We have given these Accountancy Class 12 Important Questions and Answers Chapter 11 Cash Flow Statement to solve different types of questions in the exam. Go through these Class 12 Accountancy Chapter 11 Cash Flow Statement Class 12 Important Questions and Answers Solutions & Previous Year Questions to score good marks in the board examination.

Cash Flow Statement Important Questions Class 12 Accountancy Chapter 11

Question 1.

‘Payment of dividend and interest’ will be classified as which type of activity while preparing cash flow statement? (All India 2019, 2011)

Or

While preparing cash flow statement, ‘receipt of interest and dividend’ will be classified under which type of activity in case of a non-financial enterprise? (All India 2019)

Or

‘Payment and receipt of interest and dividend’ is classified as which type of activity while preparing cash flow statement? (Delhi 2017)

Answer:

Payment and receipt of interest and dividend is classified as financing activity while preparing cash flow statement of a non-financial company.

![]()

Question 2.

What is meant by ‘cash flow’? (All India 2019, 2014: Delhi 2019, 2014, 2011)

Or

State the meaning of ‘cash flow’ while preparing cash flow statement. (All India 2014)

Answer:

‘Cash flow’ implies inflow and outflow of cash and cash equivalents. Receipt of cash from an item other than cash and cash equivalents is termed as ‘cash inflow’ while cash payment in respect of such item is termed as ‘cash outflow’.

Question 3.

When can ‘receipt of dividend’ be classified as an operating activity? State. Also give reason in support of your answer. (All India 2019)

Answer:

When dividend is received by a finance company, then it can be considered as an operating activity. It is so, because investing is a primary business of finance company.

Question 4.

Mevo Ltd a financial enterprise had advanced a loan of ₹ 3,00,000, invested ₹ 6,00,000 in shares of the other companies and purchased machinery for ₹ 9,00,000. It received divided of ₹ 70,000 on investment in shares. The company sold an old machine of the book value of ₹ 79,000 at a loss of ₹ 10,000. Compute cash flows investing activities. (Dehli 2019)

Answer:

Calculation of Cash Flow from Investing Activities

| Particulars | Amount (₹) |

| Purchase of Machinery | (9,00,000) |

| Sale of Machinery | 69,000 |

| Purchase of Investments | (6,00,000) |

| Cash used in Investing Activities | 14,31,000 |

Question 5.

Are ‘assets acquired by issue of shares disclosed in the cash flow statement? Give reason in support of your answer. (All India 2019)

Answer:

No, ‘assets acquired by issue of shares’ are not disclosed in the cash flow statement due to non-cash nature of the transction.

Question 6.

K Ltd a manufacturing company obtained a loan of ₹ 6,00,000, advanced a loan of ₹ 1,00,000 and purchased machinery for ₹ 5,00,000. Calculate the amount of cash flow from financing and investing activities. (Delhi 2019)

Answer:

Cash Flow from Investing Activities

| Particulars | Amt (₹) |

| Loan Given | (1,00,000) |

| Purchase of Machinery | (5,00,000) |

| Cash used in Investing Activity | (6,00,000) |

:

| Particulars | Amt (₹) |

| Loan Given | 6,00,000 |

| Cash Flow from Financing Activity | 6,00,000 |

Question 7.

Under which type of activity will you classify cash advances and loans made to third party while preparing cash flow statement? (All India 2019; Comportment 2018)

Answer:

Investing activities

Question 8.

State the primary objective of preparing a cash flow statement. (All India 2019,2017: CBSE 2018: Comportment 2018)

Answer:

The primary objective of preparing cash flow statement is to provide useful information about the cash flows of an enterprise during a particular period under various heads, i.e. operating, investing and financing activities.

Question 9.

What is meant by ‘cash and cash equivalents’? (All India 2019)

Or

Give the meaning of ‘cash equivalents’ for the purpose of preparing cash flow statement. (Delhi 2016)

Or

What is meant by ‘cash equivalents’? (All India 2014,2011: Delhi (C) 2014)

Answer:

Cash comprises cash in hand and demand deposits with banks and Cash equivalents are short-term highly liquid investments that can be easily convertible into known amount of cash and which are subject to an insignificant risk of change in value, e.g. Short-term marketable securities, which can be readily converted into cash, are treated as cash equivalents.

Question 10.

What is meant by ‘inflow of cash’? (All India 2019)

Answer:

‘Inflow of cash’ means funds received by a company due to operating, investing or financing activities.

Question 11.

How is goodwill written-off treated while calculating cash flow from operating activities? (All India 2019)

Answer:

Goodwill written-off is added to profit before tax and extraordinary items to calculate operating profit before working capital changes while calculating cash flow from operating activities.

Question 12.

When does an investment qualify as cash equivalent? (All India 2019)

Answer:

When the maturity period of investment is not more than three months.

Question 13.

‘Interest received and paid’ is considered as which type of activity by a finance company while preparing a cash flow statement? (CBSE 2018)

Answer:

Interest received by a finance company is an operating activity. Interest paid by a finance company is also an operating activity.

Question 14.

Normally, what should be the maturity period for a short-term investment from the date of its acquisition to be qualified as cash equivalents? (All India 2017)

Answer:

The maturity period for a short-term investment from the date of acquisition to be qualified as cash equivalents should not be more than three months.

![]()

Question 15.

Will ‘net decrease in working capital’ other than cash and cash equivalents, increase, decrease or not change cash flow from operating activities? Give reason in support of your answer. (Delhi: All Indio 2017)

Answer:

Net decrease in working capital implies increase in cash flow from operating activities due to inflow of cash.

Question 16.

Will ‘acquisition of machinery by issue of equity shares’ be considered while preparing ‘cash flow statement’? Give reason in support of your answer. (All India 2017)

Answer:

The acquisition of machinery by issue of equity shares will not be considered while preparing cash flow statement as there is no flow of cash.

Question 17.

State whether the following will increase, decrease or have no effect on cash flow from operating activities while preparing ‘cash flow statement’.

(i) Decrease in outstanding employees benefits expenses by ₹ 3,000.

(ii) Increase in prepaid insurance by ₹ 2,000. (All India 2017)

Answer:

(i) Outstanding employee benefits expenses is a current liability. So, decrease in current liability will decrease cash flow from operating activities.

(ii) Prepaid insurance is a current asset. Increase in current asset will decrease cash flow from operating activities.

Question 18.

What is meant by ‘cash flow statement’? (Delhi 2017: All India 2014, 2011)

Answer:

Cash flow statement is a statement showing the changes in financial position of a business concern during different intervals of time in terms of cash and cash equivalents.

Question 19.

Short-term investments are not considered while preparing cash flow statement. Why? (Delhi 2017)

Answer:

Short-term investments are a part of cash and cash equivalents therefore, they are not considered under operating, investing or financing activities.

Question 20.

Net increase in working capital other than cash and cash equivalents will increase, decrease or not change cash flow from operating activities. Give reason in support of your answer. (Delhi 2017)

Answer:

Net increase in working capital implies decrease in current assets and increase in current liabilities is more than the increase in current assets and decrease in current liabilities. So, it will increase the cash flow from operating activities.

Question 21.

Cheques and drafts in hand are not considered while preparing cash flow statement. Why? (Delhi 2017)

Answer:

Cheques and drafts are a part of cash equivalents and therefore not considered under operating, investing or financing activities.

Question 22.

State any two advantages of preparing cash flow statements. (Delhi 2017)

Answer:

The advantages of cash flow statement are as follows

(i) It helps in knowing the liquidity/actual cash position of the company.

(ii) Any discrepancy in the financial reporting can be gauged through the cash flow statement by comparing the cash position of both.

Question 23.

State any two objectives of preparing ‘cash flow statement’. (All India 2016)

Answer:

The objectives of preparing cash flow statement are

(i) To ascertain the sources and applications (receipts and payments) of cash and cash equivalents under operating, investing and financing activities of the enterprise.

(ii) To ascertain net change in cash and cash equivalents being the difference between sources (receipts) and applications (payments) under the three activities between the dates of two balance sheets.

Question 24.

“An enterprise may hold securities and loans for dealing or trading purpose in which case they are similar to inventory acquired specifically for resale.” Is the statement correct? Cash flows from such activities will be classified under which type of activity while preparing cash flow statement? (Delhi: All India 2016)

Answer:

Yes, this statemeht is correct. This statement refers to finance Companies. Cash flows from such activities for these companies is classified under operating activity.

Question 25.

Does movement between items that constitute cash or cash equivalents result into cash flow? Give reason in support of your answer. (All India 2016)

Answer:

No, the movement of items that constitute cash or cash equivalents does not result into cash flow.

This is because such movements indicate a mere change in the form of available cash balance rather than actual cash outflows or inflows.

Question 26.

Why is separate disclosure of cash flows from investing activities important? State. (All India 2016)

Answer:

Separate disclosure of cash flows from investing activities is important because it shows the extent to which the investment have been made for resources intended to generate future income and cash flows.

Question 27.

Deepu Ltd a non-financing company received dividend on shares. How will it be presented while preparing a ‘cash flow statement’? (All India (C) 2016)

Answer:

Dividend received by a non-financing company is a investing activity.

Question 28.

