 3 : 3

Old share of Anurag and Bhawana is 11: 9.

Question 12.

State the rights acquired by a newly admitted partner. (All India 2014: Delhi 2011)

Answer:

(i) Share in the future profits of the firm,

(ii) Share in the assets of the firm.

Question 13.

What is meant by sacrificing ratio? (All India (C) 2014)

Or

State the meaning of sacrificing ratio. (All India 2011)

Answer:

It is the ratio in which the old partners have agreed to sacrifice their share of profits in favour of new or incoming partner.

Sacrificing Ratio = Old Share – New Share

Question 14.

List any two items that need adjustments in the books of accounts of a firm at the time of admission of a partner. (All India 2014)

Answer:

Two items that need adjustment at the time of admission are

(i) Goodwill of the firm.

(ii) Reserves and accumulated profits/losses.

Question 15.

X and Y are partners. Y wants to admit his son K into business. Can K become the partner of the firm? Give reason. (Delhi (C) 2014)

Answer:

K can be admitted as a partner with the consent of X, and that to if he is a major.

![]()

Question 16.

State any one purpose for admitting a new partner in a firm. (All India 2012)

Answer:

A new partner may be admitted for the following purpose: For procuring additional capital.

Question 17.

A and B are partners sharing profits in the ratio of 5 : 4. They admit C for 1/10th share of profit which he acquires in equal proportion from both. Find the new profit sharing ratio. (Delhi (C) 2011)

Answer:

Old ratio = 5 : 4; C’s share = \(\frac { 1 }{ 10}\)th

Which he acquires in equal proportion from both,

∴ New ratio among A, B and C = 91 : 71 : 18

Question 18.

A and B are partners sharing profits in the ratio of 5 : 4. They admit C for 1/3rd share, which he acquires in equal proportion from both. Find the new profit sharing ratio. (All India 2011)

Answer:

Solve as Q no. 17 on page 98.

New Profit Sharing Ratio of A, B and C = 7 : 5 : 6

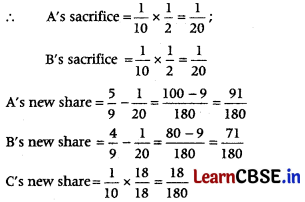

Question 19.

(i) Rajeev and Sanjeev are partners in a firm sharing profits in the ratio of 3 : 2 respectively. They admit Vijay as a new partner. Rajeev surrenders \(\frac { 1 }{ 4}\) of his share and Sanjeev \(\frac { 1 }{ 4}\) of his share in favour of Vijay. Calculate new profit sharing ratio of Rajeev, Sanjeev and Vijay.

(ii) Anita and Sunita are partners in a firm sharing profits in the ratio of 3 : 2 respectively. They admitted Vinita as a new partner for \(\frac { 1 }{ 4}\)th share. The new profit sharing ratio between Anita and Sunita will be 2 : 1. Calculate their sacrificing ratio. (Delhi 2014)

Answer:

(i) Old ratio between Rajeev and Sanjeev = 3 : 2

(ii) Old ratio between Anita and Sunita = 3 : 2

Vinita is admitted for \(\frac { 1 }{ 4}\)th share.

Remaining share = 1 – \(\frac { 1 }{ 4}\) = \(\frac { 3 }{ 4}\) which will be

shared among Anita and Sunita in the ratio of 2 : 1. Accordingly,

Anita’s new share = \(\frac{3}{4} \times \frac{2}{3}=\frac{2}{4}\)

Sunita’s new share = \(\frac{3}{4} \times \frac{1}{3}=\frac{1}{4}\)

∴ New profit sharing ratio = 2 : 1 : 1

Sacrificing Ratio = Old Share – New Share

Anita = \(\frac{3}{5}-\frac{2}{4}=\frac{12-10}{20}=\frac{2}{20}\)

Sunita = \(\frac{2}{5}-\frac{1}{4}=\frac{8-5}{20}=\frac{3}{20}\)

∴ Sacrificing ratio = 2 : 3

Question 20.

(i) Rohan and Mohan are partners in a firm sharing profits in the ratio of 5 : 3 respectively. They admit Bhim as a partner for \(\frac { 1 }{ 7}\)th share in the profit. The new profit sharing ratio will be 4 : 2 : 1. Calculate the sacrificing ratio of Rohan and Mohan.

(ii) Amla and Kamla are partners in a firm sharing profits in the ratio of 4 : 1 respectively. They admitted Bimla as a new partner for \(\frac { 1 }{ 4}\)th share in the

profits, which she acquired wholly from Amla. Determine the new profit sharing ratio of the partners. (Delhi (C) 2014)

Answer:

(i) Old ratio between Rohan and Mohan = 5 : 3

New ratio after Bhim’s admission = 4 : 2 : 1

Sacrificing Ratio = Old Share – New Share

Rohan = \(\frac{5}{8}-\frac{4}{7}=\frac{35-32}{56}=\frac{3}{56}\)

Mohan = \(\frac{3}{8}-\frac{2}{7}=\frac{21-16}{56}=\frac{5}{56}\)

∴ Sacrificing ratio = 3 : 5

(ii) Old ratio between Amla and Kamla = 4 : 1

Bimla is admitted for \(\frac { 1 }{ 4}\)th share, which she gets wholly from Amla. Accordingly,

New share of Amla = \(\frac{4}{5}-\frac{1}{4}=\frac{16-5}{20}=\frac{11}{20}\)

Share of Kamla = \(\frac { 1 }{ 5}\); Share of Bimla = \(\frac { 1 }{ 4}\)

∴ New ratio = \(\frac{11}{20}: \frac{1}{5}: \frac{1}{4}\) = 11 : 4 : 5

Question 21.

On 1st April, 2010 Sahil and Charu entered into partnership for sharing profits in the ratio of 4 : 3. They admitted Tanu as a new partner on 1st April, 2012 for \(\frac { 1 }{ 5}\)th share which she acquired equally from Sahil and Charu. Sahil, Charu and Tanu earned profits at a higher rate than the normal rate of return for the year ended 31st March, 2013. Therefore, they decided to expand their business. To meet the requirements of additional capital they admitted Puneet as a new partner on 1st April, 2013 for \(\frac { 1 }{ 7}\)th share in profits which he acquired from Sahil and Charu in 7 : 3 ratio. Calculate

(i) New profit sharing ratio of Sahil, Charu and TanuTor the year 2012-13.

(ii) New profit sharing ratio of Sahil, Charu, Tanu and Puneet on Puneet’s admission. (Delhi 2015)

Answer:

(i) Calculation of New Profit Sharing Ratio of Sahil, Charu and Tanu for the year 2012-13

Tanu is admitted for \(\frac { 1 }{ 5}\) th share

Tanu acquired profit share from Sahil = \(\frac{1}{5} \times \frac{1}{2}=\frac{1}{10}\)

Tanu acquired profit share form Charu = \(\frac{1}{5} \times \frac{1}{2}=\frac{1}{10}\)

Sahil’s New Share = Old Share – Sacrifice Share

= \(\frac{4}{7}-\frac{1}{10}=\frac{40-7}{70}=\frac{33}{70}\)

New profit sharing ratio will be = \(\frac{33}{70}: \frac{23}{70} \div \frac{1}{5}\)

= \(\frac { 33:23:14 }{ 70 }\) or 33 : 24 : 14

(ii) Calculation of New Profit Sharing Ratio

Old ratio = 33 : 23 : 14

Puneet is admitted for \(\frac { 1 }{ 7 }\)th share

Which he acquired from Sahil and Cham in 7 : 3 ratio

Puneet acquired share from Sahil = \(\frac{1}{7} \times \frac{7}{10}=\frac{7}{70}\)

Puneet acquired share from Charu = \(\frac{1}{7} \times \frac{3}{10}=\frac{3}{70}\)

Sahil s new share = \(\frac{33}{70}-\frac{7}{70}=\frac{26}{70}\)

Charu’s new share = \(\frac{23}{70}-\frac{3}{70}=\frac{20}{70}\)

New Ratio = \(\frac{26}{70}: \frac{20}{70}: \frac{14}{70}: \frac{1}{7}\)

⇒ \(\frac{26}{70}: \frac{20}{70}: \frac{14}{70}: \frac{10}{70}\)

Or 13 : 10 : 7 : 5

![]()

Question 22.

