We have given these Accountancy Class 12 Important Questions and Answers Chapter 2 Accounting for Partnership: Basic Concepts to solve different types of questions in the exam. Go through these Class 12 Accountancy Chapter 2 Accounting for Partnership: Basic Concepts Class 12 Important Questions and Answers Solutions & Previous Year Questions to score good marks in the board examination.

Accounting for Partnership: Basic Concepts Important Questions Class 12 Accountancy Chapter 2

Question 1.

A new partner acquires two main rights in the partnership firm which he joins. State one of these rights. All Indio 2019

Answer:

Right to share future profits of the firm.

Question 2.

Ritesh and Hitesh are childhood friends. Ritesh is a consultant whereas Hitesh is an architect. They contributed equal Arts amounts and purchased a building for ₹ 2 crore. After a year, they sold it for ₹ 3 crore and shared the profits equally. Are they doing the business in partnership? Give reason in support of your answer. (CBSE 2018)

Answer:

No, they are not doing the business in partnership. They are mere co-owners of the property.

![]()

Question 3.

Does partnership firm has a separate legal Ans. entity? Give reason in support of your answer. (Delhi 2017)

Answer:

No, partnership firm does not have a separate legal entity. In case a business firm is not able to meet its liabilities out of its business assets, then private assets of partners can be used to meet firm’s liabilities.

Question 4.

A group of 40 people wants to form a partnership firm. They want your advice regarding the maximum number of persons that can be there in a partnership firm and the name of the Act under whose provisions it is given. (All India 2016)

Or

What is the maximum number of partners that a partnership firm can have? Name the act that provides for the maximum number of partners in a partnership firm. (Delhi 2016)

Answer:

The maximum number of partners that a firm can have is 50. The limit has been given as per Rule 10 of Companies (Miscellaneous) Rules Act, 2014.

Question 5.

State the provisions of Indian Partnership Act, 1932 regarding interest on partners capital and interest on partners loan when there is no partnership deed.(All India 2015,2010)

Answer:

According to Indian Partnership Act, 1932, in the absence of partnership deed, no interest on partners’ capital is allowed and interest on partners loan is allowed @ 6% per annum.

Question 6.

The partnership deed is silent on payment of salary to partners. Anita, a partner, claimed that, since she managed the business, she should get a monthly salary of ?10,000. Is she entitled for the salary? Give reason. (Delhi (C) 2014)

Answer:

No, Anita is not entitled for the salary. Since, the partnership deed is silent on the payment of salary to partners, in that case provisions of Partnership Act will be followed which prohibits payment of salary to the partners.

Question 7.

State the provisions of Indian Partnership Act, 1932 regarding the payment of remuneration to a partner for the services rendered. (Delhi 2012)

Answer:

In the absence of partnership deed, a partner is not entitled to get any remuneration from the firm.

Question 8.

What share of profit would a ‘sleeping partner’, who has contributed 75% of the total capital, get in the absence of a deed? (Delhi 2011)

Answer:

In the absence of partnership deed, sleeping partner will get equal share of profit, no matter how much share of total capital he has contributed.

Question 9.

Is a sleeping partner liable for the acts of other partners? (Delhi (c) 2011)

Answer:

Yes, a sleeping partner is also liable for the acts of other partners.

Question 10.

Would a ‘charitable dispensary’ run by 8 members be deemed a partnership firm? Give reason in support of your answer. (All India 2011)

Answer:

No, acharitable dispensary’ run by 8 members cannot be deemed to be a partnership firm because

- For partnership, there must be a business.

- There must be sharing of profits among the partners from such business.

- In this case, there is no business and no sharing of profits.

Question 11.

What is meant by a partnership deed? (Delhi 2011, 2010: All India 2010)

Answer:

Partnership deed is a document which contains the terms and conditions of partnership agreement.

Question 12.

Why should a firm have a partnership deed? (All India 2011)

Answer:

A firm should have a partnership deed because

- It regulates the rights, duties and liabilities of the partners.

- It avoids disputes in future by acting as a proof.

- It serves as an evidence in the court of law.

Question 13.

What is meant by ‘unlimited liability of a partner’? (Delhi 2010)

Answer:

Unlimited liability of a partner means that each partner is liable jointly and also severally with all the other partners to the third party for all the acts of the firm done, while he is a partner. His private assets can also be used for paying off the firm’s debts.

Question 14.

A, B and C decided that interest on capitals will be provided to each partner @ 5% per annum, but after one year C wants that no interest on capital is to be provided to any partner. State how ‘C’ can do this? (Delhi 2010)

Answer:

C can do this only when all partners agree to it or if there is no partnership deed.

Question 15.

A, B and C are partners and decided that no interest on drawings is to be charged to any partner. But after one year, C wants that interest on drawings should be charged to every partner. State how C can do this. (Delhi 2010)

Answer:

C can do this only when all the partners agree to it.

Question 16.

Dev withdrew ₹ 10,000 on 15th day of every month. Interest on drawings was to be charged @ 12% per annum. Calculate interest on Dev’s drawings. (All India 2019)

Answer:

Interest on Dev’s Drawings

= 10000 × 12 × \(\frac { 12 }{ 100 }\) × \(\frac { 6 }{ 12 }\)

= ₹ 7,200

![]()

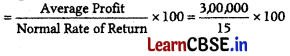

Question 17.

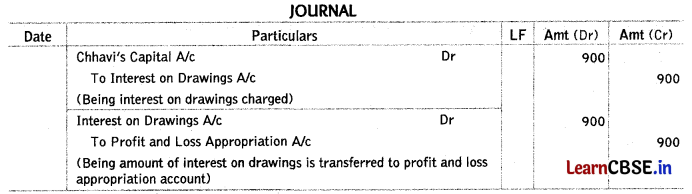

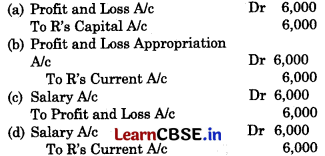

Chhavi and Neha were partners in a firm sharing profits and losses equally. Chhavi withdrew a fixed amount at the beginning of each quarter. Interest on drawings is charged @ 6% p.a. At the end of the year, interest on Chhavi’s drawings amounted to ₹ 900. Pass necessary journal entry for charging interest on drawings. (Delhi 2019)

Answer:

Question 18.

Give two items which may appear on the debit side of a Partner’s Current Account. (Comportment 2018)

Answer:

Two items which may appear on the debit side of a Partners’ Current Account are

- Drawings

- Interest on drawings

Question 19.

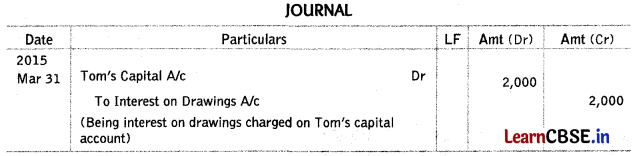

Tom and Harry were partners in a firm sharing profits in the ratio of 5 : 3. During the year ended 31st March, 2015 Tom had withdrawn ₹ 40,000. Interest on his drawings amounted to ₹ 2,000. Pass necessary journal entry for charging interest on drawings assuming that the capitals of the partners were fluctuating. (All India 2016)

Answer:

Question 20.

Nusrat and Sonu were partners in a firm sharing profits in the ratio of 3 : 2. During the year ended 31st March, 2015 Nusrat had withdrawn ₹ 15,000. Interest on her drawings amounted to ₹ 300. Pass necessary journal entry for charging interest on drawings assuming that the capitals of the partners were fixed. Delhi 2016

Answer:

Solve as Q. No. 4 on page 36.

Debit Nusrat’s Current Account and Credit Interest on Drawings with ₹ 300.

Question 21.

Anna and Bobby were partners sharing profits and losses in the ratio of 5 : 3. On 1st April, 2014 their capital accounts showed balances of ₹ 3,00,000 and ₹ 2,00,000 respectively.

Calculate the amount of profit to be distributed between the partners if the partnership deed provided for interest on capital @ 10% per annum and the firm earned a profit of ₹ 45,000 for the year ended 31st March, 2015. (All India (C) 2016)

Answer:

No profit will be distributed as the amount of profit (i.e. ₹ 45,000) is not sufficient to pay the interest on capital ( ₹ 50,000).

Question 22.

A partnership deed provides for the payment of interest on capital but there was a loss instead of profit during the year 2010-2011. At what rate will the interest on capital be allowed? (All India 2012)

Answer:

No interest on capital will be allowed as there was loss in the firm.

Question 23.

Give the average period in months for charging interest on drawings for the same amount withdrawn at the beginning of each quarter. (All India 2011)

Answer:

The average period for charging interest on drawings for the same amount withdrawn at the beginning of each quarter is 7\(\frac { 1 }{ 2 }\) months which can be computed as follows = \(\frac { 12+3 }{ 2 }\) = \(\frac { 15 }{ 2 }\) = 7.5 months

∴ Interest on Drawings = Total Drawings × \(\frac { Rate }{ 100 }\) × \(\frac { 7\frac{1}{2} }{ 12 }\)

Question 24.

Where would you record interest on drawings when capitals are fixed? (All India 2010)

Answer:

When capitals are fixed, interest on drawings will be recorded on the debit side of partners current account.

Question 25.

Where would you record interest on drawings when capitals are fluctuating? (All India 2010)

Answer:

When capital are fluctuating interest on drawings will be recorded on the debit side of partners’ capital accounts.

Question 26.

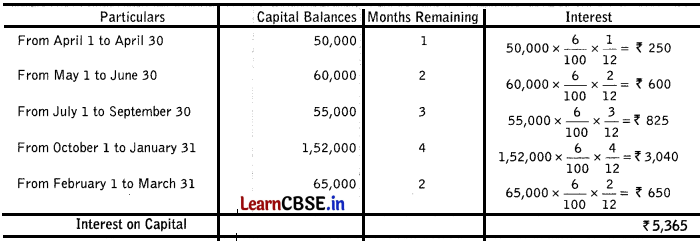

On 1st April, 2013 Mohan and Sohan entered into partnership for doing business of dry fruits. Mohan introduced ₹ 1,00,000 as capital and Sohan introduced ₹ 50,000. Since Sohan could introduce only ₹ 50,000 it was further agreed that as and when there will be a need Sohan will introduce further capital. Sohan was also allowed to withdraw from his capital when the need for the capital was less. During the year ended 31st March, 2014, Sohan introduced and withdrew the following amounts of capital.

| Date | Capital Introduced | Capital Withdrawn |

| 1st May, 2013 | 10,000 | – |

| 30th June, 2013 | – | 5,000 |

| 30th September, 2013 | 97,000 | – |

| 1st February, 2014 | – | 87,000 |

The partnership deed provided for interest on capital @ 6% per annum. Calculate interest on capitals of the partners. Foreign 2015

Answer:

Calculation of Interest on Capital

Mohan = 1,00,000 × \(\frac { 6 }{ 100 }\) = ₹ 6,000

Question 27.

Distinguish between ‘fixed capital account’ and ‘fluctuating capital account, on the basis of credit balance. (All India 2017)

Answer:

Difference between fixed and fluctuating capital account is stated below

| Basis | Fixed capital account | Fluctuating capital account |

| Credit Balance | It always shows credit balance in capital account. | Fluctuating capital can also show credit balance, as well as, debit balance. |

Question 28.

What is meant by fixed capital of a partner? (Delhi (C) 2016)

Answer:

Under this system of maintaining capital account of partners, partners capital remains fixed unless an additional capital is introduced or a part of it is withdrawn.