Why is depreciation added back to net profit while preparing ‘cash flow statement’? Al India [Cl 2016

Answer:

Depreciation is added back to net profit While preparing cash flow statement as it is a non-cash expense and does not involve any outflow of cash but results in decrease in profits.

Question 29.

Hider Ltd a mutual fund company invested ₹ 5,00,000 in shares of Prayag Ltd. It received dividend of ₹ 45,000 during the year. How will it be depicted in the cash flow statement? (Delhi (C) 2016)

Answer:

Dividend of ₹ 45,000 received by the mutual fund company will be depicted as a operating activity while preparing cash flow statement.

Question 30.

Nazma Ltd received interest on an item and the accountant classified it under investing activity while preparing cash flow statement. Name another item for which such a treatment is possible. (Delhi (C) 2016)

Answer:

The another item for which such a treatment is possible is dividend received.

![]()

Question 31.

While preparing cash flow statement, the accountant of a financing company showed ‘dividend received ₹ 50,000 on investments’ as an investing activity. Was he correct in doing so? Give reason. (All India 2018)

Or

While preparing the ‘Cash Flow Statement’ the accountant of Gulfam Ltd, a financing company showed ‘dividend received on investment’ as ‘investing activity. Was he correct in doing so? Give reason. Delhi 2016

Answer:

No, the accountant was not correct is doing so. In case of a financing company, ‘dividend received on investments’ should be classified under the head ‘operating activity’.

Question 32.

The accountant of Manav Ltd while preparing cash flow statement added depreciation provided on fixed assets to net proht for calculating cash flow from operating activities. Was he correct in doing so? Give reason. (All India Delhi 2015)

Or

While preparing cash flow statement of Sharda Ltd. ‘Depreciation provided on fixed assets’ was added to net profit to calculate cash flow from operating activities. Was the accountant correct in doing so? Give reason. (Delhi 2015)

Answer:

Yes, the accountant is correct, because depreciation is a non-cash expense and it must be added to net profit to calculate cash flow from operating activities.

Question 33.

While preparing cash flow statement, the accountant of ‘Rachana Ltd’, a financing company, included ‘interest received on loan’ in financing activities. Was he correct in doing so? Give reason. (All India 2015)

Answer:

No, accountant is not correct in doing so as Rachna Ltd is a financing company, therefore interest received on loan should be classified under the head ‘operating activity’.

Question 34.

While preparing the cash flow statement of Alka Ltd, ‘dividend paid’ was shown as an operating activity by the accountant of the. company. Was he correct in doing so ₹ Give reason.

Answer:

The treatment of the accountant is incorrect. The treatment of dividend paid while preparing the cash flow statement would be to show it under the head financing activity as ‘minus items’.

Question 35.

The accountant of ‘Nav Jeevan Ltd’ while preparing cash flow statement added the proposed dividend of the current year to net profit while calculating cash flow from operating activities. Was he correct in doing so? Give reason. (Foreign 2015)

Answer:

Yes, the accountant was correct while adding proposed dividend of the current year to net profit while calculating cash flow from operating activities. This is done in order to compute the net profit before tax and extraordinary items.

Question 36.

Payment of bonus to the employees by an insurance company is classified under which activity while preparing cash flow statement. (All India 2015 Modified)

Answer:

It is classified as operating activity.

Question 37.

Kaveri Ltd a financing company obtained loans and advances of? 5,00,000 during the year @ 12% per annum. In which activity will it be included while preparing cash flow statement? (Delhi (C) 2015 Modified)

Answer:

It will be included in operating activity.

Question 38.

G Ltd is carrying on a paper manufacturing business. In the current year, it purchased machinery for ₹ 30,00,000; it paid salaries of ₹ 60,000 to its employees, it required funds for expansion and therefore, issued shares of ₹ 20,00,000. It earned a profit of ₹ 9,00,000 for the current year. Find out cash flows from operating activities. (Delhi 2015)

Answer:

₹ 9,00,000 profit earned during the year will be the cash flow from operating activities.

Question 39.

‘Koval Ltd’ is a financing company. Under which activity will be amount of interest be paid on a loan settled in the current year be shown, while preparing cash flow statement? (All India (C) 2015 Modified)

Answer:

It will be classified under operating activity.

Question 40.

‘Shri Ltd’ was carrying on a business of packaging in Delhi and earned good profits in the past years. The company wanted to expand its business and required additional funds. To meet its requirements the company issued equity shares of ₹ 30,00,000. It purchased a computerised machine for ₹ 20,00,000. It also purchased raw material amounting to ₹ 2,00,000. During the current year, the net profit of the company was ₹ 15,00,000. Find out cash flow from operating activities from the above transactions. (All India (C) 2015)

Answer:

Net profit earned during the current year, i.e. ₹ 15,00,000 will be the cash flow from operating activities.

Question 41.

Why is specific disclosure of cash flow from financing activities important while preparing cash flow statement? (All India 2014)

Answer:

Separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by providers of funds (both capital and borrowings) to the enterprise.

![]()

Question 42.

Why is separate disclosure of cash flow from investing activities important while preparing cash flow statement? (All India 2014)

Answer:

Separate disclosure of cash flows from investing activities is important because they represent to which investment have been made for resources, intended to generate future income and cash flows.

Question 43.

Dividend paid by a financial company is classified under which type of activity, while preparing cash flow statement? (All Indio (C) 2014)

Answer:

It is classified under ‘financing activity’.

Question 44.

What is meant by outflow of cash while preparing cash flow statement? (Delhi 2014)

Answer:

Cash outflow arises when the net effect of transactions is a decrease in the amount of cash and cash equivalents.

Question 45.

State the objective of preparing a cash flow statement. (Delhi 2014,2012.2011 (C) All India 2014.2014)

Or

Why is a cash flow statement prepared? (All India 2014; Delhi (C) 2010)

Answer:

A cash flow statement provides information about the historical changes in cash and cash equivalents of an enterprise by classifying cash flows into operating, investing and financing activities between the dates of two balance sheets.

Question 46.

State with reason whether the issue of 9% debentures to the vendors for the purchase of machinery of ₹ 50,000 will result into inflow, outflow or no flow of cash. (All India (C) 2014)

Answer:

There is no flow of cash by the issue of 9% debentures to the vendors for the purchase of machinery of ₹ 50,000 because this transaction will not change the balance of cash and cash equivalents.

Question 47.

What is meant by ‘cash from operating activities’? (Delhi 2013)

Answer:

‘Cash from operating activities’ are the principal revenue producing activities of the enterprise and other activities, that are not investing or financing activities.

Question 48.

Under which type of activity will you classify ‘dividend received by a finance company’ while preparing cash flow statement? (Delhi 2013)

Answer:

Dividend received by a finance company is an operating activity.

Question 49.

State with reason whether ‘purchase of fixed asset on long-term deferred payment’ would result in inflow, outflow or no flow of cash. (Delhi 2013)

Answer:

No flow of cash because no cash is involved in this transaction.

Question 50.

Under which type of activity will you classify ‘refund of income tax received’ while preparing the cash flow statement? (Delhi 2013)

Answer:

Operating activity

Question 51.

When does the flow of cash take place? (Delhi 2013)

Answer:

Cash flow arises when the net effect of a transaction either increases or decreases the amount of cash or cash equivalent.

Question 52.

State with reason whether ‘discount received on making payment to suppliers’ would result into inflow, outflow or no flow of cash. (All India 2013)

Answer:

Discount received on making payment to suppliers will result in no flow of cash because discount received is a non-cash transaction and does not result in actual payment of cash.

Question 53.

Under which type of activity will you classify ‘interest paid on long-term borrowings’ while preparing cash flow statement? (All India 2013)

Answer:

Interest paid on long-term borrowings is a financing activity.

Question 54.

State with reason whether ‘old furniture written-off would result into inflow/ outflow or no flow of cash. (All India 2013)

Answer:

Old furniture written-off will result in no flow of cash because it does not affect cash as it is a non-cash transaction.

Question 55.

Under which type of activity will you classify ‘proceeds from sale of investment’ while preparing cash flow statement? (Delhi 2013)

Answer:

Proceeds from sale of investments is an investing activity.

Question 56.

Under which type of activity will you classify ‘proceeds from sale of patents’ while preparing cash flow statement? (All India 2013)

Answer:

Proceeds from sale of patents is an investing activity.

Question 57.

Give an example of the activity which remains financing activity for every enterprise. (All India 2013)

Answer:

Dividend paid

Question 58.

Under which type of activity will you classify ‘commission and royalty received’ while preparing cash flow statement? (All India 2013)

Answer:

Commission and royalty received is an operating activity.

![]()

Question 59.

While preparing cash flow statement which type of activity is, ‘payment of cash to acquire debenture by an investment company’? (Delhi 2012)

Answer:

Operating activity .

Question 60.

While preparing cash flow statement which type of activity is, ‘payment of cash to acquire shares of another company by a trading company’? (All India 2012)

Answer:

Investing activity

Question 61.

State with reason whether ‘deposit of cash into bank’ will result into, inflow, outflow or no flow of cash. (Delhi 2011)

Answer:

‘Deppsit of cash into bank’ does not result in cash flow. It is simply a movement between two components of cash and cash equivalents.

Question 62.