Vinay and Naman are partners sharing profit in the ratio of 4 : 1. Their capitals were ₹ 90,000 and ₹ 70,000 respectively. They admitted Prateek for 1/3 share in the profits. Prateek brought ₹ 1,00,000 as his capital. Calculate the value of firm’s goodwill. Compartment 2tn8

Answer:

Prateek’s Capital for – share = ₹ 1,00,000

Firm’s Total Capital = 1,00,000 × 3 = ₹ 3,00,000

On the basis of Prateek’s Capital,

Firm Actual Capital = 90000 + 70000 + 100000 = ₹ 2,60,000

Firm’s goodwill = 300000 – 2,60000 = ₹ 40,000

Question 23.

A, B, C and D were partners in a firm sharing profits in the ratio of 4 : 3 : 2 : 1. On 1st January, 2015, they admitted E as a new partner for \(\frac { 1 }{ 10 }\)th share in the profits. E brought ₹ 10,000 for his share of goodwill premium which was correctly recorded in the books by the accountant. The accountant showed goodwill at ₹ 1,00,000 in the books. Was the accountant correct in doing so? Give reason in support of your answer. (Delhi 2015)

Answer:

No, the accountant is not correct because according to AS-26, internally generated goodwill shall not be recognised as an asset because it is not an identifiable resource controlled by the entity that can be measured reliably at cost.

Question 24.

When the new partner brings cash for goodwill, the amount is credited to which account? (Delhi (C) 2015)

Answer:

When the new partner brings cash for goodwill, the amount is credited to premium for goodwill account.

Question 25.

Under what circumstances will the premium for goodwill paid by the incoming partner not be recorded in the books of accounts? (Delhi (C) 2014)

Answer:

When the incoming partner pays his share of goodwill privately to the sacrificing partners, outside the business, then no entry is passed in the books of the firm.

Question 26.

State the need for treatment of goodwill on admission of a partner. (Delhi 2010)

Answer:

When a new partner is admitted, his share in future profits of the firm is equal to the sacrifice of profit by an existing partner or partners of the firm. The amount he pays to compensate this sacrifice, is in the form of goodwill. Therefore, it is important to treat goodwill at the time of admission of a partner.

Question 27.

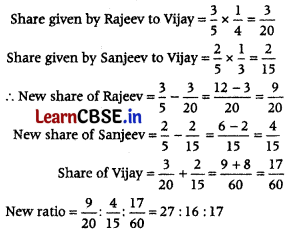

A, B, C and D were partners in a firm sharing profits and losses equally. E was admitted as a new partner for \(\frac { 1 }{ 3 }\)rd share in the profits of the firm which he acquires equally from C and 3 D. On E’s admission the goodwill of the firm was valued at ₹ 3,00,000. Calculate the new profit sharing ratio on E’s admission. Also pass necessary journal entry on E’s admission, assuming that he failed to bring his share of goodwill in cash. (All India 2019)

Answer:

E’s Share = \(\frac { 1 }{ 3 }\)rd which he acquires equally from C and D.

2. Firms goodwill = ₹ 3,00,000; E’s share of goodwill = 3,00,000 × \(\frac { 1 }{ 3 }\) = ₹ 1,00,000 to be distributed among sacrificing partners i.e. C and D in sacrificing ratio of 1 : 1

Question 28.

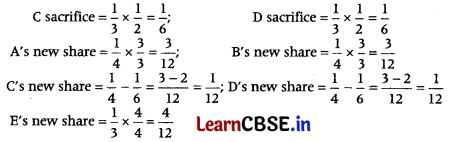

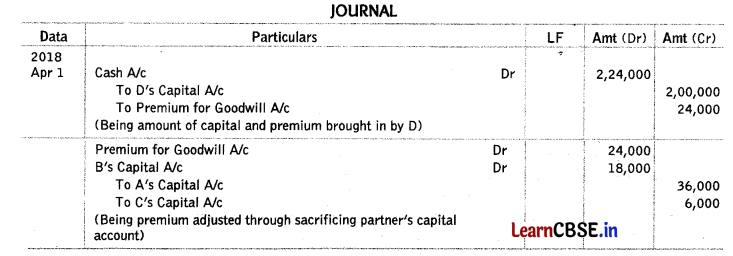

A, B and C were partners in a firm sharing profits in the ratio of 2 : 1 : 1. On 1st April, 2018 they admitted D as a new partner. D brought ₹ 2,00,000 for his capital and ₹ 24,000 for his share of goodwill premium. The new profit sharing ratio between A, B, C and D will be 1 : 2 : 1 : 1.

Pass necessary journal entries for the above transactions in the books of the firm on D’s admission. (All India 2019)

Answer:

Working Notes:

1. Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Share – New Share

2. \(\frac { 1 }{ 5 }\)th share of goodwill = ₹ 24,000

Firms goodwill = 24,000 × 5 = ₹ 1,20,000

B would compensate = 1,20,000 × \(\frac { 3 }{ 20 }\) = ₹ 18,000

A would sacrifice =1,20,000 x \(\frac { 6 }{ 20 }\) = ₹ 36,000

C would sacrifice =1,20,000 x \(\frac { 1 }{ 20 }\) = ₹ 6,000

![]()

Question 29.

Devi, Dayal and Daya were partners in a firm sharing profits in the ratio of 2 : 1 : 2. On 31st March, 2018, they admitted Divya as a new partner for -th share in theprofits. Their new profit sharing ratio was 1 : 2 : 1 : 1. Divya bought ₹ 5,00,000 as her capital and ₹ 50,000 for her share of goodwill premium.

Pass necessary journal entries for the above transactions in the books of the firm on Divya’s admission. (All India)

Answer:

Solve as Q. No. 7 on page 103-104; Sacrificing or Gaining Ratio = Devi \(\frac { 1 }{ 5 }\), and Dayal (\(\frac { 1 }{ 5 }\)), and daya \(\frac { 1 }{ 5 }\)

Debit premium for goodwill account and Dayal’s capital account with ₹ 50,000 each and credit Devi’s and Daya’s capital accounts with ₹ 50,000 each.

Question 30.

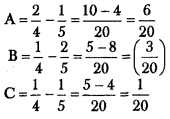

L, M and N were partner in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 1st April, 2018 they admitted S as a new partner in the firm for 1/5th share in the profits. On S’ admission the goodwill of the firm was valued at 3 years purchase of last five average profits. The profits during the last five year were:

Table

Calculate the value of the goodwill of the firm. Pass necessary journal entry for the treatment of goodwill on S’s admission. (Delhi 2019)

Answer:

5 Years Average Profit = \(\frac{4,00,000+3,00,000+2,00,000+50,000+(50,000)}{5}\) = ₹ 108000

Firm’s Goodwill = 5 Years Average Profit x No. of Years Purchase = 1,80,000 x 3 = ₹ 5,40,000

S’s share of goodwill = 5,40,000 x \(\frac { 1 }{ 5 }\) = ₹ 108000

NOTE: it is not clearly mentioned in the question that new partners S bring his share of goodwill in cash or not. So, it Is assumed that goodwill premium is brought in cash.

Alternatively, entry for not bringing goodwill premium in cash can be passed.

Question 31.

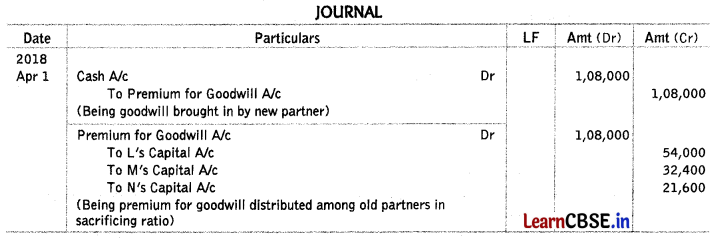

Amit and Kartik are partners sharing profits and losses equally. They decided to admit Saurabh for an equal share in the profits. For this purpose, the goodwill of the firm was to be valued for four years’ purchase of super profits.