Question 29.

What is meant by fluctuating capital of a partner? (All India (c) 2016)

Answer:

Under this system of maintaining capital accounts of partners, partners capital fluctuates when all the adjustment regarding interest on capital.

drawings, share of profit etc are recorded directly in the capital account.

![]()

Question 30.

Name the accounts which are maintained for the partners when capitals of the partners are fixed. (Compartment 2014)

Answer:

When capitals of the partners are fixed, following accounts are required to be maintained

- Partners fixed capital accounts

- Partners current capital accounts

Question 31.

Distinguish between fixed and fluctuating capital accounts. (Comportment 2014; Delhi; All India 2011)

Answer:

The differences between fixed and fluctuating capital accounts are

| Basis | Fixed capital account | Fluctuating capital basis account |

| No. of Account(s) | Each partner has two accounts, i.e. capital account and current account. | Each partner has only one account, i.e. capital account. |

| Balance | Capital account always shows a credit balance. | Sometimes capital Sccount may show a debit balance due to huge drawings or losses. |

Question 32.

When the partners’ capitals are fixed, where the drawings made by a partner will be recorded? (Delhi: All India 2013)

Answer:

When the partners’ capitals are fixed, the drawings made by a partner will be recorded in partners’ current account (debit side).

Question 33.

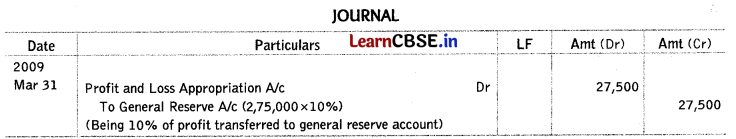

The firm XYZ earned a profit of ₹ 2,75,000 during the year ending on 31st March, 2009. 10% of this profit was to be transferred to general reserve. Pass necessary journal entry for the same. (Delhi (C) 2010)

Answer:

Question 34.

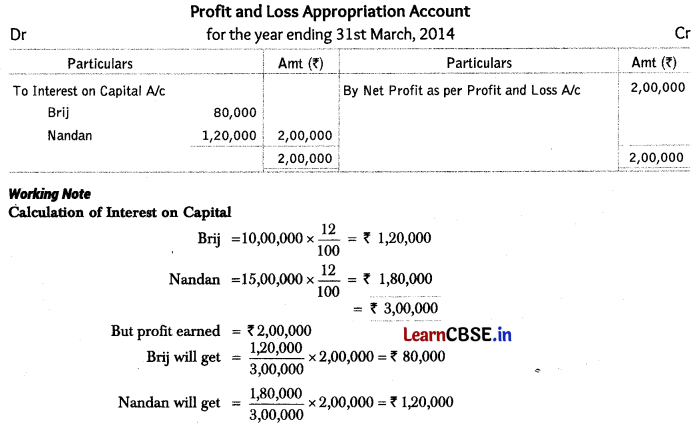

On 1st April, 2013, Brij and Nandan entered into partnership to construct toilets in government girls schools in the remote areas of Uttarakhand. They contributed capitals of ₹ 10,00,000 and ₹ 15,00,000 respectively.

Their profit sharing ratio was 2 : 3 and interest allowed on capital as provided in the partnership deed was 12% per annum. During the year ended 31st March, 2014, the firm earned a profit of ₹ 2,00,000.

Prepare profit and loss appropriation account of Brij and Nandan for the year ended 31st March, 2014. (All India 2015)

Answer:

Question 35.

On 1st April, 2013, Jay and Vijay entered into partnership for supplying laboratory equipments to government schools situated in remote and backward areas. They contributed capitals of ₹ 80,000 and ₹ 50,000 respectively and agreed to share the profits in the ratio of 3 : 2. The partnership deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of ₹ 7,800. Showing your calculations clearly, prepare profit and loss appropriation account of Jay and Vijay for the year ended 31st March, 2014. (Delhi 2015)

Answer:

Solve as Q. No. 8 on page 41.

[Interest on capital : Jay = ₹ 4,800, Vijay- ₹ 3,000]

Question 36.

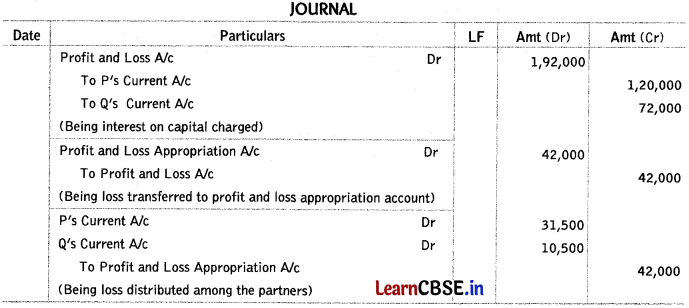

P and Q were partners in a firm sharing profits in 3 : 1 ratio. Their respective fixed capitals were ₹ 10,00,000 and ₹ 6,00,000. The partnership deed provided interest on capital @ 12% p.a. The partnership deed further provided that interest on capital will be allowed fully even if it will result into a loss to the firm. The net profit of the firm for the year ended 31st March, 2018 was ₹ 1,50,000.

Pass necessary journal entries in the books of the firm allowing interest on capital and division of profit/loss among the partners. (All India 2019)

Answer:

Working Note

Calculation of Interest on Capital

P = 10,00,000 × 12% = ₹ 20,000

Q = 6,00,000 × 12% = ₹ 72,000

Question 37.

E, F and G were partners in a firm sharing profits in the ratio of 3 : 3 : 4. Their respective fixed capitals were E ₹ 3,00,000; F ₹ 4,00,000 and G ₹ 5,00,000. The partnership deed provided for allowing interest on capital @ 2% p.a. even if it results into a loss to the firm. The net profit of the firm for the year ended 31st March, 2018 was ₹ 2,10,000.

Pass necessary journal entries for allowing interest on capital and distribution of profit/loss in the books of the firm. (All India 2019)

Answer:

Question 38.

A and B were partners in a firm sharing profits in the ratio of 5 : 3. Their fixed capitals on 31st March, 2017 were A ₹ 60,000 and B180,000. They agreed to allow interest on capital @ 12% p.a. The profit of the firm for the year ended 31st March, 2018 before allowing interest on capitals was ₹ 12,600.

Pass necessary journal entries for the above transactions in the books of A and B. Also show your working notes clearly. (All India 2019)

Answer:

Working Note:

Interest on A’s Capital = 60,000 × 12% = ₹ 7,200

Interest on B’s Capital = 80,000 × 12% = ₹ 9, 600

? 7,200 + ₹ 9, 600 = 16,800

As interest on capital is more than profit available, i.e. ₹ 12,600

So, interest on capital will be provided to the maximum of profit available.

Hence,

Interest on A’s Capital =12,600 × \(\frac { 7,200 }{ 16,800 }\) = ₹ 5 400

Interest on B’s Capital = 12,600 × \(\frac { 9,600 }{ 16,800 }\) = ₹ 7 200

Question 39.

Jain, Gupta and Singh were partners in a firm. Their fixed capitals were : Jain ₹ 4,00,000, Gupta ₹ 6,00,000 and Singh ₹ 10,00,000. They were sharing profits in the ratio of then- capitals. The firm was engaged in the processing and distribution of flavoured milk. The partnership deed provided for interest on capital at 10% per annum. During the year ended 31st March, 2014 the firm earned a profit of ₹ 1,47,000.

Showing your working notes clearly, prepare profit and loss appropriation account of the firm. (Foreign 2015)

Answer:

Solve as Q. No. 8 on page 41.

[Interest on Capital: Jain’s Current Account = ₹ 29,400; Gupta’s Current Account = ₹ 44,100 and Singh’s Current Account = ₹ 73,500]

![]()

Question 40.

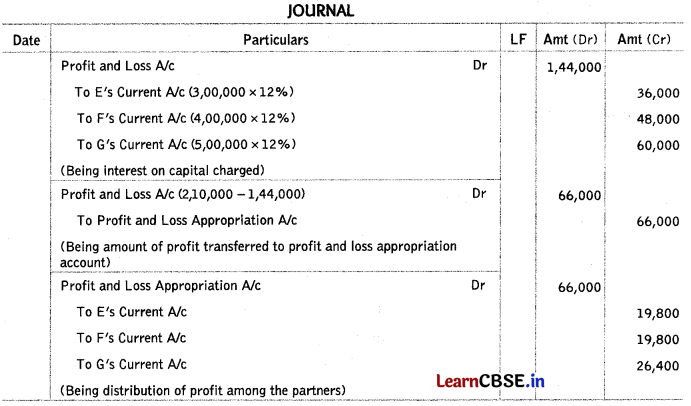

Lalan and Balan were partners in a firm sharing profits in the ratio of 3 : 2. Their fixed capitals on 1st April, 2010 were Lalan ₹ 1,00,000 and Balan ₹ 2,00,000. They agreed to allow interest on capital @ 12% per annum and charge on drawings @ 15% per annum. The firm earned a profit, before all above adjustments, of ₹ 30,000 for the year ended 31st March, 2011. The drawings of Lalan and Balan during the year were ₹ 3,000 and ₹ 5,000 respectively. Showing your calculation clearly, prepare profit and loss appropriation account of Lalan and Balan. The interest on capital will be allowed even if the firm incurs loss. (All India 2012)

Answer:

Working Notes

1. Interest on drawings is to be calculated on an average basis for 6 months as the time period is not given, i.e.

Interest on Lalan’s drawings = 3,000 × \(\frac { 15 }{ 100 }\) × \(\frac { 6 }{ 12 }\) = ₹ 225

Interest on Balan’s drawings = 5,000 × \(\frac { 15 }{ 100 }\) × \(\frac { 15 }{ 100 }\) = ₹ 375

2. Interest on capital

Lalan = 1,00,000 × \(\frac { 12 }{ 100 }\) = ₹ 12,000

Balan = 2,00,000 × \(\frac { 12 }{ 100 }\) = ₹ 24,000

Question 41.

Arun and Arora were partners in a firm sharing profits in the ratio of 5 : 3. Their fixed capitals on 1st April, 2010 were Arun ₹ 60,000 and Arora ₹ 80,000. They agreed to allow interest on capital @ 12% per annum and to charge on drawings @ 15% per annum.

The profit of the firm for the year ended 31st March, 2011 before all the above adjustments were ₹ 12,600. The drawings made by Arun were ₹ 2,000 and by Arora ₹ 4,000 during the year.

Prepare profit and loss appropriation account of Arun and Arora. Show your calucaltions clearly. The interest on capital will be allowed even if the firm incurs loss. Delhi 2012

Answer:

Solve as Q. No. 14 on page 44.

[Net loss transferred to Arun’s current account = ₹ 2,344, Arora = ₹ 1,406]

Question 42.

Sonu and Rajat started a partnership firm on 1st April, 2017. They contributed ₹ 8,00,000 and ₹ 6,00,000 respectively as their capitals and decided to share profits and losses in the ratio of 3 : 2.