List any two investing activities which result into outflow of cash. (All India 2011; Delhi (C) 2011)

Answer:

Two investing activities which result into outflow of cash are

(i) Building purchased

(ii) Investments purchased

Question 63.

List any two financing activities that will result into outflow of cash. (All India 2011: Delhi (C) 2011)

Answer:

Two financing activities that result into outflow of cash are

(i) Redemption of debentures

(ii) Interest paid on debentures

Question 64.

Name any two financing activities that result into inflow of cash. (All India (C) 2011)

Answer:

The two financing activities that result into inflow of cash are

(i) Cash proceeds from issue of shares

(ii) Cash proceeds from issue of debentures

Question 65.

Name any two investing activities that result into inflow of cash. (All India (C) 2011)

Answer:

Two investing activities that result into inflow of cash are

(i) Cash proceeds from sale of building

(ii) Cash proceeds from sale of investments

Question 66.

State with reason whether ‘withdrawal of cash from bank’ will result into, inflow, outflow or no flow of cash. (Foreign 2011)

Answer:

Withdrawal of cash from bank’ does not result in cash flow. It is simply a movement between two components of cash and cash equivalents.

Question 67.

What is meant by cash flow from financing activities? (Delhi 2011)

Answer:

Financing activities are the activities which result in change in the size and composition of the owner’s capital (including preference share capital) and borrowings (including debentures) of the enterprise from other sources. It includes proceeds from issue of shares or other similar instruments, issue of debentures, loans, bonds, other short term or long term borrowings and repayment of amount borrowed.

Question 68.

State with reason whether ‘cash paid to a creditor’ will result into inflow, outflow or no flow of cash. (Delhi 2011)

Or

State with reason whether payment of cash to creditors will result into inflow, outflow or no flow of cash. (All India 2011)

Answer:

Cash paid to a creditor will result in outflow of cash.

Question 69.

Under which type of activity will you classify ‘proceeds from sale of buildings’ while preparing cash flow statement? (All India 2010)

Answer:

It will be classified as an investing activity.

![]()

Question 70.

Redemption of debentures would result in inflow, outflow or no flow of cash? Give your answer with reason. (All India 2010)

Answer:

Redemption of debentures will result in outflow of cash as payment is made to the debentureholders.

Question 71.

Under which type of activity will you classify ‘issue of equity shares at premium’ while preparing cash flow statement? (All India 2010)

Answer:

It will be classified as a financing activity.

Question 72.

Purchase of patents would result in inflow, outflow or no flow of cash? Give your answer with reason? (All India 2010)

Answer:

Purchase of patents would result in outflow of cash, because it involves payment of cash for acquisition of an asset.

Question 73.

Under which type of activity will you classify ‘issuing 9% debentures’ while preparing cash flow statement? (Delhi 2010)

Answer:

Financing activity

Question 74.

Declaration of final dividend would result into inflow, outflow or no flow of cash? Give your answer with reason. (Delhi 2010)

Answer:

No flow of cash as final dividend is only declared, not yet paid.

Question 75.

Under which type of activity will you classify ‘proceeds from sale of machinery’ while preparing cash flow statement? (Delhi 2010)

Answer:

Investing activity

Question 76.

Interest received on debentures would result into inflow, outflow or no flow of cash? Give reason. (All India 2010)

Answer:

Cash inflow, because ca$h comes in due to interest received on debentures.

Question 77.

Give one difference between an operating activity and a financing activity. (Delhi (C) 2010)

Answer:

Operating activity is the principal revenue producing activity of an enterprise whereas, financing activity are those activities which change the size and composition of owner’s equity and borrowings of an enterprise.

Question 78.

Give any two transactions which result into ‘inflow of cash’. (All India 2010)

Answer:

The two transacting which result into ‘inflow of cash’ are

(i) Cash proceeds from sale of investments.

(ii) Cash proceeds from issue of debentures.

Question 79.

Give one difference between an operating activity and an investing activity. (All India (C) 2010)

Answer:

Operating activity is the principal revenue producing activity of an enterprise whereas, investing activity includes the acquisition and disposal of fixed assets.

Question 80.

Give one transaction which may result into outflow of cash and one which may result into no flow of cash. (All India (C) 2010)

Answer:

Outflow of cash Purchase of investments.

No flow of cash Cash deposited into the bank.

Question 81.

Under which type of activity will you classify ‘furniture purchased for cash while preparing cash flow statement? (Delhi 2010)

Answer:

It will be classified under investing activity.

Question 82.

Sale of marketable securities at par would result in inflow, outflow or no flow of cash. Give your answer with reason. (All India 2010)

Answer:

No flow of cash as marketable securities are cash equivalents.

![]()

Question 83.

Under which type of activity will you classify ‘cash received from debtors’ while preparing cash flow statement. (Delhi 2010)

Answer:

Cash received from debtors will be classified under operating activity.

Question 84.

Interest paid on debentures would result in inflow, outflow or no flow of cash. Give your answer with reason. (Delhi 2010)

Answer:

Interest paid on debentures would result in outflow of cash because it involves payment of cash to debenture holders.

Question 85.

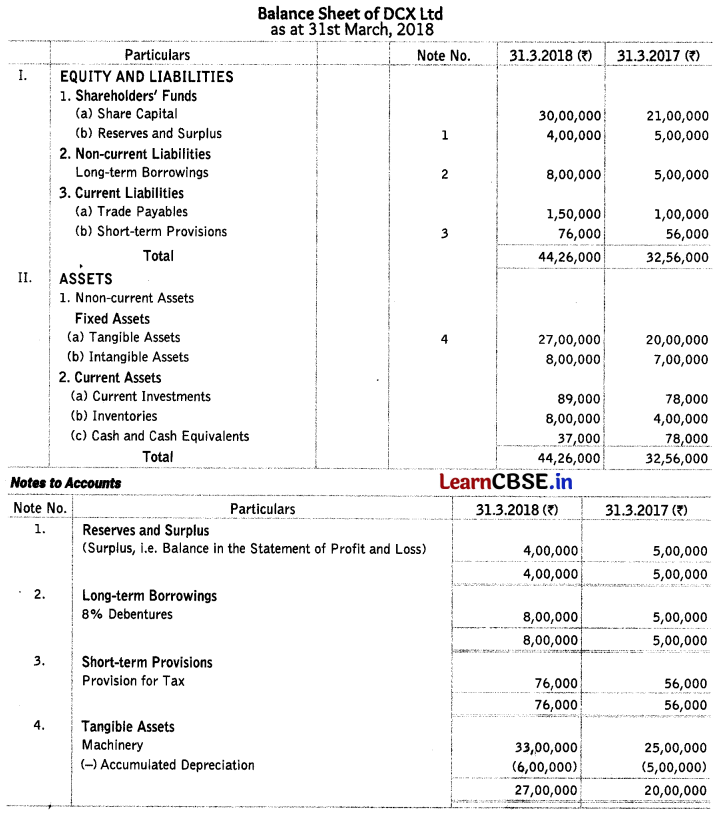

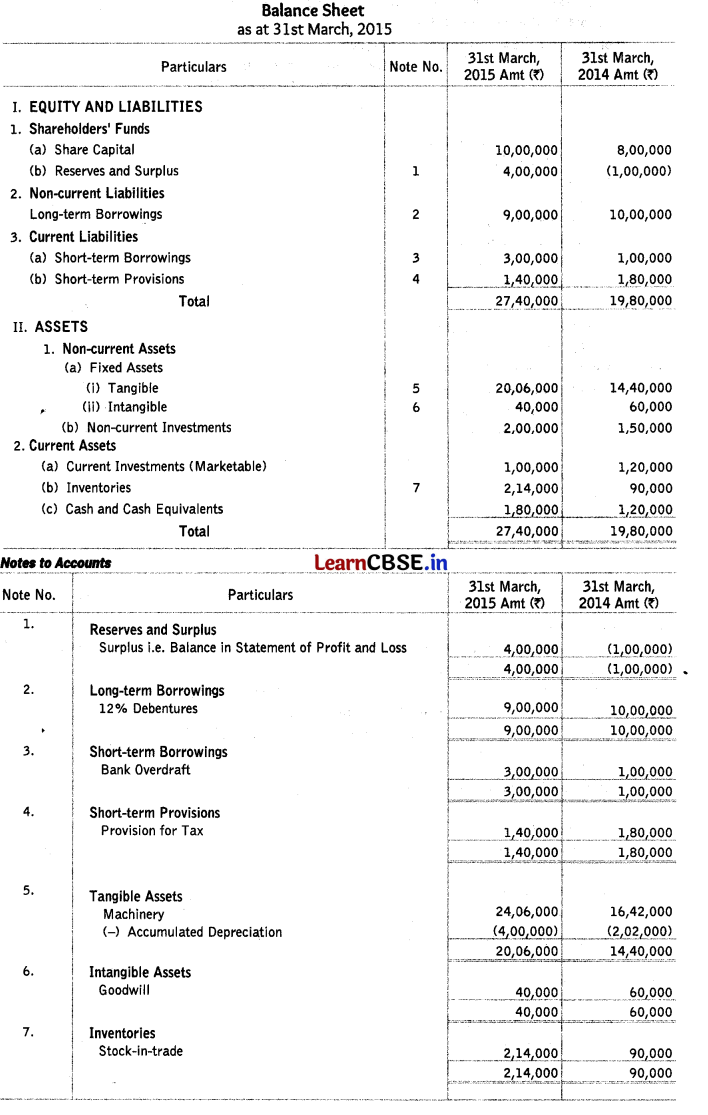

From the following balance sheet of DCX Ltd and the additional information as at 31st March, 2018. Prepare a cash flow statement.