The Balance Sheet of the firm of Saurabh’s admission was as follows:

The normal rate of return is 12% per annum. Average profit of the firm for the last four years was ₹ 30,000. Calculate Saurabh’s share of goodwill. (comportment 2018)

Answer:

Capital Employed = Amit’s Capital + Kartik’s Capital + Reserve = 90000 + 50000 + 20000 = ₹ 1,60,000

2 12 f Normal Profit = Capital Employed x Normal Rate of Return = 100000 × \(\frac { 12 }{ 100 }\) = ₹ 19,200

Average Profit = ₹ 30,000

Super Profit = Average Profit – Normal Profit = 30000 – 19200 = ₹ 10,800

Firms Goodwill = Super Profit x Number of Years Purchase = 10000 x 4 = ₹ 43,200

Saurabh’s Share of Goodwill = 43200 x \(\frac { 1 }{ 3 }\) = ₹ 14,400

Question 32.

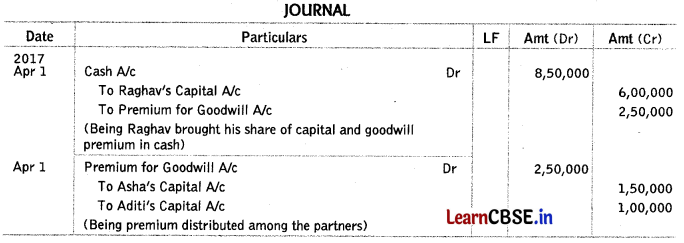

Asha and Aditi are partners in a firm sharing profits and losses in the ratio of 3 : 2. They admit Raghav as a partner for \(\frac { 1 }{ 4 }\)th share in the profits of the firm Raghav brings ₹ 6,00,000 as his capital and his share of goodwill in cash. Goodwill of the firm is to be valued at two years’ purchase of average profits of the last four years.

The profits of the firm during the last four years are given below

Table 2

The following additional information is given

(i) To cover management cost an annual charge of ₹ 56,250 should be made for the purpose of valuation of goodwill.

(ii) The closing stock for the year ended 31st March, 2017 was overvalued by ₹ 15,000.

Pass necessary journal entries on Raghav’s admission showing the working notes clearly. (CBSE 2018)

Answer:

Working Note:

Calculation of Adjusted Profit

2013- 14 3,50,000 – 56,250 = 2,93,750

2014- 15 4,75,000 – 56,250 = 4,18,750

2015- 16 6,70,000 – 56,250 = 6,13,750

2016- 17 7,45,000 – 56,250 – 15,000 = 6,73,750

Total profit =2,93,750 + 4,18,750 + 613,750 + 6,73,750 = ₹ 20,00,000

Average profit = \(\frac { 20,00,000 }{ 4 }\) = ₹ 5,00,000

Goodwill = Average Profit × Number of Years’ Purchase

= 5,00,000 × 2 = ₹ 10,00,000

Raghav’s share of goodwill =10,00,000 × \(\frac { 1 }{ 4 }\) = ₹ 2,50,000 to be shared by Asha and Aditi in 3 : 2 ratio.

Question 33.

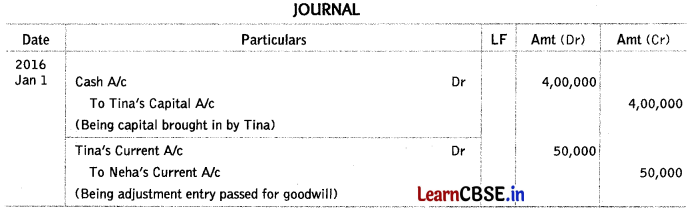

Madhu and Neha were partners in a firm sharing profits and losses in the ratio of 3 : 5. Their fixed capitals were f 4,00,000 and ₹ 6,00,000 respectively. On 1st January, 2016. Tina was admitted as a new partner for \(\frac { 1 }{ 4 }\)th share in the profits. Tina acquired her share of profit from Neha. Tina brought ₹ 4,00,000 as her capital which was to be kept fixed like the capitals of Madhu and Neha. Calculate the goodwill of the firm on Tina’s admission and the new profit sharing ratio of Madhu, Neha and Tina. Also, pass necessary journal entry for the treatment of goodwill on Tina’s admission considering that Tina did not bring her share of goodwill premium in cash. (All India 2017)

Answer:

Calculation of New Profit Sharing Ratio:

Madhu’s share = \(\frac { 3 }{ 8 }\)(same as before)

Neha s share = \(\frac{5}{8}-\frac{1}{4}=\frac{5-2}{8}=\frac{3}{8}\)

Tina’s share = \(\frac{1}{4} \times \frac{2}{2}=\frac{2}{8}\)

New profit sharing ratio of Madhu : Neha : Tina = 3 : 3 : 2

Calculation of Goodwill of the Firm on Tina’s Admission

Working Notes:

1. Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Share – New Share

Madhu = \(\frac{3}{8}-\frac{3}{8}=\frac{3-3}{8}\) = Nil; Neha = \(\frac{5}{8}-\frac{3}{8}=\frac{5-3}{8}=\frac{2}{8}\)

Tina’s share of goodwill 2,00,000 × \(\frac { 1 }{ 4 }\) = ₹ 50,000

![]()

Question 34.

Karan and Varun were partners in a firm sharing profits and losses in the ratio of 1 : 2. Their fixed capitals were ₹ 2,00,000 and ₹ 3,00,000 respectively. On 1st April, 2016, Kishore was admitted as a new partner for \(\frac { 1 }{ 4 }\)th share in the profits. Kishore brought ₹ 2,00,000 for his capital which was to be kept fixed like the capitals of Karan and Varun. Kishore acquired his share of profit from Varun.

Calculate goodwill of the firm on Kishore’s admission and the new profit sharing ratio of Karan, Varun and Kishore. Also, pass necessary journal entry for the treatment of goodwill on Kishore’s admission considering that Kishore did not bring his share of goodwill premium in cash. (Delhi 2017)

Answer:

Solve as Q no. 12 on page 107.

Hidden goodwill = ₹ 1,00,000

New profit sharing ratio of Karan : Varun : Kishore =4 : 5 : 3

Debit Kishore’s current account with ₹ 25,000 and credit Vanin’s current account with ₹ 25,000.

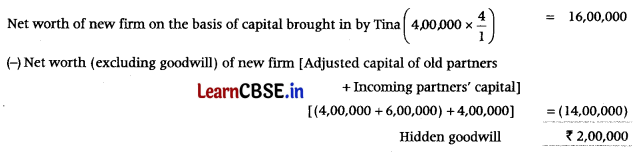

Question 35.

Anu and Bhagwan were partners in a firm sharing profits in the ratio of 3 : 1. Goodwill appeared in the books at ₹ 4,40,000. Raja was admitted to the partnership. The new profit sharing ratio among Anu, Bhagwan and Raja was 2 : 2 : 1. Raja brought ₹ 1,00,000 for his capital and necessary cash for his goodwill premium. The goodwill of the firm was valued at ₹ 2,50,000. Record the necessary journal entries in the books of the firm for the above transactions. (All India 2015)

Answer:

Working Note:

Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Share – New Share

Anu = \(\frac{3}{4}-\frac{2}{5}=\frac{15-8}{20}=\frac{7}{20}\)

Bhagwan = \(\frac{1}{4}-\frac{2}{5}=\frac{5-8}{20}=\left(\frac{3}{20}\right)\) gain

Since Bhagwan is gaining, he will also compensate Anu proportionately.

Bhagwan will compensate = 2,50,000 × \(\frac { 3 }{ 20 }\) = ₹ 37,500

Question 36.