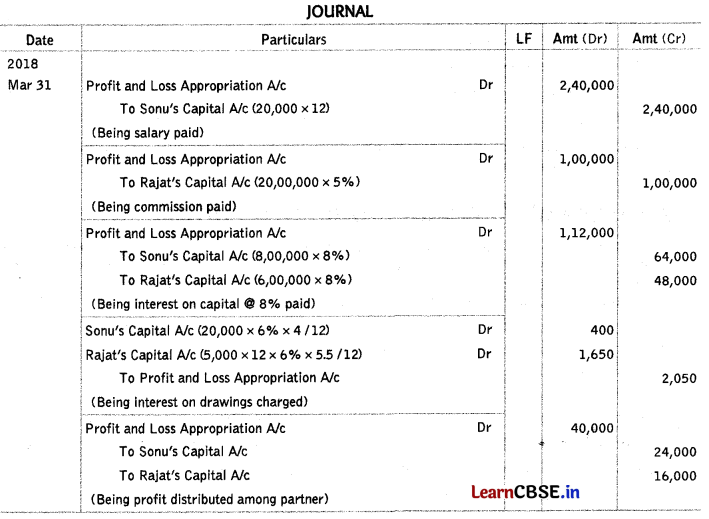

The partnership deed provided that Sonu was to be paid a salary of ₹ 20,000 per month and Rajat a commission of 5% on turnover. It also provided that interest on capital be allowed @ 8% p.a. Sonu withdrew ₹ 20,000 on 1st December, 2017 and Rajat withdrew ₹ 5,000 at the end of each month. Interest on drawings was charged @ 6% p.a. The net profit as per Profit and Loss Account for the year ended 31st March, 2018 was ₹ 4,89,950. The turnover of the firm for the year ended 31st March, 2018 amounted to ₹ 20,00,000. Pass necessary journal entries for the above transactions in the books of Sonu and Rajat. (Delhi 2019)

Answer:

Working notes:

Question 43.

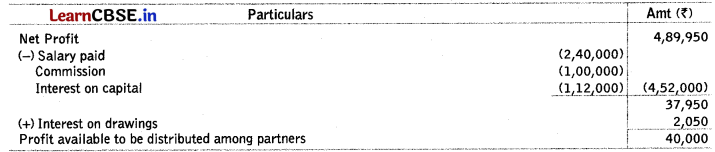

P and Q were partners in a firm sharing profits and losses equally. Their fixed capitals were ₹ 2,00,000 and ₹ 3,00,000 respectively. The partnership deed provided for interest on capital @12% per annum. For the year ended 31st March, 2016, the profits of the firm were distributed without providing interest on capital. Pass necessary adjustment entry to rectify the error. (All India 2017)

Answer:

Question 44.

P and Q were partners in a firm sharing profits equally. Their fixed capitals were ₹ 1,00,000 and ₹ 50,000 respectively. The partnership deed provided for interest on capital at the rate of 10% per annum. For the year ended 31st March, 2016 the profits of the firm were distributed without providing interest on capital. Pass necessary adjustment entry to rectify the error. (Delhi 2017)

Answer:

Solve as Q. no. 1 on Page 47.

Debit Q’s Current Account and Credits P’s Current Account with ₹ 2,500.

Question 45.

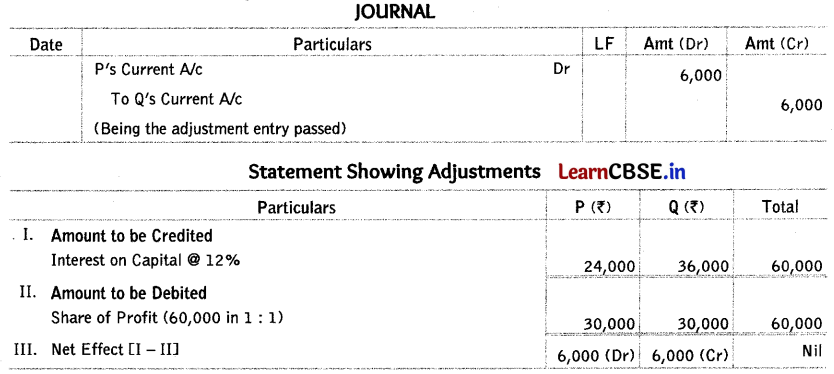

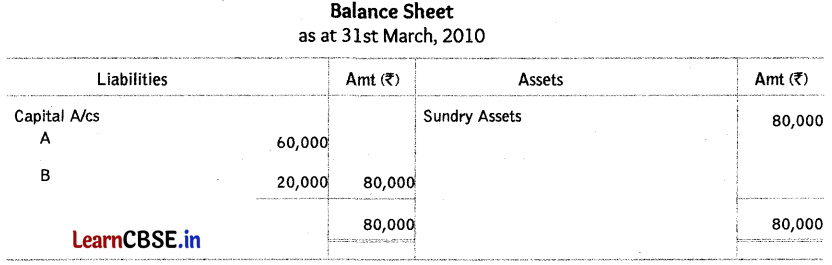

A and B are partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2014, the balance sheet of the firm was as follows

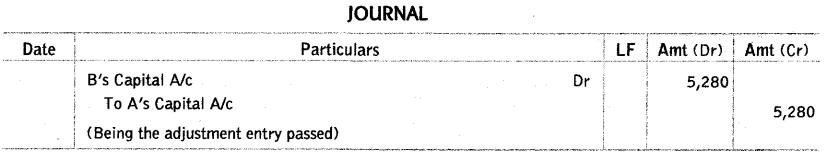

The profit of ₹ 80,000 for the year ended 31st March, 2014 was divided between the partners without allowing interest on capital @12% per annum and a salary to A at ₹ 1,000 per month. Dining the year A withdrew ₹ 10,000 and ₹ 20,000. Pass a single journal entry to rectify the error. (Foreign 2015)

Answer:

Working Note

Calculation of Opening Capital and Interest on Capital

Calculation of Adjusted Profits

Adjusted Profits = Given Profit – Salary – Interest on Capital = 80,000-12,000 – (2,640 + 960) = ₹ 64,400

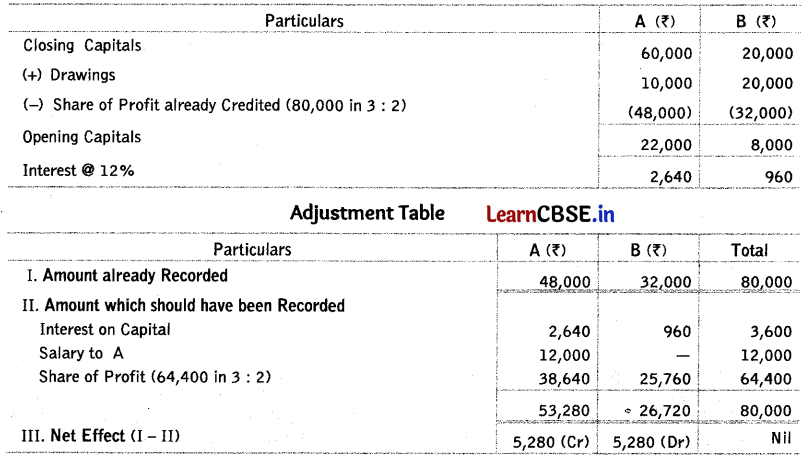

Question 46.

Mukesh and Ramesh are partners sharing profits and losses in the ratio of 2 : 1 respectively. They admit Rupesh as a partner with 1/4 share in profits with a guarantee that his share of profit shall be atleast ₹ 55,000. The net profit of the firm for the year ending 31st March, 2013 was ₹ 1,60,000. Prepare profit and loss appropriation account. (All India (C) 2014)

Answer:

Profit and Loss Appropriation Account for the year ending 31st March, 2013

Working Note

Calculation of New Profit Sharing Ratio

Rupesh’s share = \(\frac { 1 }{ 4 }\)

Mukesh’s share = \(1-\frac{1}{4}=\frac{3}{4}\)

Remaining share = \(\frac{3}{4} \times \frac{2}{3}=\frac{2}{4}\)

Ramesh’s share = \(\frac{3}{4} \times \frac{1}{3}=\frac{1}{4}\)

Distributable profits = ₹ 1,60,000 to be distributed between Mukesh, Ramesh and Rupesh in 2 : 1 : 1 ratio.

Mukesh’s share = 1,60,000 x \(\frac { 2 }{ 4 }\) = ₹ 80,000;

Ramesh’s share = 1,60,000 x \(\frac { 1 }{ 4 }\) = ₹ 40,000;

Rupesh’s share = 1,60,000 x \(\frac { 1 }{ 4 }\) = ₹ 40,000;

Rupesh’s share is less than the guaranteed amount of ₹ 55,000, therefore deficiency of ₹ 15,000 (55,000 – 40,000) shall be borne by Mukesh and Ramesh in 2:1 ratio, i.e. Mukesh will give

= 15,000 x \(\frac { 1 }{ 3 }\) = ₹ 10,000 and Ramesh will give =15,000 x \(\frac { 1 }{ 3 }\) = ₹ 5,000.

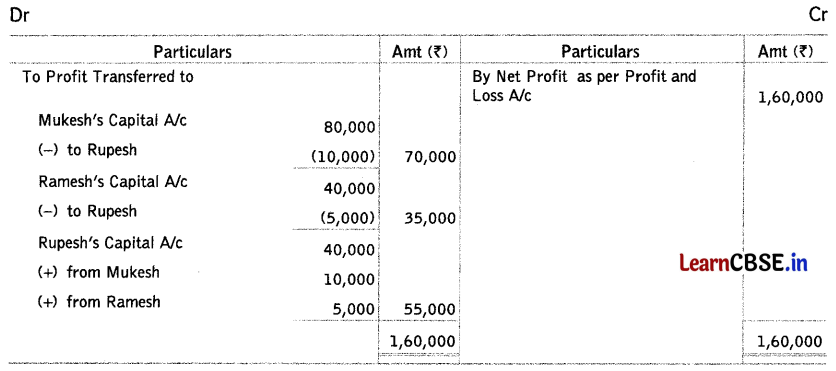

Question 47.

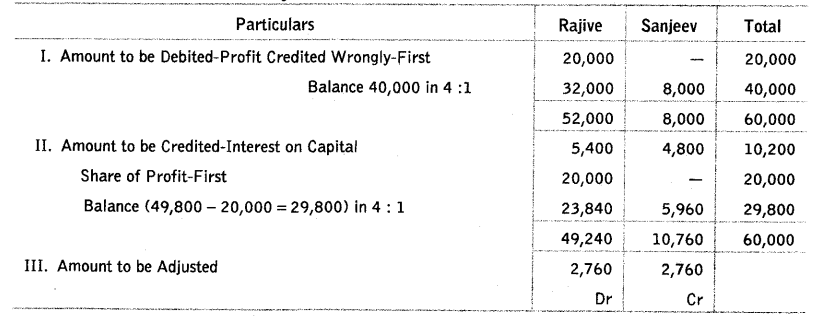

Rajiv and Sanjeev were partners in a firm. Their partnership deed provided that the profits shall be divided as follows

First ₹ 20,000 to Rajeev and the balance in the ratio of 4 : 1. The profits for the year ended 31st March, 2017 were ₹ 60,000 which had been distributed among the partners. On 1-4-2016 their capitals were Rajeev ₹ 90,000 and Sanjeev ₹ 80,000. Interest on capital was to be provided @ 6% p.a. While preparing the profit and loss appropriation interest on capital was omitted. Pass necessary rectifying entry for the same. Show your workings clearly. (Compartment 2018)

Answer:

Working Note

Calculation of amount to be adjusted

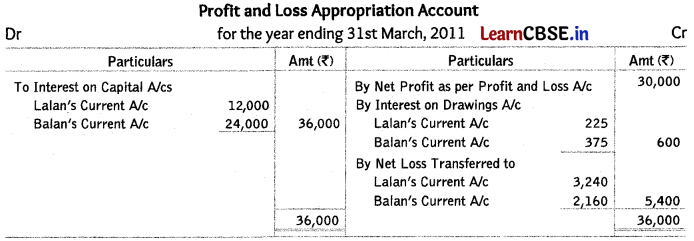

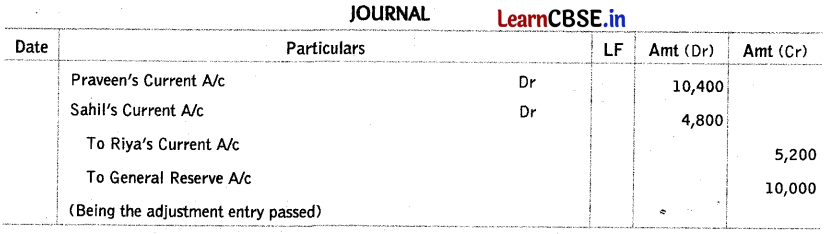

Question 48.