Additional Information:

(i) During the year a machinery costing ₹ 8,00,000 on which accumulated depreciation was ₹ 3,20,000 was sold for ₹ 6,40,000.

(ii) Debentures were issued on 1st April, 2017. (All India 2019)

Answer:

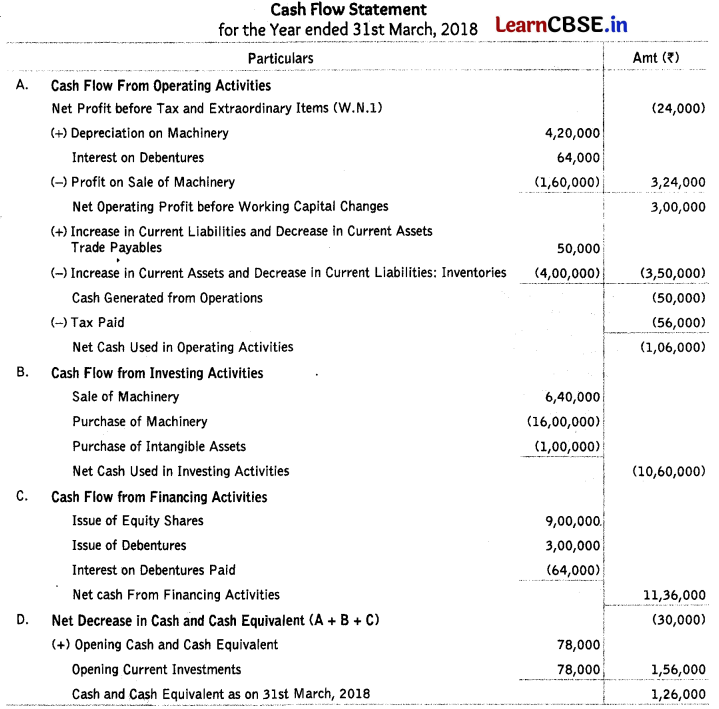

Question 86.

The following is the balance sheet of R M Ltd as at 31st March, 2017. Prepare a cash flow statement.

Additional Information:

(i) During the year, a machine costing ₹ 80,000 on which accumulated depreciation was ₹ 50,000 was sold for ₹ 30,000.

(ii) 9% Debentures were released on 31st March, 2017. (All India 2019)

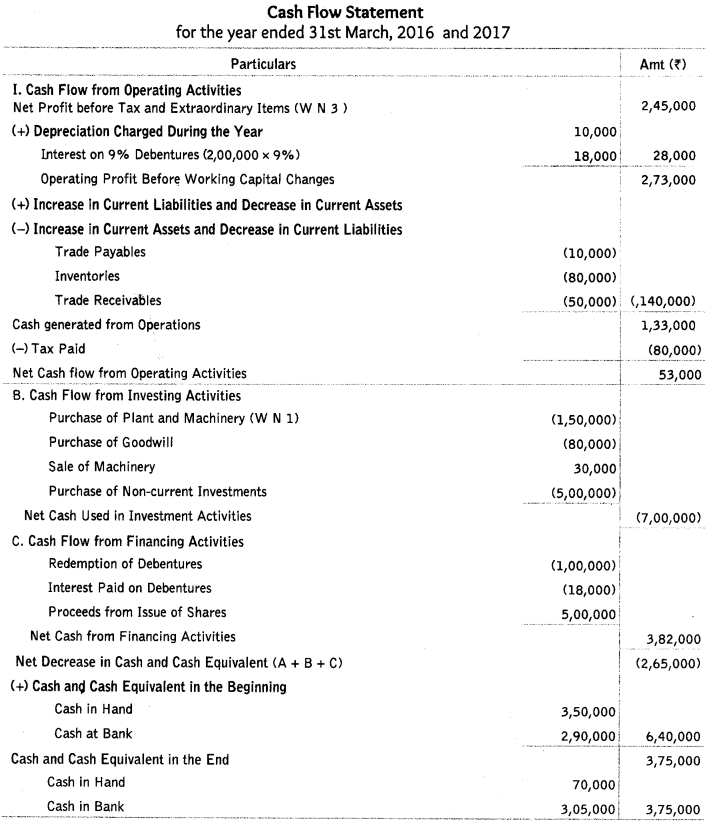

Answer:

![]()

Question 87.

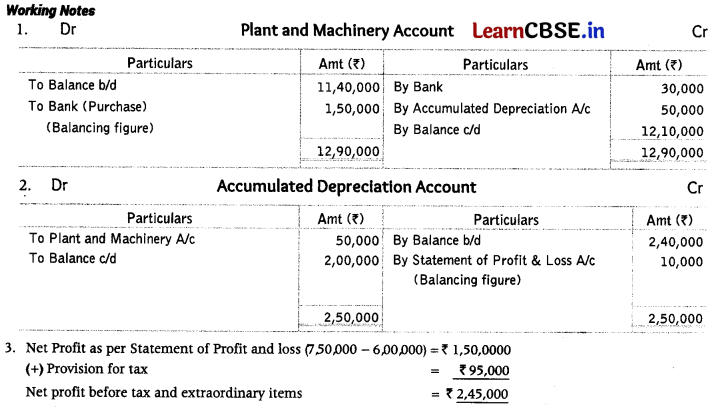

From the following balance sheet of Kiero Ltd and the additional information as on 31-3-2018, prepare a cash flow statement. (All India 2019)

Additional Information:

12% debentures were issued on 1st September, 2017 (All India 2019)

Question 88.

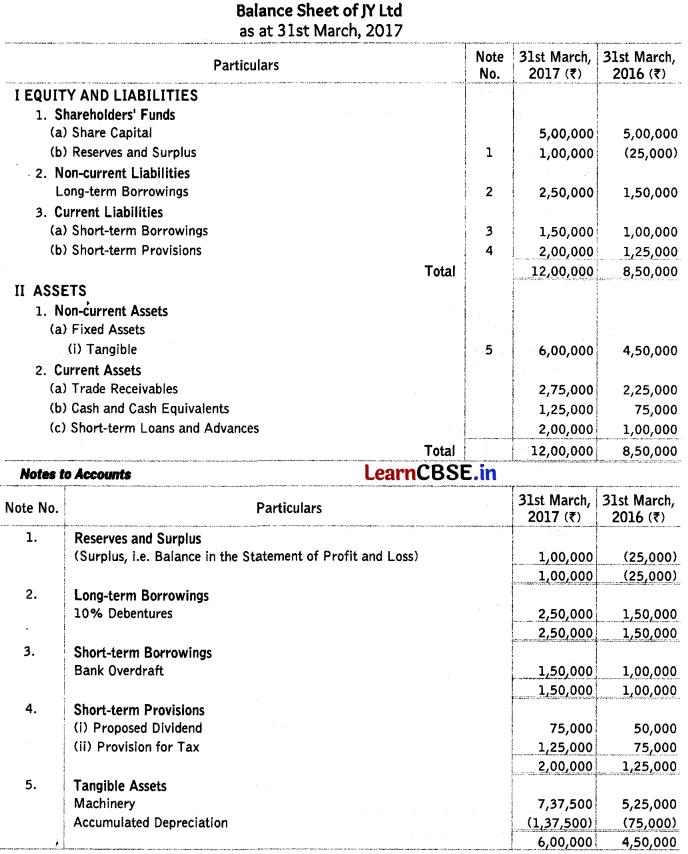

From the following balance sheet of JY Ltd as at 31st March, 2017 , prepare a cash flow statement.

Additional Information:

₹ 1,00,000, 10% debentures were issued on 31st March, 2017. (CBSE 2018)

Answer:

Question 89.

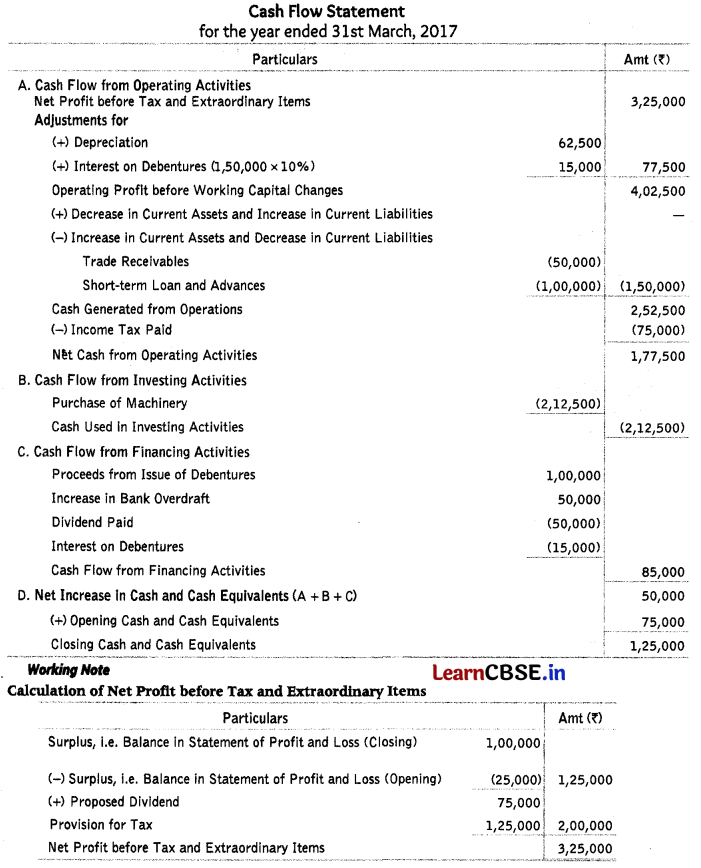

Following is the balance sheet of Mevanca Ltd as at 31st March, 2017.