Hemant and Nishant were partners in a firm sharing profits in the ratio of 3 : 2. Their capitals were ₹ 1,60,000 and ₹ 1,00,000 respectively. They admitted Somesh on 1st April,

2013 as a new partner for \(\frac { 1 }{ 5 }\)th share in the future profits. Somesh brought f 1,20,000 as his capital. Calculate the value of goodwill of the firm and record necessary journal entries for the above transactions on Somesh’s admission. (All India 2014)

Answer:

Solve as Q no. 12 on page 107.

Debit Somesh’s capital account with ₹ 44,000 and credit Hemant’s and Nishant’s capital accounts with ₹ 26,400 and ₹ 17,600 respectively; Hidden goodwill = ₹ 220000

Question 37.

Saloni and Shrishti were partners in a firm sharing profits in the ratio of 7 : 3. Their capitals were ₹ 2,00,000 and ₹ 1,50,000 respectively. They admitted Aditi on 1st April, 2013 as a new partner for 1/6th share in future profits. Aditi brought ₹ 1,00,000 as her capital. Calculate the value of goodwill of the firm and record necessary journal entries for the above transaction on Aditi’s admission. (Delhi 2014)

Answer:

Solve as Q no. 12 on page 107.

Hidden goodwill = ₹ 1,50,000

Debit Aditi’s capital account with ₹ 25,000 and credit Saloni’s capital account and Shrishti’s capital account with ₹ 17,500 and ₹ 7,500 respectively.

Question 38.

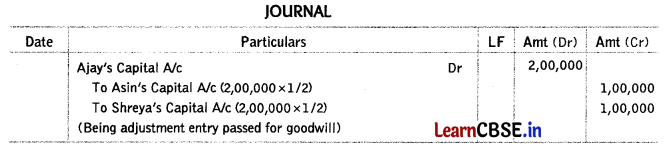

Asin and Shreya are partners in a firm. They admit Ajay as a new partner with 1/5th share in the profits of the firm. Ajay brings ₹ 5,00,000 as his share of capital. The value of the total assets of the firm was ₹ 15,00,000 and outside liabilities were valued at ₹ 5,00,000 on that date. Give the necessary journal entry to record goodwill at the time of Ajay’s admission. Also, show your workings. (All India 2013)

Answer:

Working Note:

1. Calculation of Ajay’s Share of Goodwill

(a) New firm’s capital on the basis of Ajay’s capital and his profit share = 5,00,000 x \(\frac { 5 }{ 1 }\) = ₹ 25,00,000

(b) Adjusted Capital of Old Partners = Assets – Liabilities

Value of hidden goodwill (a – b) = 25,00,000 – 15,00,000 = ₹ 10,00,000

Ajay’s share = 10,00,000 x \(\frac { 1 }{ 5 }\) = ₹ 2,00,000

2. Sacrificing ratio has been taken as equal as old partners’ profit sharing ratio is not given.

Question 39.

Abhay and Beena are partners in a firm. They admit Chetan as a partner with 1/4th share in the profits of the firm. Chetan brings ₹ 2,00,000 as his share of capital. The value of the total assets of the firm is ₹ 5,40,000 and outside liabilities are valued at ₹ 1,00,000 on that date. Give the necessary entry to record goodwill at the time of Chetan’s admission. Also show your working notes. (Delhi 2013)

Answer:

Solve as Q no. 17 on page 109.

Hidden goodwill = ₹ 1,60,000

Debit Chetan’s capital account with ₹ 40,000 and credit Abhay and Beena’s capital account with ₹ 20,000 respectively.

Question 40.

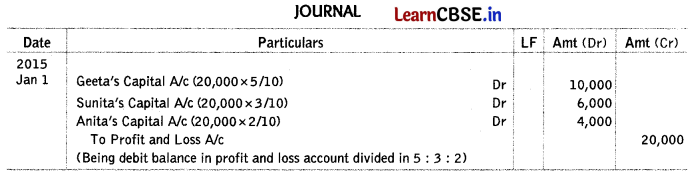

Geeta, Sunita and Anita were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 1st January, 2015 they admitted Yogita as a new partner for 1/10th share in the profits. On Yogita’s admission, the profit and loss account of the firm was showing a debit balance of ₹ 20,000 which was credited by the accountant of the firm to the capital accounts of Geeta, Sunita and Anita in their profit sharing ratio. Did the accountant give correct treatment? Give reason in support of your answer. (All India 2015)

Answer:

No, the accountant has done wrong treatment. The correct treatment would be as under

Question 41.

When a new partner is admitted, the balance of general reserve appearing in the balance sheet at the time of admission is credited to which account? (All India (C) 2015)

Answer:

The balance of general reserve appearing in the balance sheet at the time of admission is credited to capital accounts of old partners.

Question 42.

Why are assets and liabilities revalued at the time of admission of a partner? (Delhi (C) 2014)

Answer:

Assets and liabilities are revalued at the time of admission of a partner, so that profit or loss arising on account of revaluation, may be adjusted among old partners in their old profit sharing ratio, since it belongs to them.

Question 43.

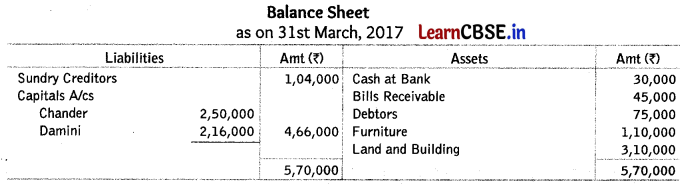

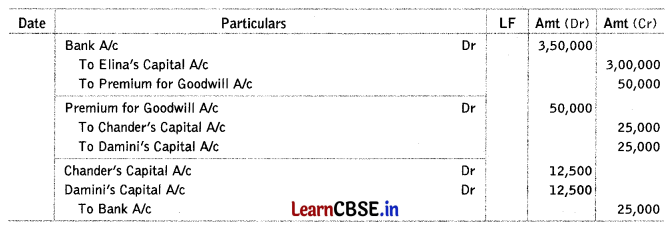

Chander and Damini were partners in a firm sharing profits and losses equally. On 31st March, 2017 their balance sheet was as follows

On 1st April, 2017, they admitted Elina as a new partner for \(\frac { 1 }{ 3 }\)rd share in the profits on the following conditions.

(i) Elina will bring ₹ 3,00,000 as her capital and ₹ 50,000 as her share of goodwill premium, half of which will be withdrawn by Chander and Damini.

(ii) Debtors to the extent of ₹ 5,000 were unrecorded.

(iii) Furniture will be reduced by 10% and 5% provision for bad and doubtful debts will be created on bills receivables and debtors.

(iv) Value of land and building will be appreciated by 20%.

(v) There being a claim against the firm for damages, a liability to the extent of ₹ 8,000 will be created for the same.

Prepare revaluation account and partners’ capital accounts, (CBSE 2018)

Answer:

Working Notes

1. Provision for Doubtful Debts = (45,000 + 80,000) × \(\frac { 5 }{ 100 }\) = ₹ 6,250

Question 44.

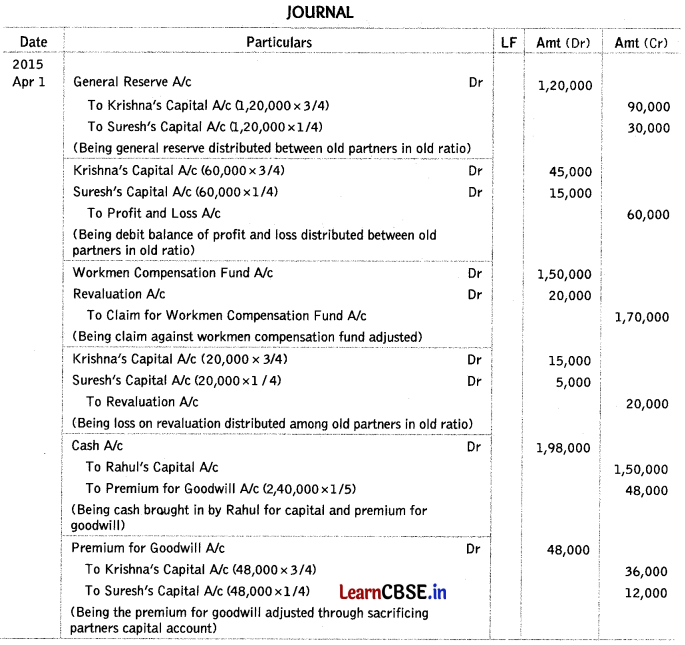

Krishna and Suresh were partners in a firm sharing profits in the ratio of 3 : 1. On 1st April, 2015 they admitted Rahul as a new partner for 1/5th share in profits of the firm. On the date of Rahul’s admission, the balance sheet of Krishna and Suresh showed a general reserve of ₹ 1,20,000, a debit balance of ₹ 60,000 in profit and loss account and workmen compensation fund of ₹ 1,50,000. The following was agreed upon on Rahul’s admission

(i) Rahul will bring ₹ 150,000 as his capital and his share of goodwill premium in cash.