Praveen, Sahil and Riya are partners having fixed capitals of ₹ 2,00,000, ₹ 1,60,000 and ₹ 1,20,000 respectively. They share profits in the ratio of 3 : 1 : 1. The partnership deed provided for the following which were not recorded in the books.

(i) Interest on capital @ 5% per annum.

(ii) Salary to Praveen ₹ 1,500 per month and to Riya ₹ 1,000 per month.

(ii) Transfer of profit to general reserve ₹ 10,000. Net profit for the year ended 31st March, 2015 was ₹ 1,00,000.

Pass necessary rectifying entry for the above adjustments in the books of the firm. Also show your workings clearly. (All India (C) 2016)

Answer:

Working Note

Interest on Capital

Praveen = 200000 x \(\frac { 5 }{ 100 }\) = ₹ 10,000, Sahil = 1,60000 x \(\frac { 5 }{ 100 }\) = ₹ 8,000, Riya = 1,20000 x \(\frac { 5 }{ 100 }\) = ₹ 6,000

Salary: Praveen (1,500 x 12) = ₹ 18,000, Riya (1,000 x 12) = ₹ 12,000

Calculation of Adjusted Profits

Adjusted Profits = Given Profit – Transfer to Reserve – Interest on Capital – Salary

= 100000 -10000 – 24000 (10,000 +8000 + 6000) – 30000 88000 + 12000) = ₹ 36000

![]()

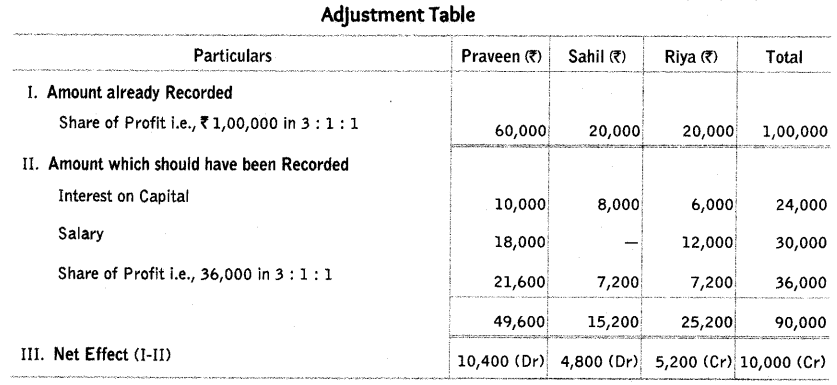

Question 49.

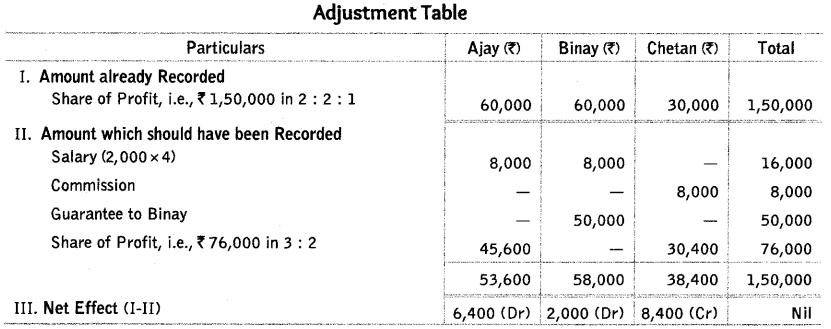

Ajay, Binay and Chetan were partners sharing profits in the ratio of 3 : 3 : 2. The partnership deed provided for the following

(i) Salary of ₹ 2,000 per quarter to Ajay and Binay.

(ii) Chetan was entitled to a commission of ₹ 8,000.

(iii) Binay was guaranteed a profit of₹ 50,000 per annum.

Answer:

Working Note

Calculation of Adjusted Profits

Adjusted Profit = Given Profit – Salary – Commission – Guarantee to Binay

= 1,50,000 – 16,000 (8,000 + 8,000) – 8,000 – 50,000

= ₹ 76000

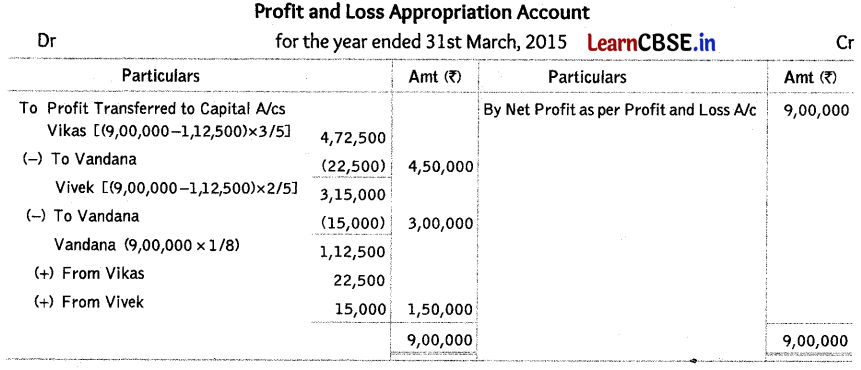

Question 50.

Vikas and Vivek were partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2014, they admitted Vandana as a new partner for 1/8th share in the profits with a guaranteed profit of ₹ 1,50,000. The new profit sharing ratio between Vivek and Vikas will remain the same but they decided to bear any deficiency on account of guarantee to Vandana in the ratio 2 : 3. The profit of the firm for the year ended 31st March, 2015 was ₹ 9,00,000.

Prepare profit and loss appropriation account of Vikas, Vivek and Vandana for the year ended 31st March, 2015. (All India 2016)

Answer:

Working Note

Vandana’s share in profit = 9,00,000 x \(\frac { 1 }{ 8 }\) = ₹ 1,12,500

Minimum profit guaranteed to Vandana = ₹ 1,50,000

Deficiency = 37,500 (1,50,000 – 1,12,500) is to be borne by Vivek and Vikas in 2 : 3 ratio.

Deficiency to be borne by Vivek = 37, 500 x \(\frac { 2 }{ 5 }\) = ₹ 15,000

Deficiency to be borne by Vikas = 37, 500 x \(\frac { 3 }{ 5 }\) = ₹ 22,500

Question 51.

P and Q were partners in a firm sharing profits in the ratio of 5 : 3. On 1st April, 2014 they admitted R as a new partner for 1/8th share in the profits with a guaranteed profit of ₹ 75,000. The new profit sharing ratio between P and Q will remain the same but they agreed to bear any deficiency on account of guarantee to R in the ratio of 3 : 2. The profit of the firm for the year ended 31st March, 2015 was ₹ 4,00,000. Prepare profit and loss appropriation account of P, Q and R for the year ended 31st March, 2015. (Delhi 2016)

Answer:

Solve as Q. no. 8 on Page 52.

Amount Transferred to Capital Accounts: P = ₹ 2,03,750; Q = ₹ 1,21,250; R = ₹ 75,000

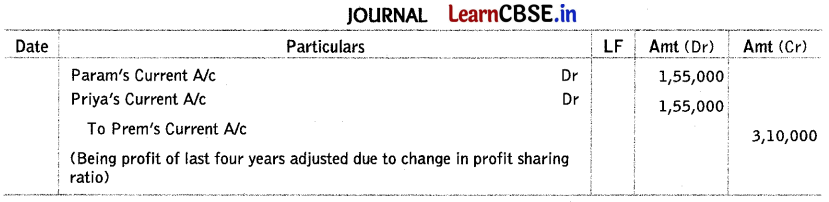

Question 52.

Prem, Param and Priya were partners in a firm. Their fixed capitals were Prem ₹ 2,00,000; Param ₹ 3,00,000 and Priya ₹ 5,00,000. They were sharing profits in the ratio of their capitals. The firm was engaged in the sale of ready-to-eat food packets at three different locations in the city, each being managed by Prem, Param and Priya. The outlet managed by Prem was doing more business than the outlets managed by Param and Priya.

Prem requested Param and Priya for a higher share in the profits of the firm which Param and Priya accepted. It was decided that the new profit sharing ratio will be 2 : 1 : 2 and its effect will be introduced retrospectively for the last four years. The profits of the last four years were ₹ 2,00,000, ₹ 3,50,000, ₹ 4,75,000 and ₹ 5,25,000 respectively.

Showing your calculations clearly, pass a necessary adjustment entry to give effect to the new agreement between Prem, Param and Priya. (All India 2015)

Answer:

Working Note

Question 53.

A and B are partners in a firm sharing profit and losses in the ratio of 3 : 2. The following was the balance sheet of the firm as at 31st March, 2010.

The profits ₹ 30,000 for the year ended 31st March, 2010 were divided between the partners without allowing interest on capital @ 12% per annum and salary to A @ ₹ 1,000 per month. During the year, A withdrew ₹ 10,000 and B ₹ 20,000. Pass the necessary adjustment journal entry and show your working clearly. (Delhi 2011)

Answer:

Solve as Q. no. 3 given on Page 48.

Debit B’s Capital Account and Credit A’s Capital Account with ₹ 5,280.

Question 54.

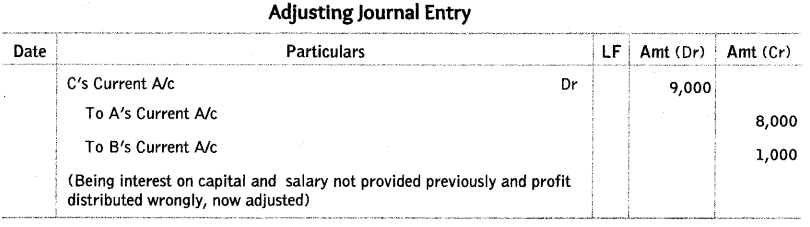

A, B and C were partners in a firm. On 1st April, 2008, their fixed capitals stood at ₹ 50,000, ₹ 25,000 and ₹ 25,000 respectively.

As per the provisions of the partnership deed

(i) B was entitled for a salary of ₹ 5,000 per annum.

(ii) All the partners were entitled to interest on capital at 5% per annum.

(iii) Profits were to be shared in the ratio of capitals.

The net profit for the year ending 31st March, 2009 of ₹ 33,000 and 31st March, 2010 of ₹ 45,000 was divided equally without providing for the above terms.