Additional Information:

(i) Additional loan was taken on 1st July, 2016.

(ii) Tax of ₹ 53,000 was paid during the year. Prepare cash flow statement. (Compartment 2018)

Answer:

Cash Flow Statement for the year ending 31st March, 2017

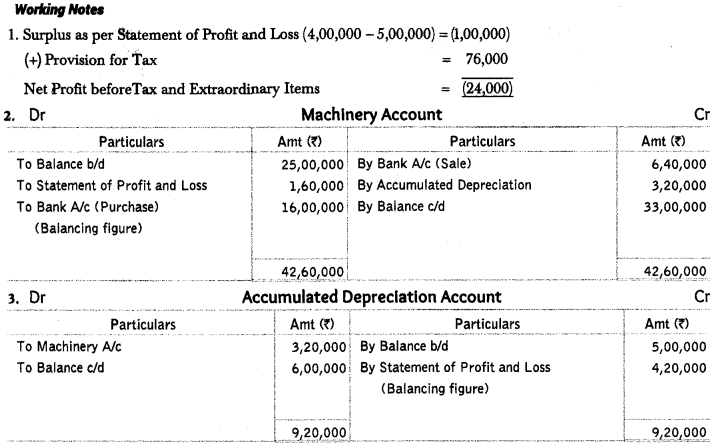

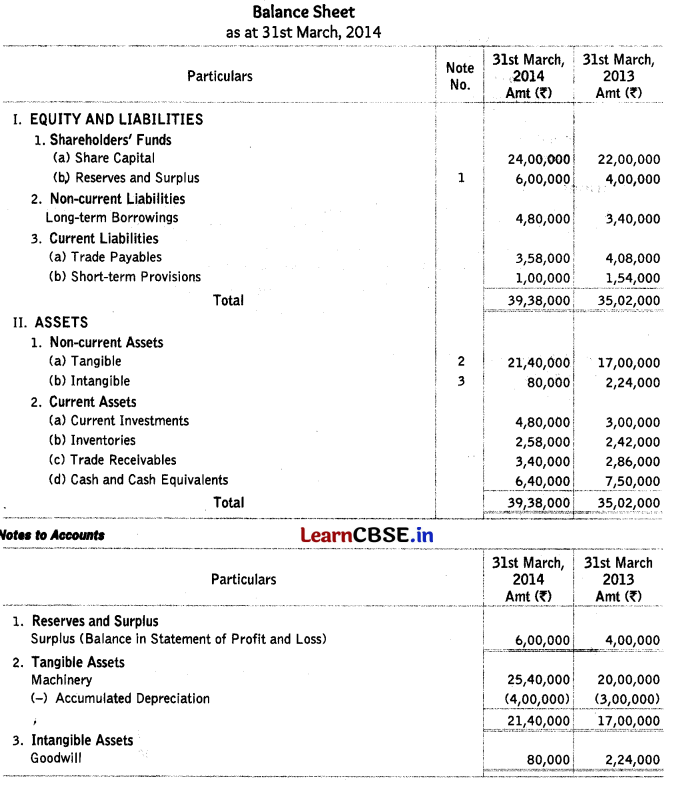

Question 90.