(ii) Goodwill of the firm be valued at ₹ 2,40,000.

(iii) There was a claim of workmen compensation for ₹ 1,70,000.

(iv) The partners decided to share future profits in the ratio of 3 : 1 : 1.

Pass the necessary journal entries for the above on Rahul’s admission. (All India (C) 2016)

Answer:

Working Note:

Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Share – New Share

Krishna = \(\frac{3}{4}-\frac{3}{5}=\frac{15-12}{20}=\frac{3}{20}\)

Suresh = \(\frac{1}{4}-\frac{1}{5}=\frac{5-4}{20}=\frac{1}{20}\)

Sacrificing ratio = 3 : 1

![]()

Question 45.

Anil and Beena were partners in a firm sharing profits in the ratio of 4 : 3.

On 1st April, 2015 they admitted Chahat as a new partner for 1/4th share in the profits of the firm. On the date of Chahat’s admission, the balance sheet of Anil and Beena showed a general reserve of ₹ 70,000, a debit balance of ₹ 7,000 in the profit and loss account and an investment fluctuation fund of ₹ 10,000.

The following was agreed upon, on Chahat’s admission

(i) Chahat will bring ₹ 80,000 as her capital and her share of goodwill premium of ₹ 21,000 in cash.

(ii) The market value of investments was ₹ 17,000 less than the book value.

(iii) New profit sharing ratio was agreed at 2 : 1: 1.

Pass the necessary journal entries for the above on Chahat’s admission. (Delhi (C) 2016)

Answer:

Solve as Q no. 5 on page 113 and 114.

Hint: Treatment of investment fluctuation fund will be same as treatment of workmen compensation fund in Q no. 5.

Question 46.

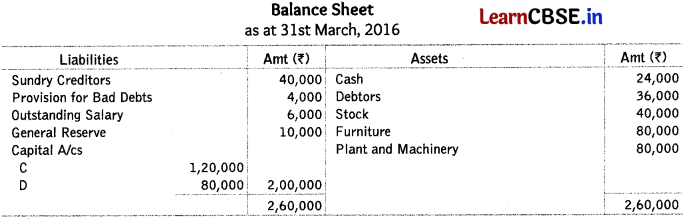

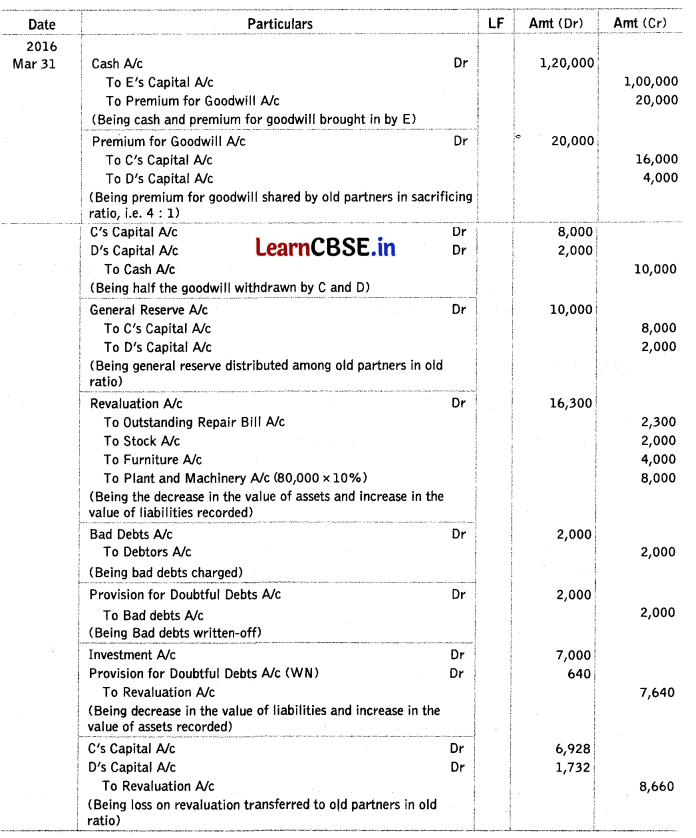

C and D are partners in a firm sharing profits in the ratio of 4 : 1. On 31st March, 2016, their balance sheet was as follows

On the above date, E was admitted for \(\frac { 1 }{ 4 }\) th share in the profits on the following terms

(i) E will bring ₹ 1,00,000 as his capital and ₹ 20,000 for his share of goodwill premium, half of which will be withdrawn by C and D.

(ii) Debtors ₹ 2,000 will be written off as bad debts and a provision of 4% will be created on debtors for bad and doubtful debts.

(iii) Stock will be reduced by ₹ 2,000, furniture will be depreciated by ₹ 4,000 and 10%, depreciation will be charged on plant and machinery.

(iv) Investments ₹ 7,000 not shown in the balance sheet will be taken into account.

(v) There was an outstanding repairs bill of ₹ 2,300 which will be recorded in the books.

Pass necessary journal entries for the above transactions in the books of the firm on E’s admission. (All India 2017)

Answer:

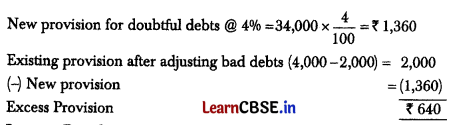

Working Notes

1. Distribution of Goodwill in Sacrificing Ratio

C’s share = 20,000 x \(\frac { 4 }{ 5 }\) = ₹ 16,000 D’s share = 20,000 x \(\frac { 1 }{ 5 }\) = ₹ 4,000

NOTE It has been assumed that C and D sacrifice in ratio of 4:1 [equal to old profit sharing ratio].

2. Provision for Bad Debts

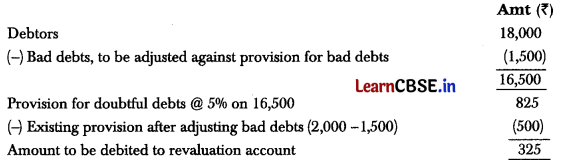

which will be adjusted against provision for bad debts

3. Loss on Revaluation

It can be ascertained by preparing revaluation account in the following manner

Question 47.

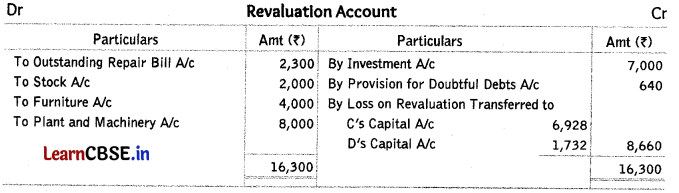

W and R are partners in a firm sharing profits in the ratio of 3 : 2. Their balance sheet as at 31st March, 2016 was as follows Delhi 2017

On the above date, C was admitted for \(\frac { 1 }{ 6 }\)th share in the profits on the following terms

(i) C will bring ₹ 30,000 as his capital and ₹ 10,000 for his share of goodwill premium, half of which will be withdrawn by W and R.

(ii) Debtors ₹ 1,500 will be written off as bad debts and a provision of 5% will be created for bad and doubtful debts.