Pass an adjustment journal entry to rectify the above error. (All India 2011)

Answer:

Adjusting Journal Entry

Working Notes

2. Calculation of Adjusted Profit

Adjusted Profit = Given Profit – Salary – Interest on Capital

31st March, 2009 ⇒ 33,000 – 5,000 – 5,000 (2,500 + 1,250 + 1,250) ⇒ ₹ 23,000

31st March, 2010 ⇒ 45,000 – 5,000 – 5,000 (2,500 + 1,250 + 1,250) ⇒ ₹ 35,000

Calculation of Interest on Capital

A = 50,000 x \(\frac { 5 }{ 100 }\) = ₹ 2,500; B = 25,000 x \(\frac { 5 }{ 100 }\) = ₹ 1,250; C = 25,000 x \(\frac { 5 }{ 100 }\) = ₹ 1,250

Question 55.

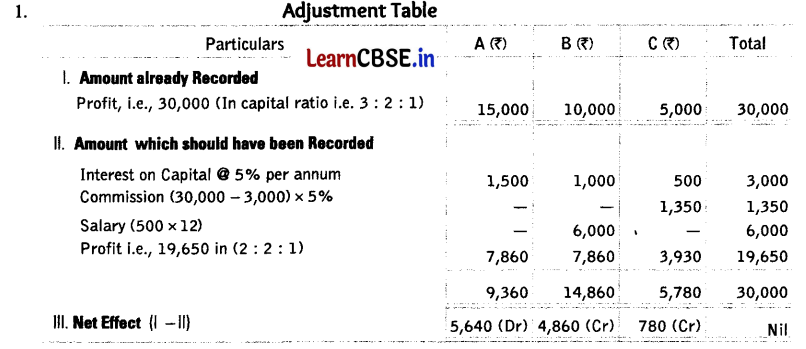

A, B and C were partners. Their capitals were ₹ 30,000, ₹ 20,000 and ₹ 10,000 respectively. According to the partnership deed, they were entitled to interest on capital @ 5% per annum. In addition, B was also entitled to draw a salary of ₹ 500 per month. C was entitled to a commission of 5% on the profits after charging the interest on capitals but before charging the salary payable to B. The net profits for the year were ₹ 30,000 distributed in the ratio of their capitals without providing for any of the above adjustments. The profits were to be shared in the ratio of 2 : 2 : 1.

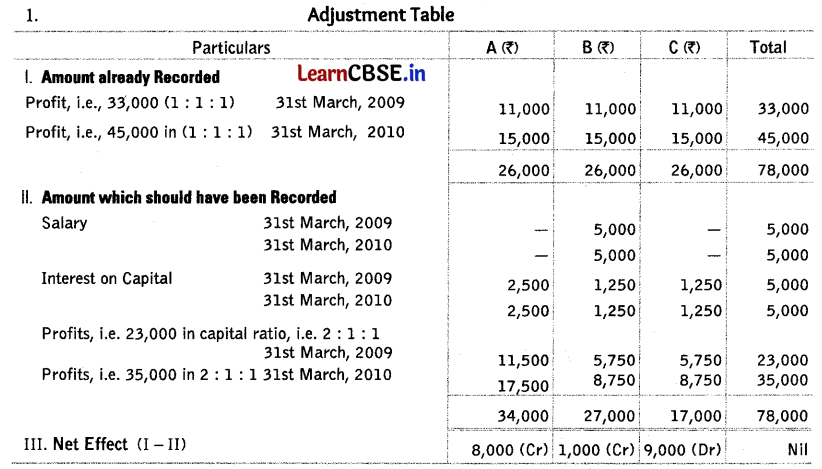

Pass the necessary adjustment entry showing the working clearly. (Delhi; All India 2010)

Answer:

Working Notes

1. Adjustment Table

2. Calculation of Adjusted Profit

Adjusted Profit = Given Profit – Interest on Capital – Salary – Commission

= 30,000 – 3,000 (1,500 +1,000 +500) – 6,000 – 1,350 = ₹ 19,650

3. Interest on Capital

A = 30,000 x \(\frac { 5 }{ 100 }\) = ₹ 1,500, B = 20,000 x \(\frac { 5 }{ 100 }\) = ₹ 1,000, C = 10,000 x \(\frac { 5 }{ 100 }\) = ₹ 500

![]()

Question 56.

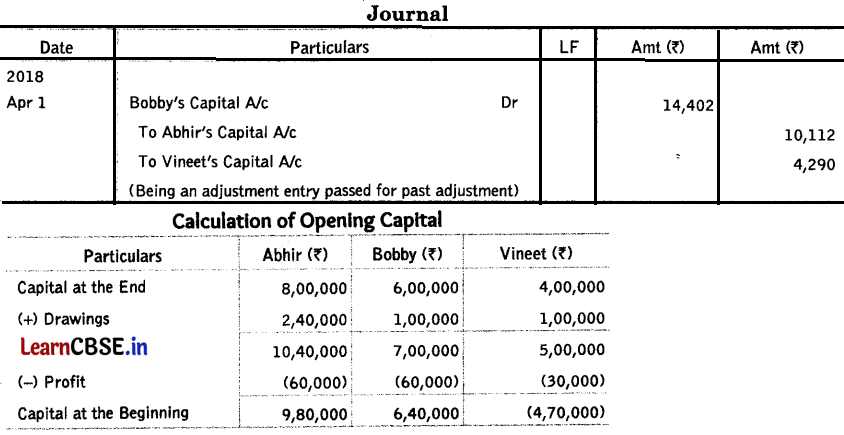

On 31st March, 2018 the balance in the capital accounts of Abhir, Bobby and Vineet, after making adjustemnts for profits and drawings were ₹ 8,00,000, ₹ 6,00,000 and ₹ 4,00,000 respectively.

Subsequently, it was discovered that interest on capital and interest on drawings had been omitted. The partners were entitled to interest on capital @ 10% p.a. and were to be charged interest on drawings @ 6% p.a. The drawings during the year were Abhir ₹ 20,000 drawn at the end of each month, Bobby ₹ 50,000 drawn at the beginning of every half year and Vineet ₹ 1,00,000 withdrawn on 31st October, 2017. The net profit for the year ended 31st March, 2018 was ₹ 1,50,000. The profit sharing ratio was 2 : 2 : 1.

Pass necessary adjusting entry for the above adjustments in the books of the firm. Also, show your workings clearly. (All India 2019)

Answer:

Calculation of Interest on Drawings

Calculation of Opening Capital

Abhir = 20,000 x 12 x \(\frac { 6 }{ 100 }\) x \(\frac { 5.5 }{ 12 }\) = ₹ 6,600

Bobby = 50000 x 2 x [\(\frac { 6 }{ 100 }\) x \(\frac { 9 }{ 12 }\) = ₹ 4,500

Vineet = 1,00,000 x \(\frac { 6 }{ 100 }\) x \(\frac { 5 }{ 12 }\) = ₹ 2,500

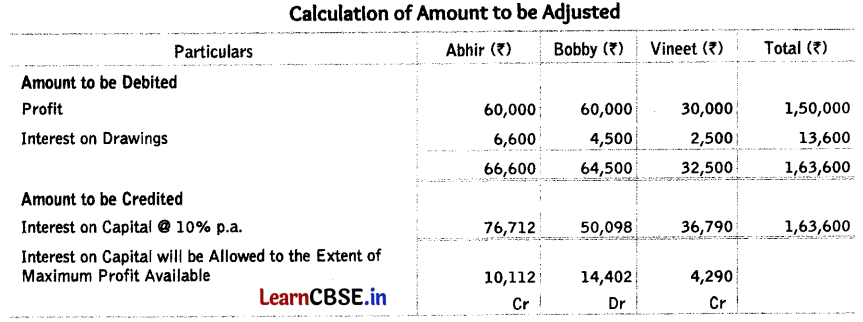

Question 57.

Naveen, Qadir and Bajesh were partners doing an electronic goods business in Uttarakhand. After the accounts of partnership were drawn up and closed, it was discovered that interest on capital has been allowed to partners @ 6% p.a. for the years ending 31st March, 2017 and 2018, although there is no provision for interest on capital in the partnership deed. On the other hand, Naveen and Qadir were entitled to a salary of ₹ 3,500 and ₹ 4,000 per quarter respectively, which has not been taken into consideration. Their fixed capitals were ₹ 4,00,000, ₹ 3,60,000 and ₹ 2,40,000 respectively. During the last two years they had shared the profits and losses as follows

| Year Ended | Ratio |

| 31st March, 2017 | 3 : 2 : 1 |

| 31st March, 2018 | 5 : 3 : 2 |

Pass necessary adjusting entry for the above adjustments in the books of the firm. Also, show your workings clearly. (All India 2019)

Answer:

Question 58.

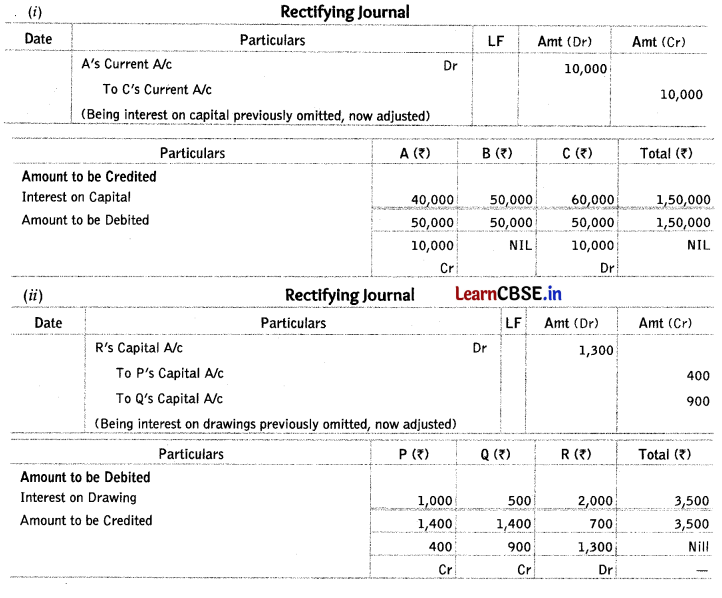

Pass necessary rectifying journal entries for the following omissions committed while preparing profit and loss appropriation Account. You are also required to show your workings clearly.

(i) A, B and C were partners sharing profits and losses equally. Their fixed capitals were A ₹ 4,00,000; B ₹ 5,00,000 and C ₹ 6,00,000. The partnership deed provided that interest on partners’ capital will be allowed @10% per annum. The same was omitted.

(ii) P, Q and R were partners in a firm sharing profits and losses in the ratio of 2 : 2 :1. Their partnership deed provided that interest on partners’ drawings will be charged @ 18% p.a. Interest on the partners’ drawings was ₹ 1,000, ₹ 500 and ₹ 2,000 respectively. The same was omitted. (All India 2019)

Answer:

(i) Rectifying Journal

Question 59.