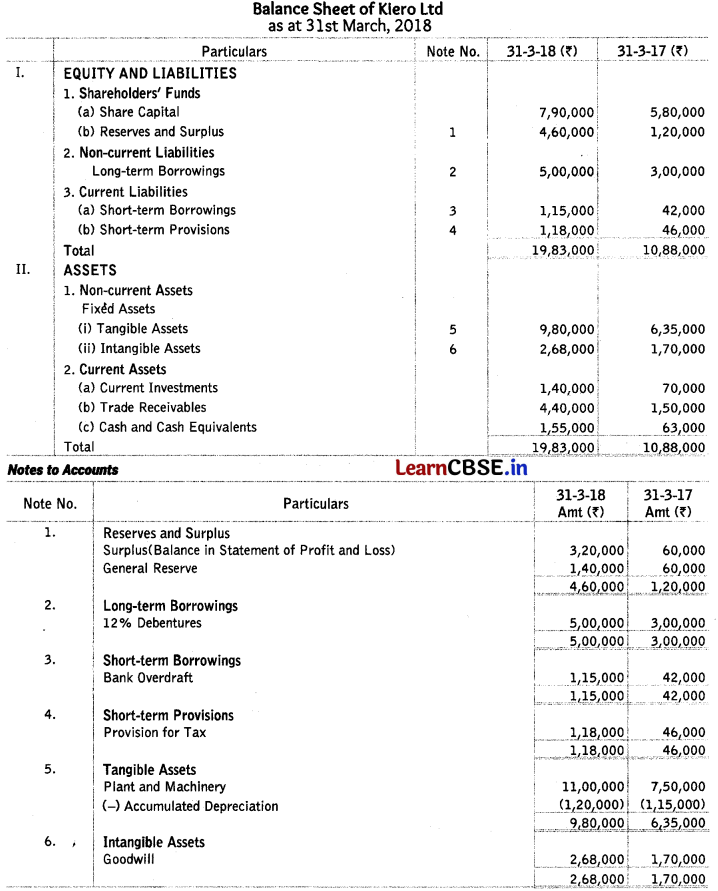

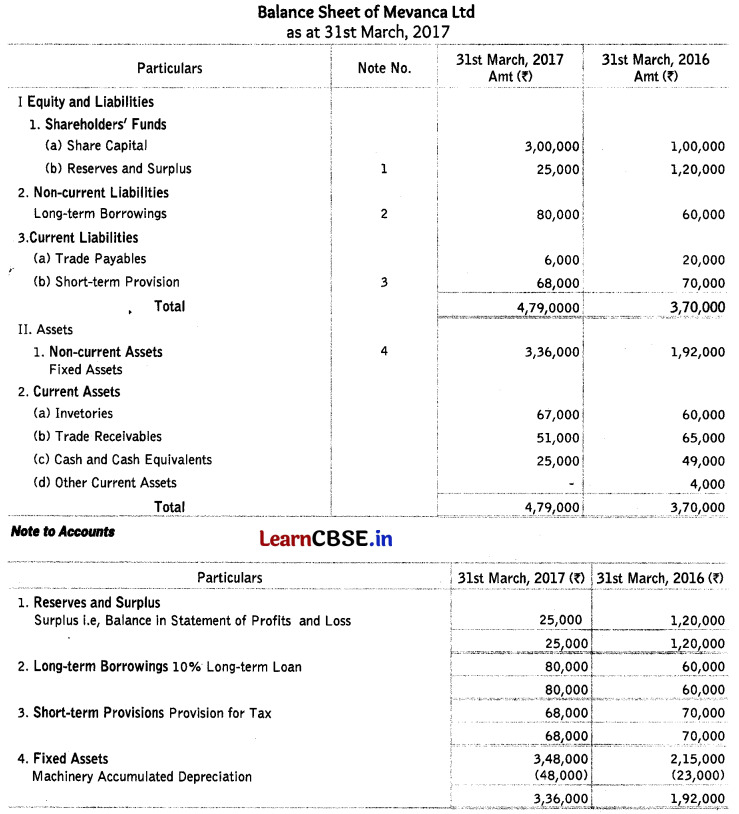

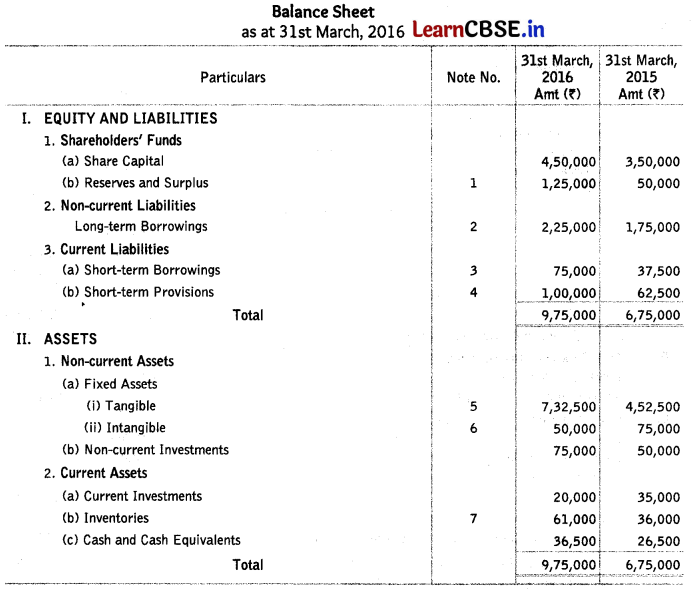

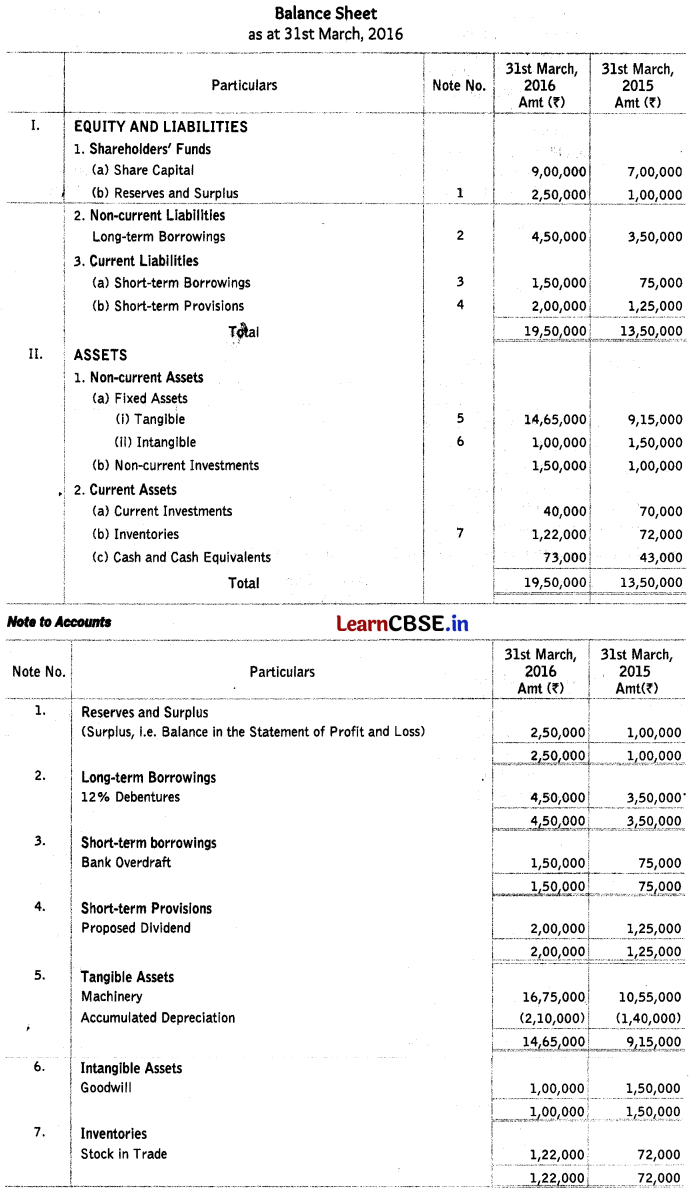

From the following balance sheet of SRS Ltd and the additional information as on 31st March, 2016, prepare a cash flow statement

(i) ₹ 50,000, 12% debentures were issued on 31st March, 2016

(ii) During the year a piece of machinery costing ₹ 40,000 on which accumulated depreciation was ₹ 20,000, was sold at a loss of ₹ 5,000. (All India 2017)

Additional Information:

(i) ₹ 50,000, 12% debentures were issued on 31st March, 2016

(ii) During the year a piece of machinery costing ₹ 40,000 on which accumulated depreciation was ₹ 20,000, was sold at a loss of ₹ 5,000. (All India 2017)

Answer:

Working Notes:

1. Calculation of Net Profit before Tax and Extraordinary Items

![]()

Question 91.

Following is the balance sheet of RS Ltd as at 31st March, 2016. (Delhi 2017)

Additional Information:

(i) ? 1,00,000, 12% debentures were issued on 31st March, 2016.

(ii) During the year a piece of machinery costing ₹ 80,000 on which accumulated depreciation was ₹ 40,000 was sold at a loss of ₹ 10,000.

Prepare a cash flow statement.

Answer:

Solve as Q no. 90 on page 474 – 476.

Net Cash Flow from Operating Activities = ₹ 5,12,000

Net Cash used in Investing Activities = ₹ (7,20,000)

Net Cash Flow from Financing Activities = ₹ 2,08,000

Question 92.

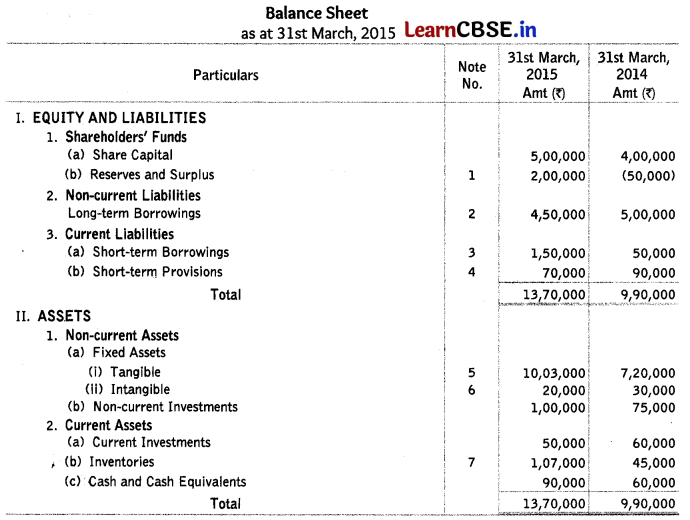

Following is the balance sheet of MM Ltd as on 31st March, 2015.

Additional Information:

(i) 12% debentures were redeemed on 31st March, 2015.

(ii) Tax ₹ 70,000 was paid during the year.

Prepare cash flow statement. (All India 2016)

Answer:

Question 93.

Following is the balance sheet of KK Ltd as at 31st March, 2015.

Additional Information:

(i) 12% debentures were redeemed on 31st March, 2015.

(ii) Tax ₹ 1,40,000 was paid during the year.

Prepare cash flow statement. (Delhi 2016)

Answer:

Solve as Q no. 90 on page 474-476

Cash Flow from Operating Activities = 7 6,74,000 Cash Flow Used in Investing Activities =7(8,14,000)

Cash Flow from Financing Activities = 71,80,000

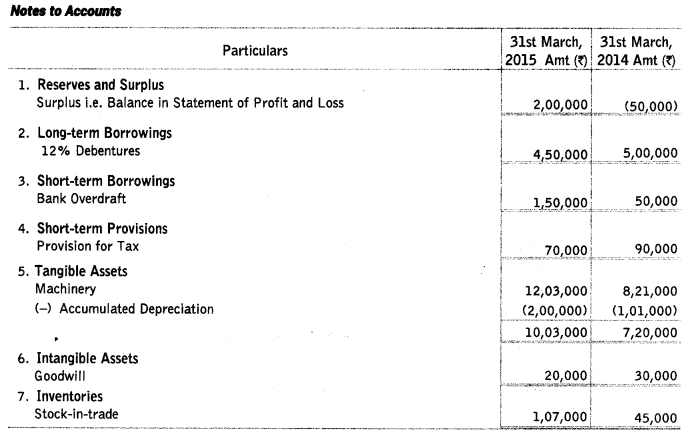

Question 94.

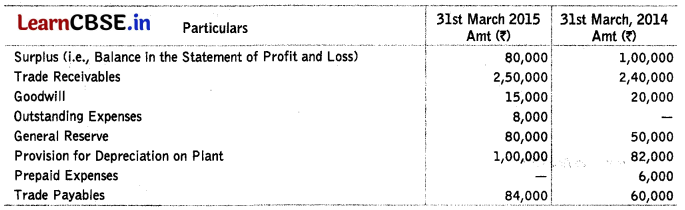

Calculate ‘Cash flows from operating activities from the following information

Additional Information:

(i) Plant costing ₹ 60,000 having book value of? 36,000 was sold for ₹ 40,000 during the year

(ii) Income tax paid during the year was ₹ 30,000

(iii) Dividend paid during the year was ₹ 18,000 (All India (C) 2016)

Answer:

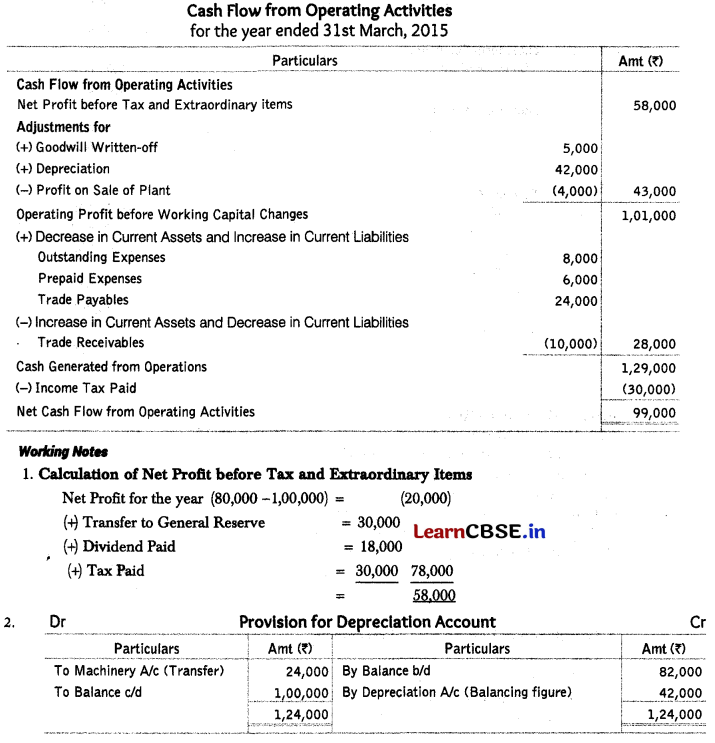

Question 95.