(iii) Outstanding salary will be paid-off.

(iv) Stock will be depreciated by 10%, furniture by ₹ 500 and plant and machinery by 8%.

(v) Investments ₹ 2,500 not mentioned in the balance sheet were to be taken into account.

(vi) A creditor of ₹ 2,100 not recorded in the books was to be taken into account. Pass necessary journal entries for the above transactions in the books of the firm oft C’s admission. (Delhi 2017)

Answer:

Working Notes

1. Distribution of Goodwill in Sacrificing Ratio

W’s share = 10,000 x \(\frac { 3 }{ 5 }\) = ₹ 6,000

R’s share =10,000 x \(\frac { 2 }{ 5 }\) = ₹ 4,000

NOTE It has been assumed that W and R sacrifice in ratio 3:2 [equal to old profit sharing ratio].

2. Provision for Bad and Doubtful Debts

3. Loss on Revaluation

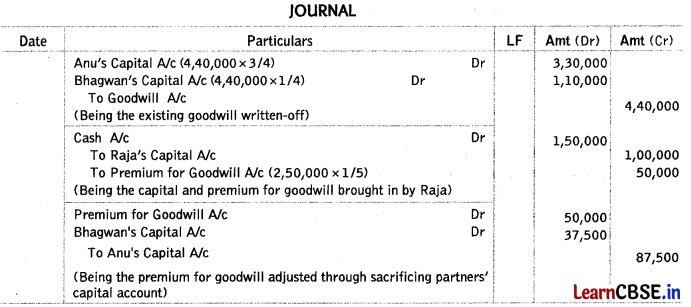

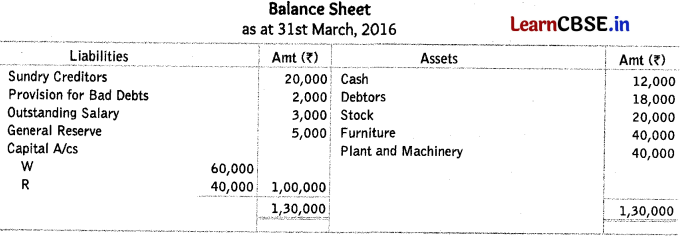

Question 48.

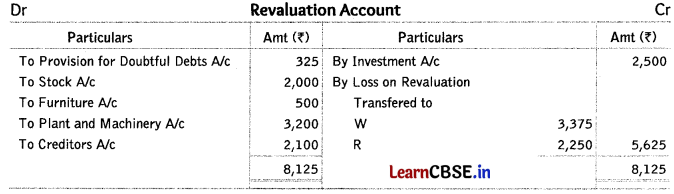

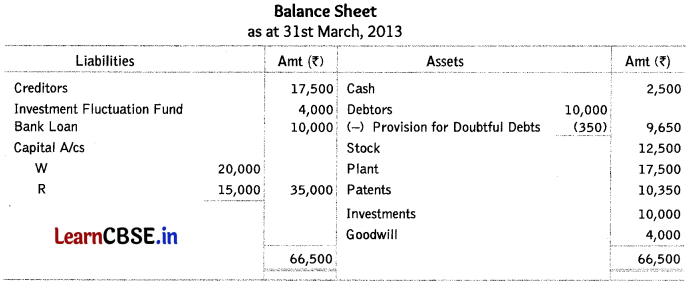

W and R were partners in a firm sharing profits in the ratio of 3 : 2 respectively. On 31st March, 2013, their balance sheet was as follows

B was admitted as a new partner on the following conditions 4

(i) B will get \(\frac { 4 }{ 15 }\)th share of profits.

(ii) B had to bring ₹ 15,000 as his capital.

(iii) B would pay cash for his share of goodwill based on 2.5 years purchase of average profit of last 4 years.

(iv) The profits of the firm for the years ending 31st March, 2010, 2011, 2012 and 2013 were ₹ 10,000, ₹ 7,000 , ₹ 8,500 and ₹ 7,500 respectively.

(v) Stock was valued at ₹ 10,000 and provision for doubtful debts was raised up to ₹ 500.

(vi) Plant was revalued at ₹ 20,000.

Prepare revaluation account, partners’ capital account and the balance sheet of the new firm. (All India (C) 2014)

Answer:

Working Note:

Average profit = \(\frac{10,000+7,000+8,500+7,500}{4}\) = ₹ 8,250

Goodwill = Average Profit x Number of Years’ Purchase

= 8,250 x 2.5

= ₹ 20,625

B’s share = 20,625 x \(\frac { 4 }{ 15 }\) = ₹ 5,500 which will be distributed among W and R in their sacrificing ratio, i.e. 3 : 2.

![]()

Question 49.

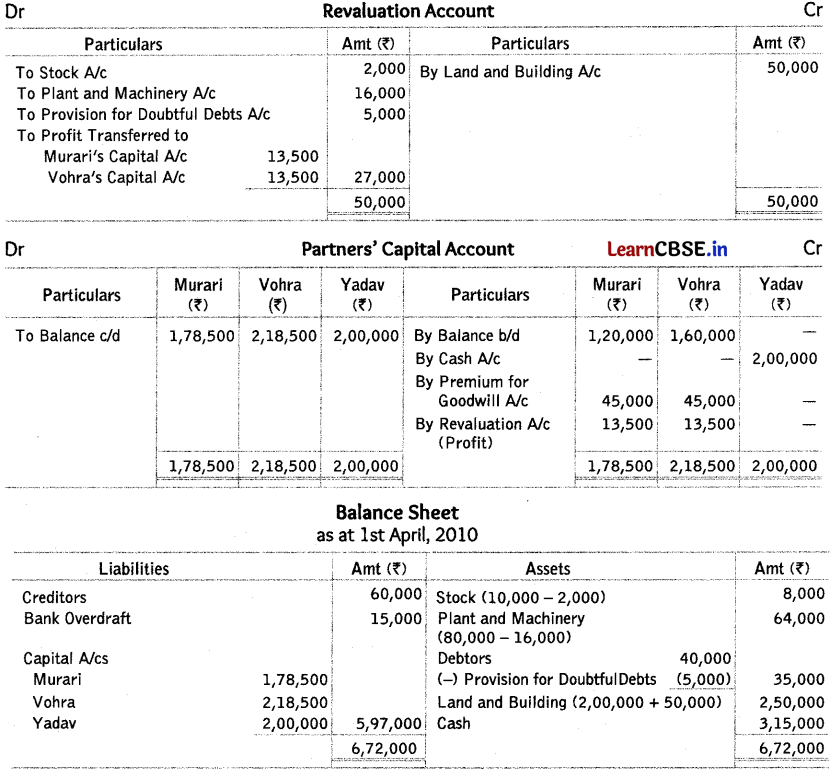

Murari and Vohra were partners in a firm with capitals of ₹ 1,20,000 and ₹ 1,60,000 respectively. On 1st April, 2010 they admitted Yadav as a partner for l/4th share in profits on his payment of ₹ 2,00,000 as his capital and ₹ 90,000 for his 1/4th share of goodwill. On that date, the creditors of Murari and Vohra were ₹ 60,000 and bank overdraft was ₹ 15,000. Their assets apart from cash included stock ₹ 10,000; debtors ₹ 40,000; plant and machinery ₹ 80,000; land and building ₹ 2,00,000. It was agreed that stock should be depreciated by ₹ 2,000; plant and machinery by 20%, ₹ 5,000 should be written-off as bad debts and land and building should be appreciated by 25%.

Prepare revaluation account, capital accounts of Murari, Vohra and Yadav and the balance sheet of the new firm. (All India 2011)

Answer:

Working Notes:

Question 50.