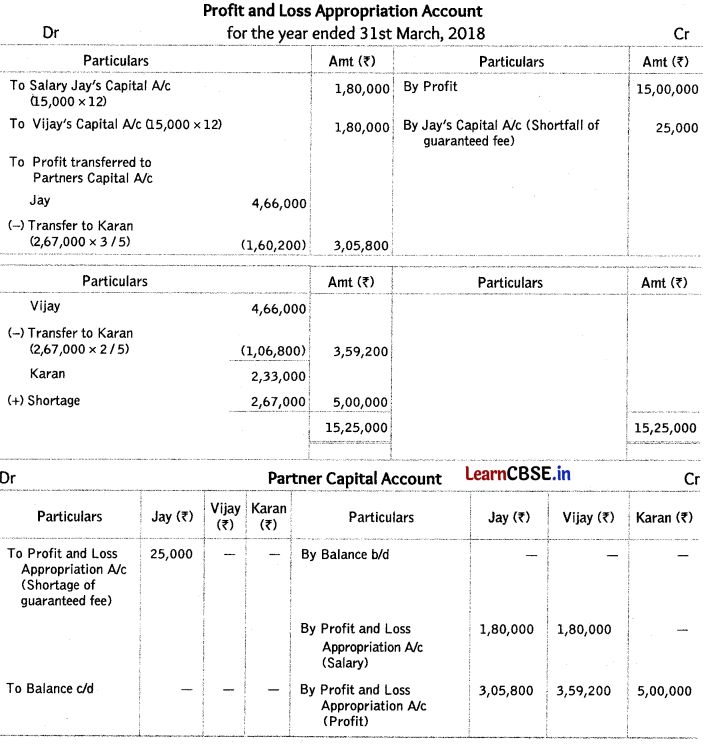

Jay, Vijay and Karan were partners of an architect firm sharing profits in the ratio of 2 : 2 : 1. Their partnership deed provided the following:

(i) A monthly salary of ₹ 15,000 each to Jay and Vijay.

(ii) Karan was guaranteed a profit of ₹ 5,00,000 and Jay guaranteed that he will earn an annual fee of ₹ 2,00,000. Any deficiency arising because of guarantee to Karan will be borne by Jay and Vijay in the ratio of 3 : 2.

During the year ended 31st March, 2018 Jay earned fee of ₹ 1,75,000 and the profits of the firm amounted to ₹ 15,00,000.

Showing your workings clearly prepare Profit and Loss Appropriation Account and the Capital Account of Jay, Vijay and Karan for the year ended 31st March, 2018. (Delhi 2019)

Answer:

NOTE: In the absence of any information of capital at the beginning, it is not possible to close capital account and calculate capital at the end. Alternatively, we can calculate the balance also.

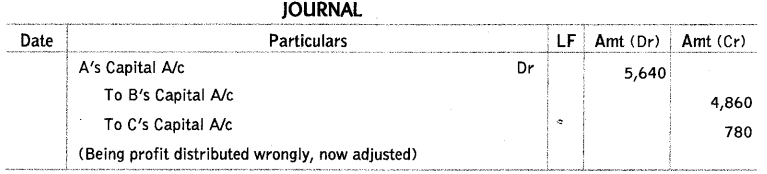

Question 60.

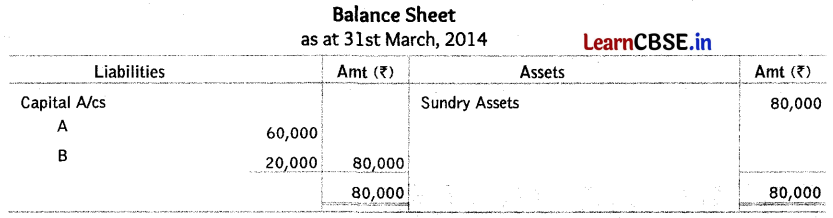

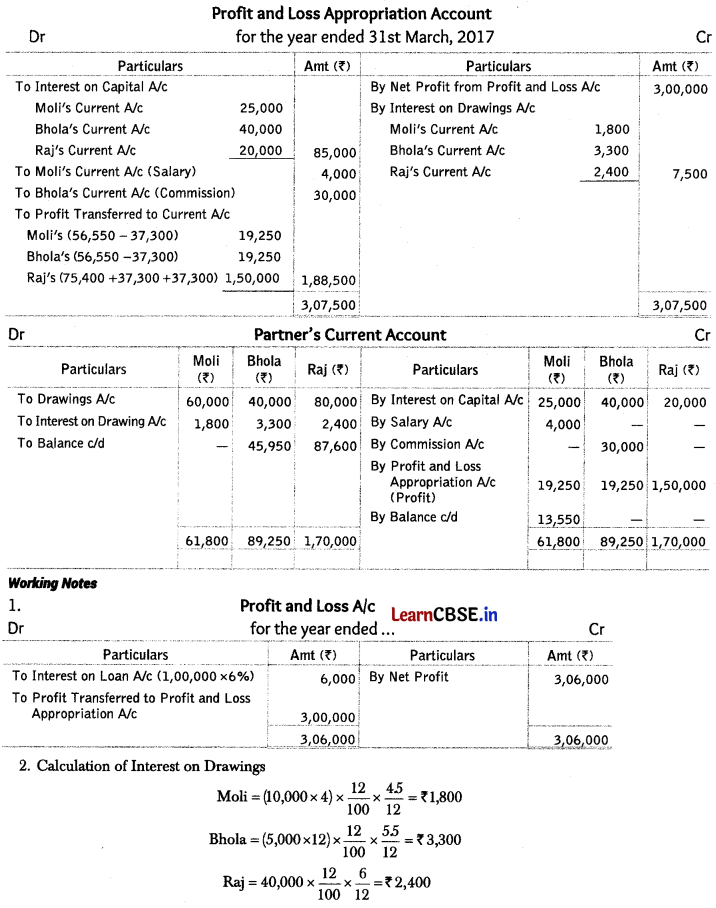

Moli, Bhola and Raj were partners in a firm sharing profits and losses in the ratio of 3 : 3 : 4. Their partnership deed provided for the following.

(i) Interest on capital @ 5% per annum.

(ii) Interest on drawing @ 12% per annum.

(iii) Interest on partners’ loan @ 6% per annum.

(iv) Moli was allowed an annual salary of ₹ 4,000, Bhola was allowed a commission of 10% of net profit as shown by profit and loss account and Raj was guaranteed a profit of ₹ 1,50,000 after making all the adjustments as provided in the partnership agreement.

Their fixed capitals were Moli ₹ 5,00,000; Bhola ₹ 8,00,000 and Raj ₹ 4,00,000. On 1st April, 2016 Bhola extended a loan of ₹ 1,00,000 to the firm. The net profit of the firm for the year ended 31st March, 2017 before interest on Bhola’s loan was ₹ 3,06,000.

Prepare profit and loss oppropriation account of Moli, Bhola and Raj for the year ended 31st March, 2017 and their current accounts assuming that Bhola withdrew ₹ 5,000 at the end of each month, Moli withdrew ₹ 10,000 at the end of each quarter and Raj withdrew ₹ 40,000 at the end of each half year. (CBSE 2018)

Answer:

3. Calculation of Commission Payable to Bhola

3,0, 000 x \(\frac { 10 }{ 100 }\) = ₹ 30,000

4. Distributable profits = 3,00,000 + 7,500 – 85,000 – 4,000 – 30,000 = ₹ 1,88,500

Moli’s share =1,88,500 x \(\frac { 3 }{ 10 }\) = ₹ 56,550; Bhola’s share = 1,88,500 x \(\frac { 3 }{ 10 }\) = ₹ 56,500

Raj’s share =1,88,500 x \(\frac { 4 }{ 10 }\) = ₹ 75,400; Amount guaranteed to Raj = ₹ 1,50,000

Deficiency = Guaranteed amount – Actual amount

= 1,50,000 – 75,400 = ₹ 74,600 to be borne by Moli and Bhola equally, i.e. 37,300 each.

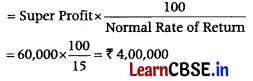

![]()

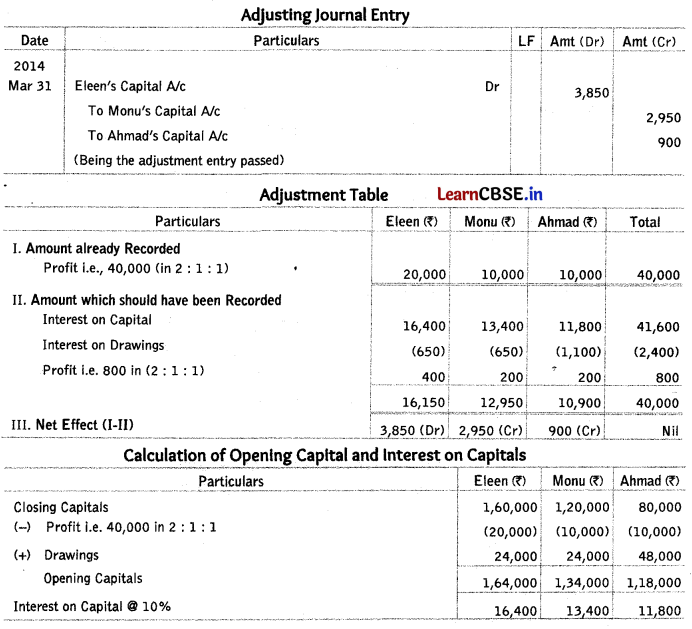

Question 61.

On 31st March, 2014, the balances in the capital accounts of Eleen, Monu and Ahmad after making adjustments for profits and drawings were ₹ 1,60,000, ₹ 1,20,000 and ₹ 80,000 respectively. Subsequently, it was discovered that the interest on capital and drawings had been omitted.

(i) The profit for the year ended 31st March, 2014 was ₹ 40,000.

(it) During the year Eleen and Monu each withdrew a total sum of ₹ 24,000 in equal instalments in the beginning of each month and Ahmad withdrew a total sum of ₹ 48,000 in equal instalments at the end of each month.

(iii) The interest on drawings was to be charged @ 5% per annum and interest on capital was to be allowed @ 10% per annum.

(iv) The profit sharing ratio among the partners was 2 : 1 : 1.

Showing your working notes clearly, pass the necessary rectifying entry. (Delhi (c) 2015)

Answer:

Interest on Drawings

Eleen = 24,000 x \(\frac { 5 }{ 100 }\) x \(\frac { 6.5 }{ 12 }\) = ₹ 650

Monu = 24,000 x \(\frac { 5 }{ 100 }\) × \(\frac { 6.5 }{ 12 }\) = ₹ 650

Ahmad = 48000 x \(\frac { 5 }{ 100 }\) × \(\frac { 5.5 }{ 12 }\) = ₹ 1.100

Calculation of Adjusted Profit:

Adjusted Profit = Given Profit – Interest on Capital + Interest on Drawings

=40,000 – 41,600 (16,400 + 13,400 + 11,800) + 2,400 (650 + 650 + 1,100) = ₹ 800

Question 62.

A, B and C were partners in a firm. On 1st April, 2012 their capitals stood as ₹ 5,00,000, ₹ 2,50,000 and ₹ 2,50,000 respectively.

As per provisions of the partnership deed

(i) C was entitled for a salary of ₹ 5,000 per month,

(ii) A was entitled for a commission of ₹ 80,000 per annum,

(iii) Partners were entitled to interest on capital @ 6% per annum.

(iv) Partners will share profits in the ratio of capitals.

Net profit for the year ended 31st March, 2013 was ₹ 3,00,000 which was distributed equally, without taking into consideration the above provisions. Showing your working clearly, pass necessary adjustment entry for the above. (Delhi (C) 2014)

Answer:

Solve as Q. no. 12 on page 54 and 55.

Debit B’s Capital Account and Credit A’s Capital Accounts with ₹ 60,000

Question 63.