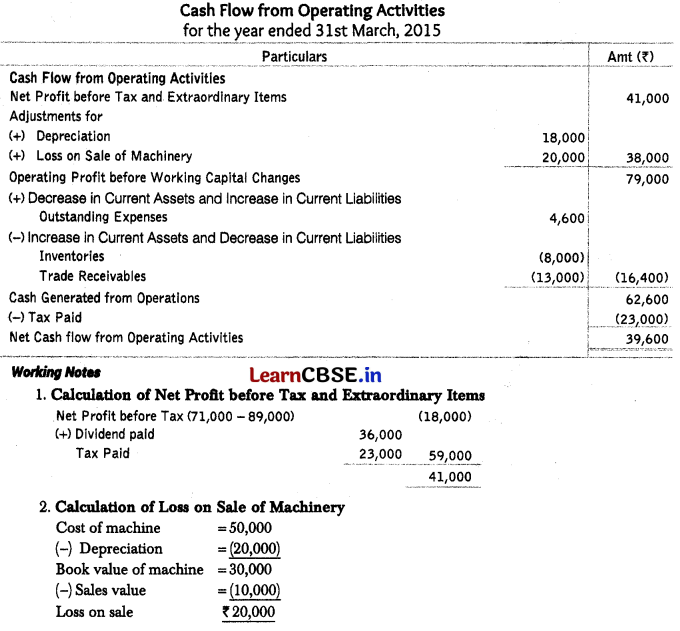

From the following information, calculate cash flow from operating activities

Additional Information:

(i) A piece of machinery costing ₹ 50,000 on which depreciation of ₹ 20,000 had been charged was sold for ₹ 10,000. Depreciation charged during the year was ₹ 18,000

(ii) Income tax ₹ 23,000 was paid during the year

(iii) Dividend paid during the year was ₹ 36,000. Delhi to 2016

Answer:

![]()

Question 96.

Following is the balance sheet of Solar Power Ltd as at 31st March, 2014.

Additional Information:

During the year a piece of machinery costing ₹ 48,000 on which accumulated depreciation was ₹ 32,000 was sold for ₹ 12,000. Prepare cash flow statement. (All india 2015)

Answer:

Question 97.

Following is the balance sheet of Thermal Power Ltd as at 31st March, 2014.

Additional Information:

During the year a piece of machinery, costing ₹ 24,000 on which accumulated depreciation was ₹ 16,000, was sold for ₹ 6,000.

Prepare cash flow statement. Delhi 2015

Answer:

Solve as Q no. 96 on page 484-486

Cash Flow from Operating Activity = ₹ 1,53,000; Cash Used in Investing Activity = ₹ (2,88,000);

Cash Flow from Financing Activity = ₹ 1,70,000

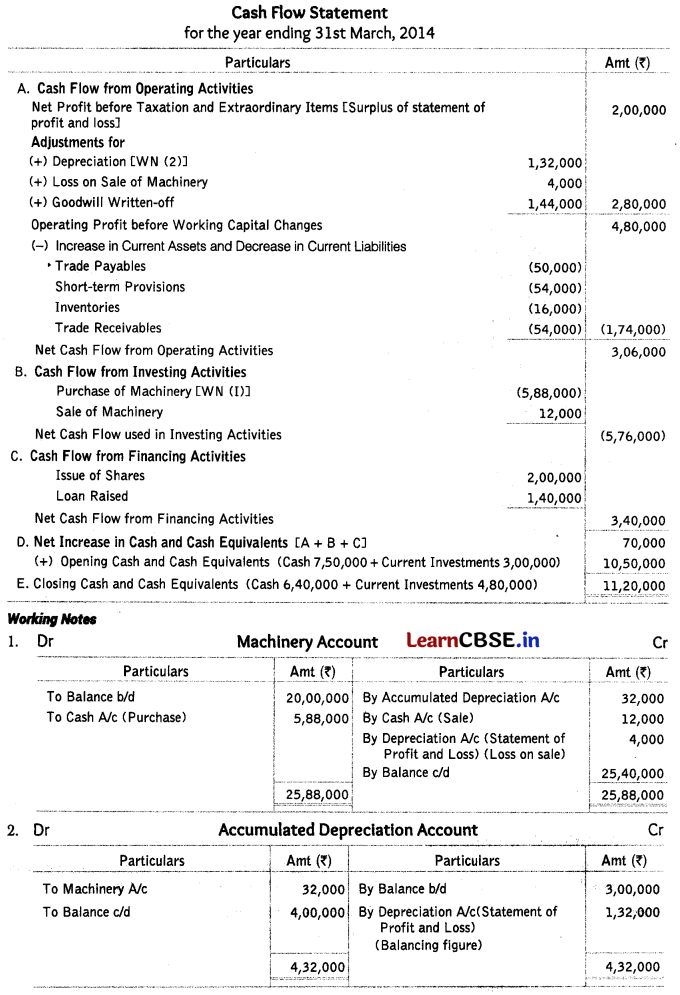

Question 98.

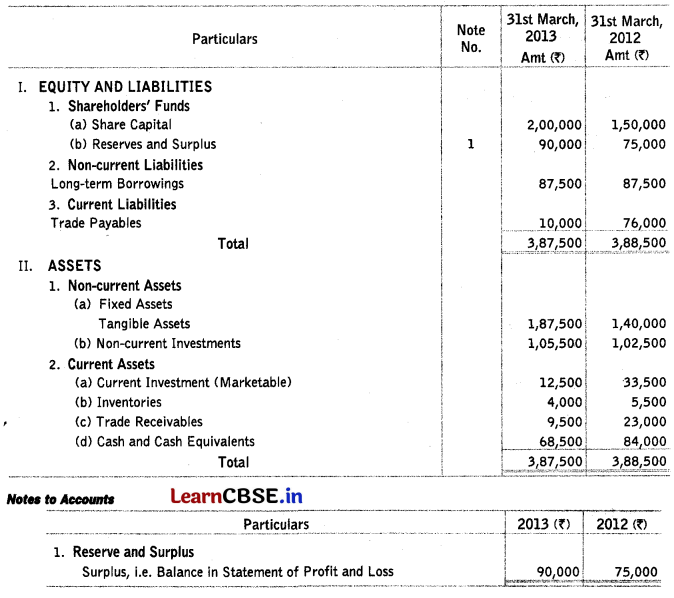

Prepare a cash flow statement on the basis of the information given in the balance sheet of Simco Ltd as at 31st March, 2013 and 2012.

Answer:

Question 99.

Prepare a cash flow statement on the basis of the information given in the balance sheets of Liva Ltd as at 31st March, 2013 and 2012.

Answer:

Solve as Q no. 98 on page 487 and 488.

Cash Flow from Operating Activities = ₹ 50,500

Cash Used in Investing Activities = ₹ (72,000)