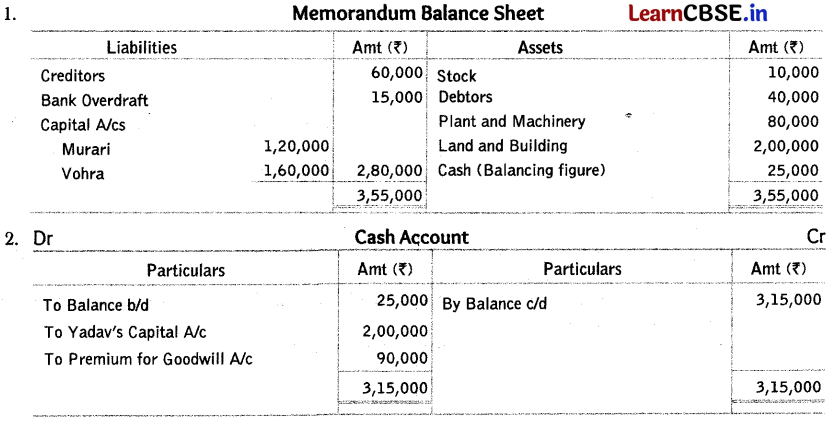

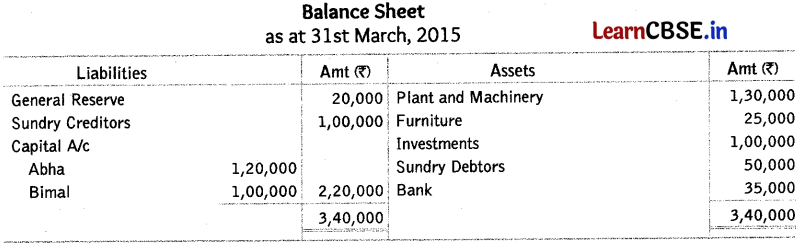

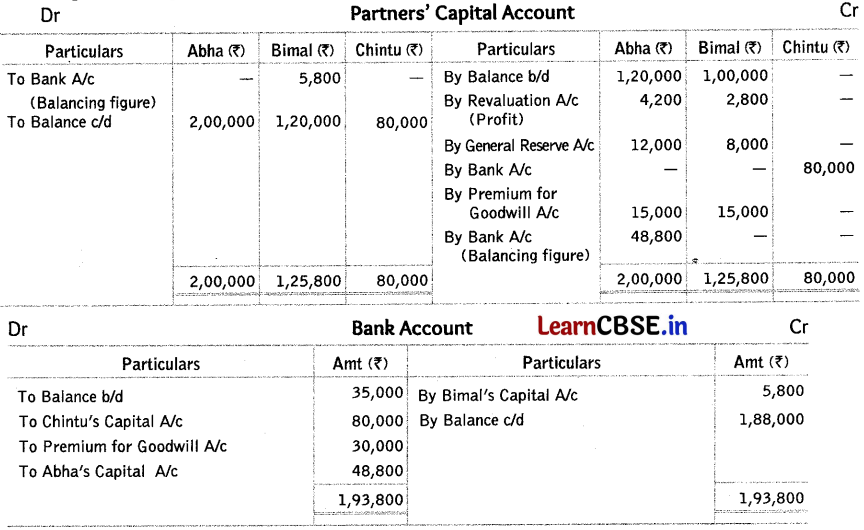

Abha and Bimal are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2015 they admitted Chintu into partnership for 1/5th share in the profits of the firm. On that date their balance sheet stood as under

Chintu was admitted on the following terms

(i) He will bring ₹ 80,000 as capital and ₹ 30,000 for his share of goodwill premium.

(ii) Partners will share future profits in the ratio of 5 : 3 : 2.

(iii) Profit on revaluation of assets and reassessment of liabilities was ₹ 7,000.

(iv) After making adjustments, the capital accounts of the partners will be in proportion to Chintu’s capital. Balance to be paid off or brought in by the old partners by cheque as the case may be.

Prepare the capital accounts of the partners and bank account. (All India (C) 2016)

Answer:

Working Notes

1. Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Share – New Share

Abha = \(\frac{3}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\), Bimal = \(\frac{2}{5}-\frac{3}{10}=\frac{4-3}{10}=\frac{1}{10}\)

Sacrificing ratio = 1 : 1

2. Calculation of New Capitals

Chintu’s share = \(\frac { 1 }{ 5 }\)

Capital brought in by Chintu for \(\frac { 1 }{ 5 }\)th share = ₹ 80,000

Finn’s capital = 80,000 x \(\frac { 5 }{ 1 }\) = ₹ 4,00,000

Abha’s capital = 4,00,000 x \(\frac { 5 }{ 10 }\) = ₹ 2,00,000

Banal’s capital = 4,00,000 x \(\frac { 3 }{ 10 }\) = ₹ 1,20,000

Chintu’s capital = 4,00,000 x \(\frac { 2 }{ 10 }\) = ₹ 1,20,000

Question 51.

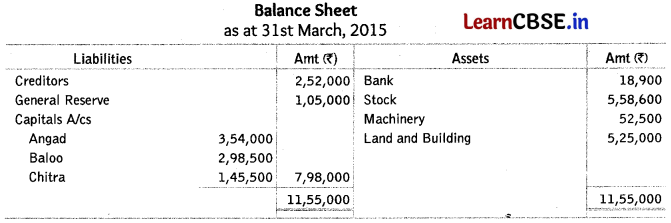

Angad, Baloo and Chitra were partners in a firm sharing profits and losses in the ratio of 6:5:3. Their balance sheet as at 31st March, 2015 was as follows

They agreed to admit Dinesh into partnership and give him 1/8th share in the profits on the following terms

(i) Dinesh will bring ₹ 1,47,000 as his capital and ₹ 1,40,700 as his share of goodwill premium.

(ii) That after making adjustments, the capital accounts of the old partners will be in proportion of Dinesh’s capital to his share in the business i.e., actual cash to be paid-off or brought in by the old partners by cheque as the case may be.

Prepare partners’ capital account and bank account considering that gain on revaluation was ₹ 95,200. (Delhi (C) 2016)

Answer:

Solve as Q no. 1 on page 124 and 125.

Balance in Farmers’ Capital A/c : Angad = ₹ 4,41,000; Baloo = ₹ 3,67,500; Chitra = ₹ 2,20,500 and Dinesh = ₹ 1,47,000

Chitra brings ₹ 1,950, Angad and Baloo withdraw ₹ 59,100 and ₹ 52,750 respectively.