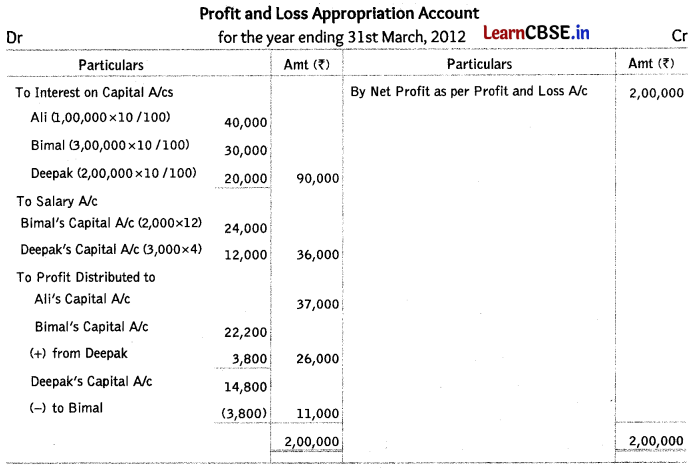

Ali, Bimal and Deepak are partners in a firm. On 1st April, 2011 their capital accounts stood at ₹ 4,00,000, ₹ 3,00,000 and ₹ 2,00,000 respectively. They shared profits and losses in the ratio of 5 : 3 : 2 respectively. Partners are entitled to interest on capital @ 10% per annum and salary to Bimal and Deepak @ ₹ 2,000 per month and ₹ 3,000 per quarter respectively as per the provisions of the partnership deed.

Bimal’s share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of ₹ 50,000 per annum. Any deficiency arising on that account shall be met by Deepak. The profits of the firm for the year ended 31st March, 2012 amount to ₹ 2,00,000. Prepare profit and loss appropriation account for the year ended on 31st March, 2012. (Delhi 2013)

Answer:

Working Note:

Distributable profits = 2,00,000 – 90,000 – 36,000 = ₹ 74,000 to be distributed in 5 : 3 : 2

Ali’s share = 74,000 × \(\frac { 5 }{ 10 }\) = ₹ 37,000; Deepak’s share = 74,000 × \(\frac { 3 }{ 10 }\) = ₹ 14,800

Bimal’s share (excluding interest on capital and salary) = 74,000 x \(\frac { 3 }{ 10 }\) = ₹ 22,200

Bimal’s share (excluding interest on capital and including salary) = 22,200 + 24,000 (Salary) = ₹ 46,200

Guarantee by Deepak = ₹ 50,000

Deficiency to be borne by Deepak = 50,000 – 46,200= ₹ 3,800

Question 64.

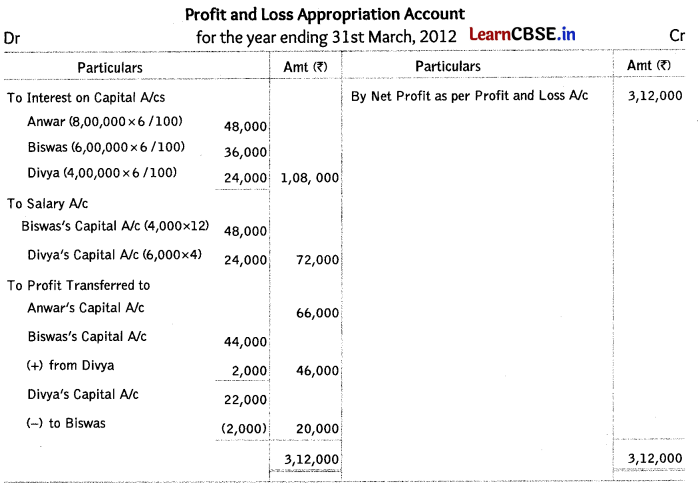

Anwar, Biswas and Divya are partners in a firm. Their capital accounts stood at ₹ 8,00,000, ₹ 6,00,000 and ₹ 4,00,000 respectively on 1st April, 2011. They shared profits and losses in the ratio of 3 : 2 : 1 respectively. Partners are entitled to interest on capital @ 6% per annum and salary to Biswas and Divya @ ₹ 4,000 per month and ₹ 6,000 per quarter respectively as per the provisions of partnership deed.

Biswas’s share of profit (including interest on capital but excluding salary) is guaranteed at a minimum of ₹ 82,000 per annum. Any deficiency arising on that account shall be met by Divya. The profits for the year ended 31st March, 2012 amounted to ₹ 3,12,000. Prepare profit and loss appropriation account for the year ended 31st March,2012. (Delhi 2013)

Answer:

Working Note

Distributable profits = 3,12,000 – 1,08,000 – 72,000 = ₹ 1,32,000 to be distributed in 3 : 2 : 1

Anwar’s share = 1,32,000 x \(\frac { 3 }{ 6 }\) = ₹ 66,000; Divya’s share = 1,32,000 × \(\frac { 1 }{ 6 }\) = ₹ 22,000

Biswas’s share of profit (excluding interest on capital an salary) = 1,32,000 × \(\frac { 2 }{ 6 }\) = ₹ 44,000

Biswas’s share (excluding salary and including interest on capital)

= 44,000 + 36,000 (Interest on Capital) = ₹ 80,000

Guarantee by Divya = ₹ 82,000. Therefore, deficiency of ₹ 2,000 (82,000 – 80,000) should be contributed by Divya.

Question 65.

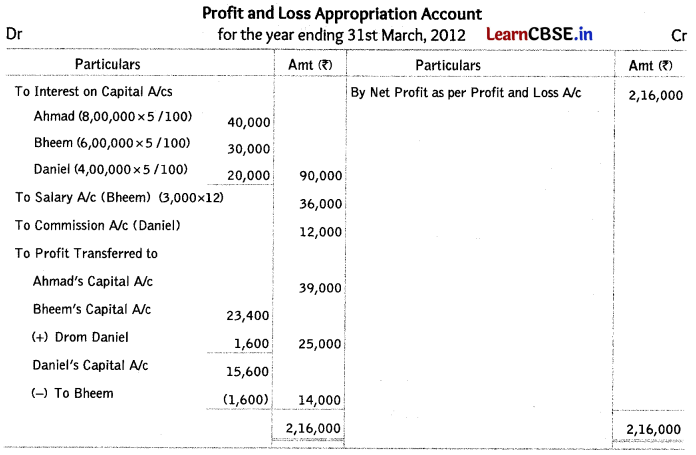

Ahmad, Bheem and Daniel are partners in a firm. On 1st April, 2011, the balance in their capital accounts stood at ₹ 8,00,000, ₹ 6,00,000 and ₹ 4,00,000 respectively. They shared profits in the proportion of 5 : 3 : 2 respectively. Partners are entitled to interest on capital @ 5% per annum and salary to Bheem @ ₹ 3,000 per month and a commission of ₹ 12,000 to Daniel as per the provisions of the partnership deed.

Ahmad’s share of profit (excluding interest on capital) is guaranteed at not less than ₹ 25,000 per annum. Bheem’s share of profit (including interest on capital but excluding salary) is guaranteed at not less than ₹ 55,000 per annum. Any deficiency arising on that account shall be met by Daniel. The profits of the firm for the year ended 31st March, 2012 amounted to ₹ 2,16,000. Prepare ‘profit and loss appropriation account’ for the year ended 31st March, 2012. (All India 2013)

Answer:

Working Note:

Distributable profits = 2,16,000 – 90,000 – 36,000 -12,000 = ₹ 78,000 to be distributed in 5 : 3 : 2.

Ahmad’s share of profit = 78,000 x \(\frac { 5 }{ 10 }\) = ₹ 39,000

Ahmad’s share of profit is already above the guaranteed amount, therefore no adjustment is required. I

Bheem’s share of profit (excluding interest on capital and salary) = 78,000 x \(\frac { 3 }{ 10 }\) = ₹ 23,400

Bheem’s share (excluding salary and including interest on capital) = 23,400 +30,000 = ₹ 53,400 1

Guarantee by Daniel = ₹ 55,000

Therefore, deficiency of ₹ 1,600 (55,000 – 53,400) should be contributed by Daniel.

Daniel’s share =78,000 x \(\frac { 2 }{ 10 }\) = ₹ 15,600

Question 66.

How does nature of business affect the value of goodwill of a firm? (All India 2019:2011)

Answer:

If the nature of the products, in which the firm deals, are in high demand, the profit of the firm will be higher and therefore the value of goodwill will increase.

![]()

Question 67.

How does the market situation affect the value of goodwill of a firm? (Delhi 2011)

Answer:

The monopoly condition or limited competition enables the concern to earn high profits which leads to higher value of goodwill.

Question 68.

How does the factor ‘quality of product’ affect the goodwill of a firm? (Delhi: All Indio 2010)

Answer:

If the firm enjoys good reputation for its product quality, there will be higher sales and the value of its goodwill will increase.

Question 69.

How does the factor ‘efficiency of management’ affect the goodwill of a firm? (Delhi: All Indio 2010)

Answer:

When the management of a firm is capable and competent, the firm will earn higher profits therefore the ‘efficiency of management’ surely will affect or increase the goodwill.

Question 70.

How does the factor location affect the goodwill of a firm? (Delhi 2010)

Answer:

The value of business will be more, if it is located in a convenient or prominent locality.

Question 71.

The firm of P, Q and R earned ₹ 4,00,000 average profits during the last three years. The capital employed in the business was ₹ 6,00,000. Normal rate of return of the industry is 8%.

Calculate the goodwill of the firm by capitalising the super profits. (All India 2019)

Answer:

Average Profit = ₹ 4,00,000

Capital Employed = ₹ 6,00,000

Normal Rate of Return = 8%

Normal Profit = 6,00,000 x \(\frac { 8 }{ 100 }\) = ₹ 48,000 100

Super Profit = Average Profit – Normal Profit

= 4,00,000 – 48P00 = ₹ 3,52,000

Goodwill = Super Profit × \(\frac { 100 }{ Normal Rate of Return }\)

= 3,52,000 × \(\frac { 100 }{ 8 }\)

= ₹ 44,00,000

Question 72.

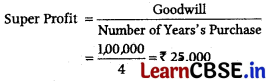

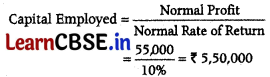

Average profits of a firm during the last few years are ? 80,000 and the normal rate of return in a similar business is 10%. If the goodwill of the firm is ₹ 1,00,000 at 4 years’ purchase of super profit, find the capital employed by the firm. (All India 2019)

Answer:

Normal Profit = Average Profit – Super Profit

= 80000 – 25000 = ₹ 55,000

Question 73.

A firm earned average profit of ₹ 3,00,000 during the last few years. The normal rate of return of the industry is 15%. The assets of the business were ₹ 17,00,000 and its liabilities were ₹ 2,00,000. Calculate the goodwill of the firm by capitalisation of average profits. (Dehli 2019)

Answer:

Average Profit = ₹ 3,00,000

Normal Rate of Return = 15%

Capitalised Value of Average Profits

= ₹ 20,00,000 …(1)

Capital Employed = Total Assets – Liabilities

= 17,00,000 – 2,00,000 = ₹ 15,00,000 …(2)

Goodwill = Capitalised Value of verage Profit – Capital employed

= 20,00,000 – 15,00,000 = ₹ 500000

Question 74.

The capital of the firm of Anuj and Benu is ₹ 10,00,000 and the market rate of interest were is 15%. Annual salary to the partner is ₹ 60,000 each. The profit for the last three years ₹ 3,00,000, ₹ 3,60,000 and ₹ 4,20,000. Goodwill of the firm is to be valued on the basis of two years purchase of last three years average super profits. Calculate the goodwill of the firm. (Delhi 2019)

Answer:

Capital Employed = ₹ 10,00,000

Normal Rate of Return = 15%

Normal Profit = 10,00,000 × 15% = ₹ 1,50,000

3 Year’s Average Profit

= \(\frac { 3,00,000 + 3,60,000 + 4,20,000 }{ 3 }\)

= ₹ 3,60,000

Average profit after partners salary

= 3,00,000 – 60,000 × 2 = ₹ 2,40,000

Super Profit = Average Profit – Normal Profit

= 2,40,000 – 1,50,000 = ₹ 90,000

Goodwill = Super Profit × No. of Year’s Purchase

= 90,000 × 2 = ₹ 1,00,000

Question 75.