Balance of Bank Account =₹ 1,96,700

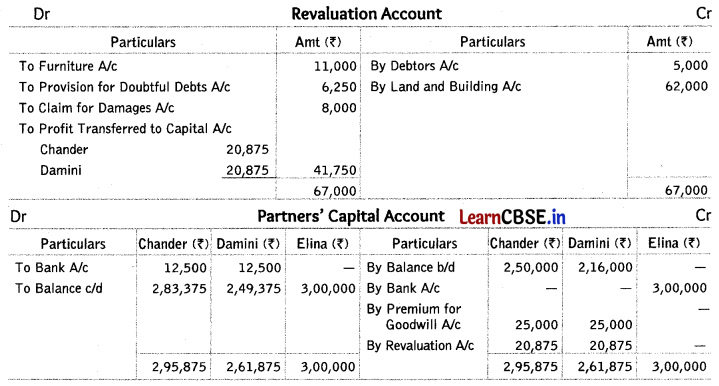

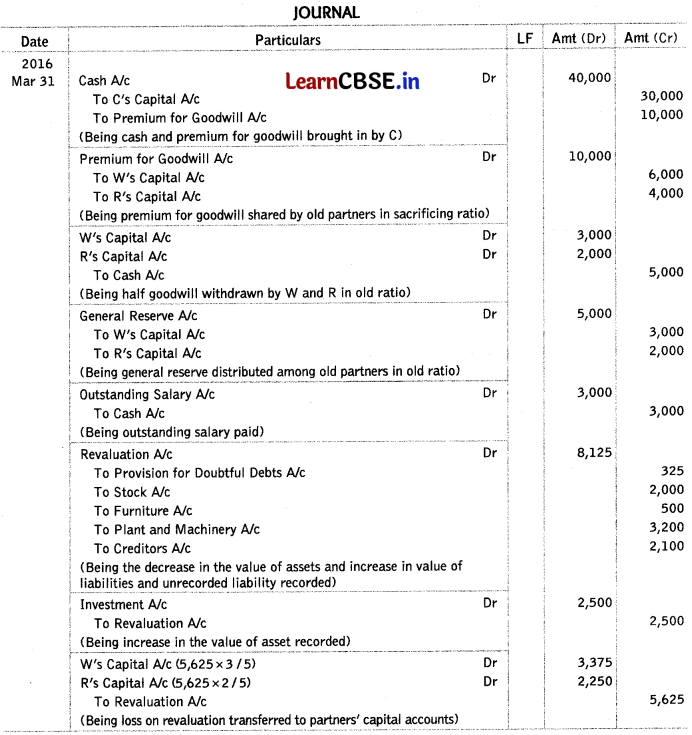

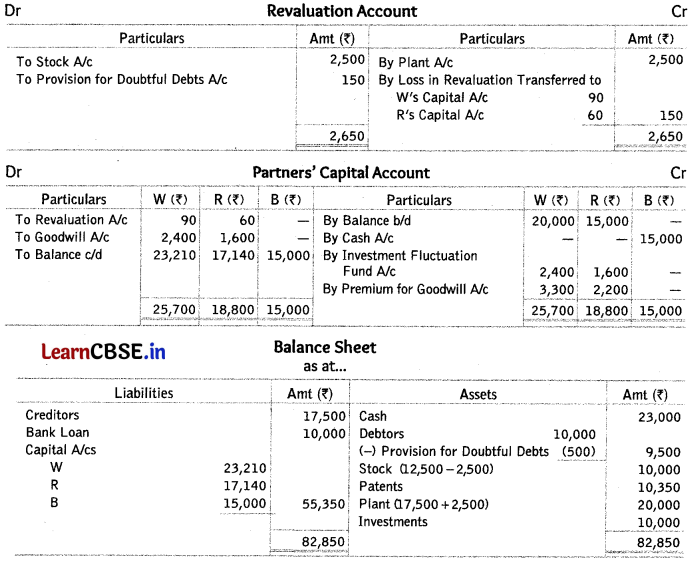

Question 52.

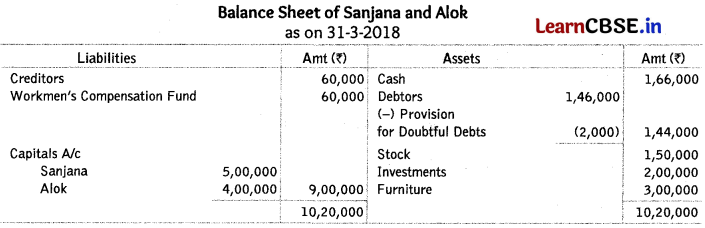

Sanjana and Alok were partners in a firm sharing profits and losses in the ratio 3:2. On 31st March, 2018, their balance sheet was as follows:

On 1st April, 2018, they admitted Nidhi as a new partner for 1 /4th share in the profits on the following terms

(i) Goodwill of the firm was valued at ₹ 4,00,000 and Nidhi brought the necessary amount in cash for her share of goodwill premium, half of which was withdrawn by the old partners.

(ii) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(iii) Investments were to be value at ₹ 3,00,000. Alok took over investment at this value.

(iv) Nidhi brought ₹ 3,00,000 a her capital and the capitals of Sanjana and Alok were adjusted in the new profit sharing ratio.

Prepare revaluation account, partners’ capital accounts and the balance sheet of the reconstituted firm on Nidhi’s admission. (Delhi 2019)

Answer:

Working Notes

1. Firm’s goodwill = ₹ 4,00,000

Nidhi’s share of goodwill = 4,00,000 x \(\frac { 1 }{ 4 }\) = ₹ 1,00,000 to be distributed among Sanjana and Alok in sacrificing ratio.

2. Sanjana’s capital after adjustment = ₹ 5,90,000

Alok’s capital after adjustment = ₹ 1,60,000

= ₹ 7,50,000

to be in profit sharing ratio

Sanjana = 7,50,000 x \(\frac { 3 }{ 5 }\) = 4,50,000 – 5,90,000 = ₹ 1,40,000 cash withdrew

Alok = 7,50,000 x \(\frac { 2 }{ 5 }\) = 3,00,000 – 1,60,000 = ₹ 1,40,000 cash brought in

![]()

Question 53.

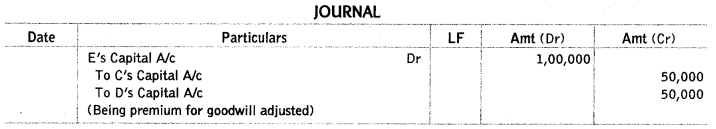

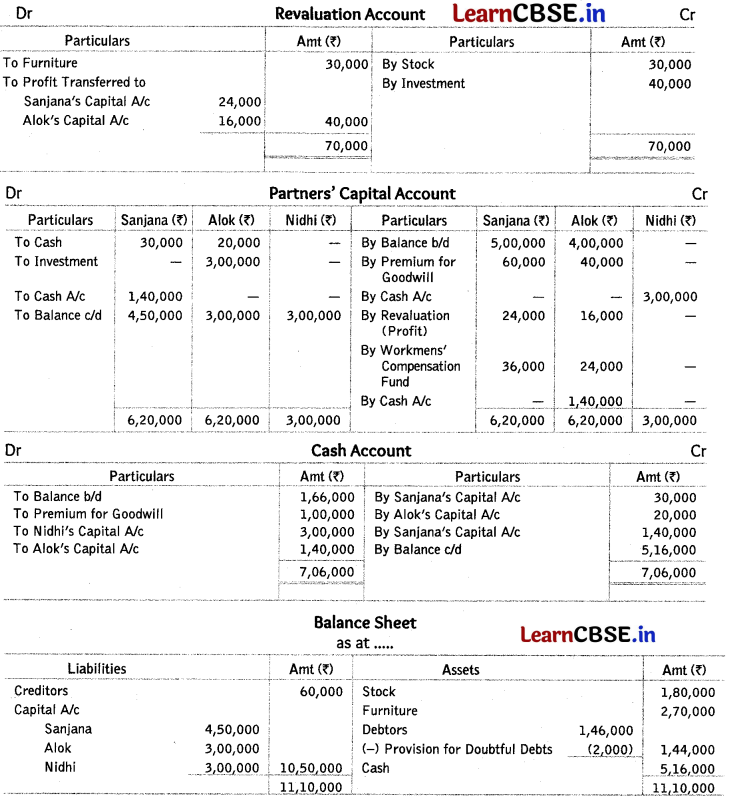

A and B were partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2018, was as follows

C was admitted as a new partner and brought ₹ 64,000 as capital and ₹ 15,000 for his share of goodwill premium. The new profit sharing ratio was 5 : 3 : 2.

On C’s admission, the following was agreed upon

(i) Stock was to be depreciated by 5%.

(it) Provision for doubtful debts was to be made at ₹ 2,000.

(iii) Furniture was to be depreciated by 10%.

(iv) Building was valued at ₹ 1,60,000.

(v) Capitals of A and B were to be adjusted on the basis of C’s capital by bringing or paying of cash as the case may be.

Prepare revaluation account, partners’ capital accounts and the balance sheet of reconstituted firm. (All India 2019)

Answer:

Working Notes:

1. Calculation of Sacrificing Ratio

A sacrifice = \(\frac{3}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\); B sacrifice = \(\frac{2}{5}-\frac{3}{10}=\frac{4-3}{10}=\frac{1}{10}\)

Sacrificing ratio = 1 : 1

2. \(\frac { 2 }{ 10 }\)th share capital = ₹ 64,000

Firm’s capital = 64,000 x \(\frac { 10 }{ 2 }\) = ₹ 3,20,000

A’s new capital = 3,20,000 × \(\frac { 5 }{ 10 }\) = ₹ 1,60,000

B’s new capital = 3,20,000 × \(\frac { 3 }{ 10 }\) = ₹ 96,000