State any three circumstances other than (i) death of a partner (ii) admission of a partner and (iii) retirement of a partner when need for valuation of goodwill of a firm may arise. (Delhi; All India 2016)

Answer:

The need for valuation of goodwill may arise

(i) When there is a Change in Profit Sharing Ratio In case the existing partners in the firm decide to mutually change the profit sharing ratio between them, there is a need to value the goodwill.

(ii) When the Partnership Firm is Sold as Going Concern The need for valuation of goodwill arises, in case the partnership firm is sold to some other concern on going basis.

(iii) When Two Firms Amalgamate The need for valuing also arises in case of amalgamation of two firms that is merger or acquisition of two business.

![]()

Question 76.

On 1st April, 2014 a firm had assets of ₹ 1,00,000 excluding stock of ₹ 20,000. Partners’ capital accounts showed a balance of ₹ 60,000. The current liabilities were ₹ 10,000 and the balance constituted the reserve. If the normal rate of return is 8% the ‘Goodwill’ of the firm is valued at ₹ 60,000 at four years’ purchase of super profit, find the average profit of the firm. (All India (C) 2015)

Answer:

Goodwill = Super Profit × Number of Years’ Purchase

60,000 = Super profit × 4

Super profit = \(\frac { 60,000 }{ 4 }\) = ₹ 15000

Capital Employed

⇒ Total Assets – Current liabilities

⇒ (100000 + 20000) – 10000

⇒ ₹ 110000

Normal Profit = Capital Employed × Normal Rate of Return

= 110000 x \(\frac { 8 }{ 100 }\) = ₹ 8,800

Super Profit = Average Profit – Normal Profit

15000 = Average profit – 8,800

Average profit = 15,000 + 8,800 = ₹ 23000

Question 77.

The average profit earned by a firm is ₹ 75,000 which includes undervaluation of stock of ₹ 5,000 on an average basis. The capital invested in the business is ₹ 7,00,000 and the normal rate of return is 7%. Calculate goodwill of the firm on the basis of 5 times the super profit. (Delhi (C) 2015)

Answer:

Average profit = 75,000 + 5,000 = ₹ 80,000

Normal Profit = Capital Employed × Normal Rate of Return

= 700000 × \(\frac { 7 }{ 100 }\) = ₹ 49000

Super Profit = Average Profit – Normal Profit

= 80000 – 49000 = ₹ 31000

Goodwill = Super Profit × Number of Years Purchase

= 31000 × 5 = ₹ 1,55000

Question 78.

A business has earned average profits of ₹ 1,00,000 during the last few years and the normal rate of return in similar business is 10%. Find out the value of goodwill by

(i) Capitalisation of super profit method.

(ii) Super profit method, if the goodwill is valued at 3 years’ purchase of super profit.

The assets of the business were ? 10,00,000 and its external liabilities ₹ 1,80,000. (Delhi 2011)

Answer:

Actual average profit = ₹ 1,00,000

Normal rate of return = 10%

Total assets = ₹ 10,00,000

External liabilities = ₹ 1,80,000

Capital Employed = Total Assets – External Liabilities

= 10,00,000 – 1,80,000

= ₹ 8,20,000

Normal Profit = Capital Employed × \(\frac { Normal Rate of Return }{ 100 }\)

= 8,20,000 x \(\frac { 10 }{ 100 }\) = ₹ 82,000

Super Profit = Average Profit – Normal Profit

= 100,000 – 82000 = ₹ 18,000

(i) Calculation of Goodwill by Capitalisation of Super Profit Method

Goodwill

= Super Profit × \(\frac { 100 }{ Normal Rate of Return }\)

= 18000 x \(\frac { 100 }{ 10 }\) = ₹ 180000

(ii) Calculation of Goodwill by Super Profit Method

Goodwill = Super Profit × Number of Years’ Purchase

= 18000 × 3 = ₹ 54000

Question 79.

A partnership firm earned net profits during the last 3 years as follows

| Year | Net Profit |

| 2007-2008 | 1,90,000 |

| 2008-2009 | 2,20,000 |

| 2010-2011 | 2,50,000 |

The capital employed in the firm throughout the above mentioned period has been ₹ 4,00,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. The remuneration of all the partners during this period is estimated to be ₹ 1,00,000 per annum.

Calculate the value of goodwill on the basis of

(i) 2 years’ purchase of super profits earned on average basis during the above mentioned 3 years and

(ii) By capitalisation method. (All india 2011)

Answer:

3 years’ total profit = 1,90000 + 220000 + 2,50000 = ₹ 6,60,000

Average profit = \(\frac { 660000 }{ 3 }\) = ₹ 2,20,000

(-) Remuneration to partners = ₹ 1,00,000

Actual average profit = ₹ 1,20,000

Capital employed = ₹ 4,00,000

Normal rate of return = 15%

Normal profit = 400000 × \(\frac { 15 }{ 100 }\) = ₹ 60,000

Super Profit = Actual Average Profit – Normal Profit

= 1,20,000 – 60,000 = ₹ 60,000

(i) Goodwill = Super Profit × Number of Years’ Purchase

= 60,000 × 2 = ₹ 1,20,000

(ii) Capitalised Value of Goodwill

Question 80.

If partnership deed is silent or has not been formulated, then partners are entitled for

(a) salary

(b) commission

(c) interest on loan

(d) profit share in capital ratio

Answer:

(c) interest on loan

Question 81.

In partnership business, partner’s liability is

(a) in proportion to profit/loss

(b) in proportion to capital

(c) limited

(d) unlimited

Answer:

(d) unlimited

![]()

Question 82.

If a partner individually carries on any business of the same nature as competing with that of firm, he shall account for

(a) retire from partnership

(b) all profits made by him

(c) dissolve the firm

(d) None of the above

Answer:

(b) all profits made by him

Question 83.

In a partnership, manager’s commission is shown in

(a) profit and loss account

(b) profit and loss appropriation account

(c) balance sheet

(d) None of the above

Answer:

(a) profit and loss account

Question 84.

In a partnership, interest on partner’s capital is

(a) debited to profit and loss appropriation account

(b) credited to profit and loss appropriation acoount

(c) debited to profit and loss account

(d) credited to profit and loss account

Answer:

(a) debited to profit and loss appropriation account

Question 85.

If a partner draws a fixed amount on the first day of every month, then for what period the interest on total drawings is calculated?

(a) 5.5 months

(b) 6.5 months

(c) 6 months

(d) None of these

Answer:

(c) 6 months

Question 86.

‘A’ and ‘B’ were partners in a firm. They share their profits in the ratio of 2 : 1. A’ withdraws an amount of ₹ 2,000 on 1st July, 2017. Journalise it.

(a) Profit and Loss Appropriation A/c Dr – 2,000

To A’s Capital A/c – 2,000

(b) A’s Capital A/c Dr – 2,000

To Profit and Loss A/c – 2,000

(c) A’s Drawings A/c Dr – 2,000

To Cash/Bank A/c – 2,000

(d) A’s Capital A/c Dr – 2,000

To A’s Drawings A/c – 2,000

Answer:

(c) A’s Drawings A/c Dr – 2,000

To Cash/Bank A/c – 2,000

Question 87.

Gupta and Bansal are partners in a firm, Gupta withdraw ₹ 800 per month at the beginning of every month for 6 months ending on 31st December, 2017. Bansal withdraw ₹ 800 per month at the end of every month for 6 months ending on 31st December, 2017. Calculate interest on drawings @ 15% per annum on 31st December, 2017.

(a) Gupta = ₹ 320, Bansal ₹ 280

(b) Gupta = ₹ 180, Bansal = ₹ 220

(c) Gupta = ₹ 720, Bansal = ₹ 720

(d) Gupta = ₹ 210, Bansal = ₹ 150

Answer:

(d) Gupta = ₹ 210, Bansal = ₹ 150

Question 88.

When fluctuating capital method is used, which of the following items are shown in debit side of partners’ capital account?

(a) Opening debit balance of capital account

(b) Drawings

(c) Interest on drawings

(d) All of the above

Answer:

(d) All of the above

Question 89.

‘A’ and ‘B’ were partners in a firm. They share profits in the ratio of 2 : 3. Their capital account balance as on 1st April, 2017 was ? 10,00,000 and ? 20,00,000. Additional capital introduced by them, A = ₹ 3,00,000, B = ₹ 2,00,000. Journalise it.

Answer:

Question 90.

Asha and Bipasha are partners in a firm. They share profits in the ratio of 1 : 1. In this year, they suffered a loss. They maintain capital accounts under fluctuating account method. Pass journal entry to transfer the loss to the capital accounts of Asha and Bipasha.

(a) Profit and Loss Appropriation A/c Dr

To Asha’s Capital A/c

To Bipasha’s Capital A/c

(b) Asha’s Capital A/c Dr

To Bipasha’s Capital A/c

(c) Asha’s Capital A/c Dr

Bipasha’s Capital A/c Dr

(d) None of the above

Answer:

(c) Asha’s Capital A/c Dr

Bipasha’s Capital A/c Dr

Question 91.

‘R’ and ‘S’ were partners in a firm. They share their profits and losses in 1 : 2 ratio. ‘R’ is hard working and dedicated to the affairs of the firm. As per contract or deed he is to receive ₹ 500 per month as salary. Journalise it if capital account is maintained under fixed capital method.

Answer:

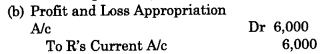

Question 92.

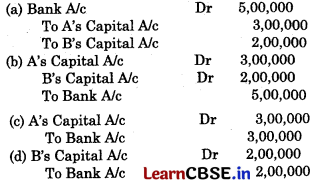

Pass the journal entry to record salary of partner

(a) Profit and Loss Appropriation A/c Dr

To Partners’ Capital A/c

(b) Profit and Loss A/c Dr

To Salary A/c

(c) Partner’s Capital A/c Dr

To Salary A/c

(d) Salary A/c Dr

To Profit and Loss Appropriation A/c

Answer:

(a) Profit and Loss Appropriation A/c Dr

To Partners’ Capital A/c

![]()

Question 93.

‘X’ and Y are partners in a firm sharing profits in the ratio of 3 : 2. As per their agreement, “X’ will receive 5% per annum interest on his loan of ₹ 1,00,000 and Y will receive 2% commission on sales affected by him, which were ₹ 1,00,000. Calculate X’s share of profit when net profit as per profit and loss account is ₹ 1,00,000.

(a) ₹ 58,800

(b) ₹ 58,000

(c) ₹ 60,000

(d) ₹ 48,200

Answer:

(a) ₹ 58,800

Question94.

‘A’ and ‘B’ are partners sharing profits in the ratio of 3 : 2. Calculate interess on A/s capital if profits for the year are ₹ 15,000 and interest on capital to all partners is ₹ 20,000 each.

(a) ₹ 20,000

(b) ₹ 12,500

(c) ₹ (7,500)(loss)

(d) ₹ 7,500

Answer:

(d) ₹ 7,500