Cash Flow from Financing Activities = ₹ 30,000

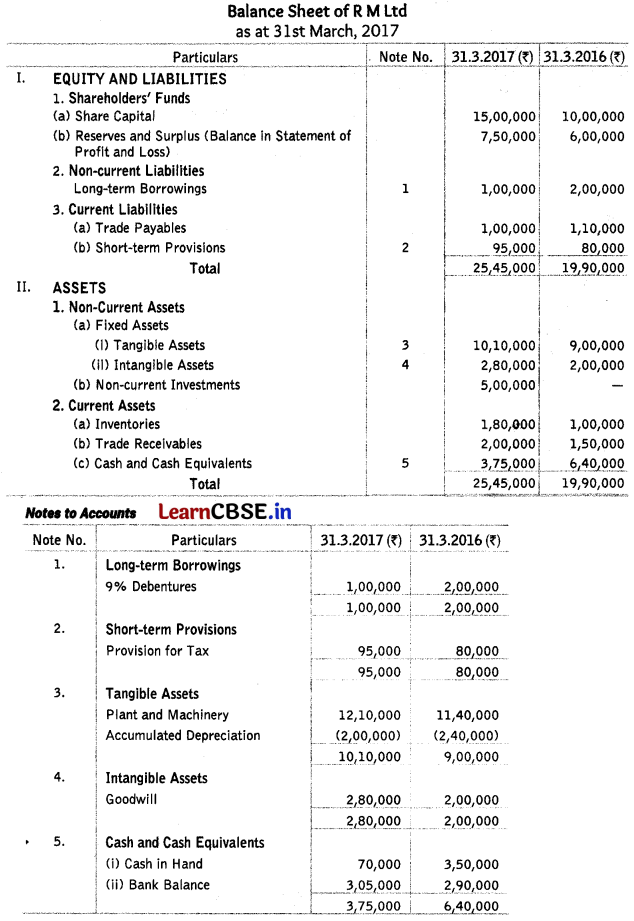

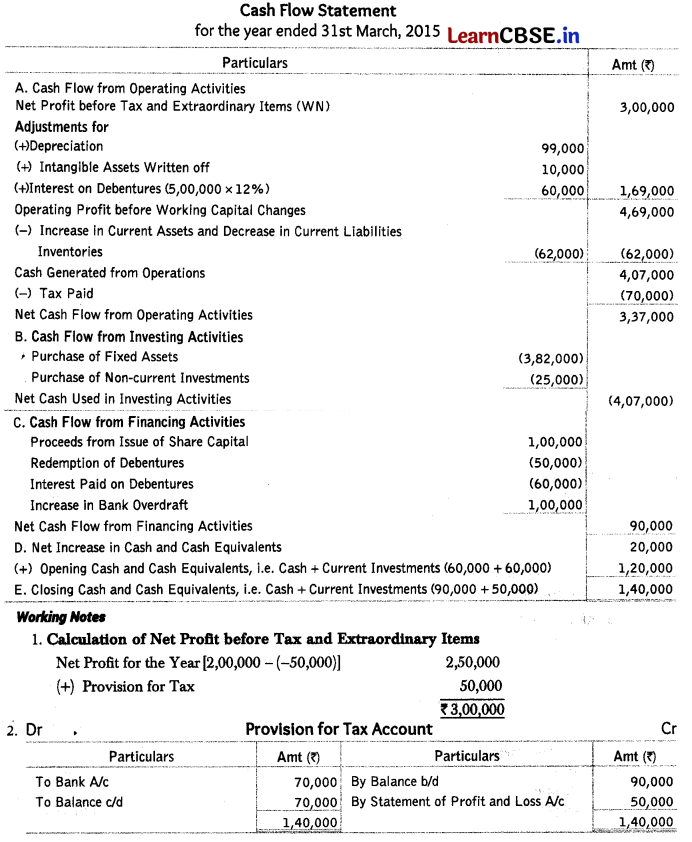

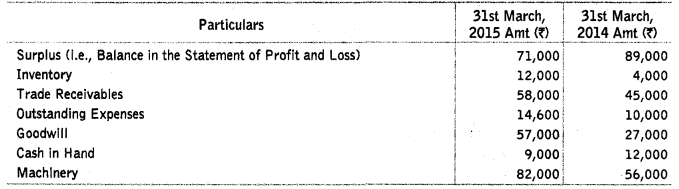

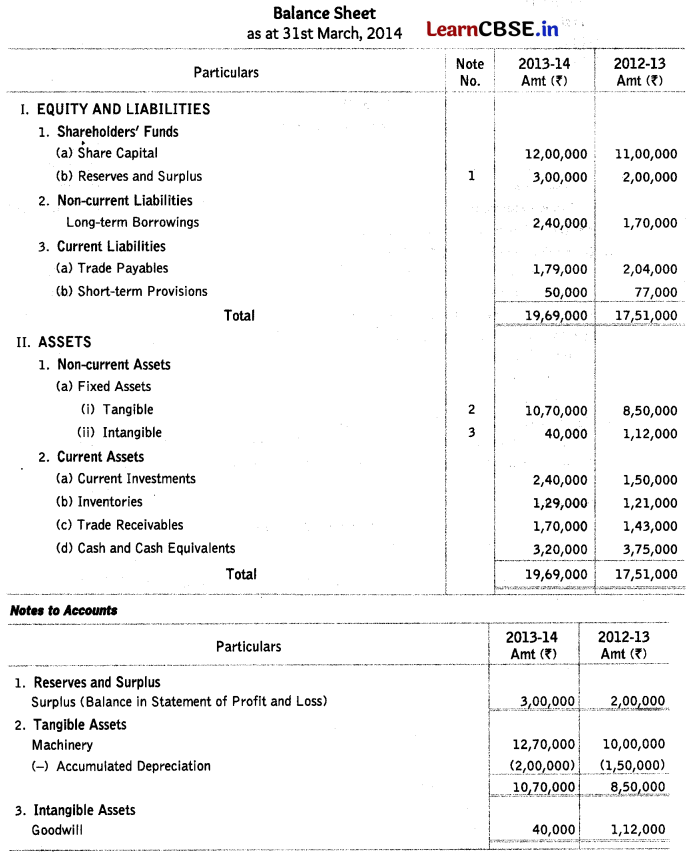

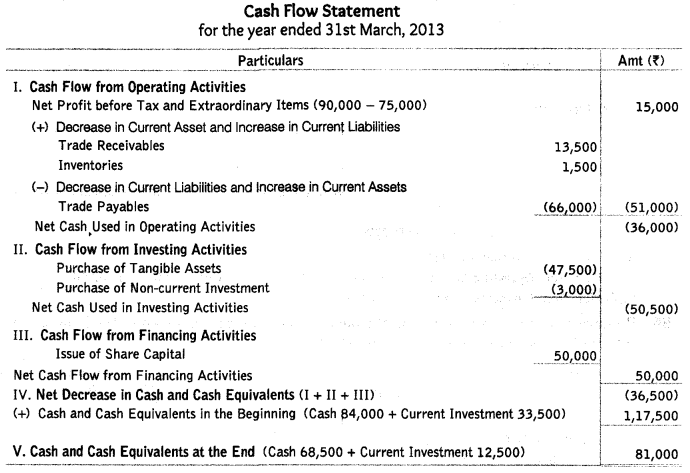

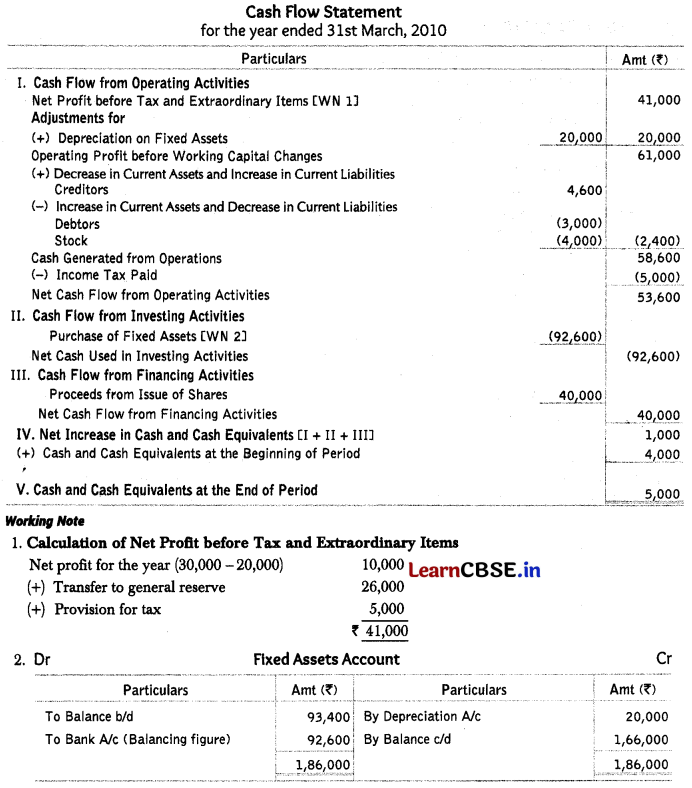

Question 100.

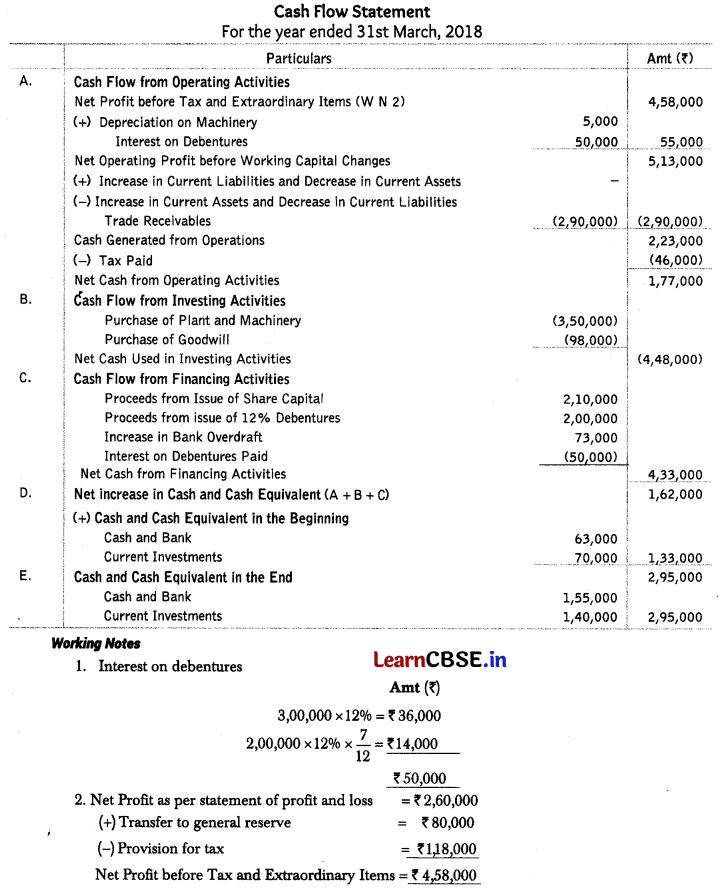

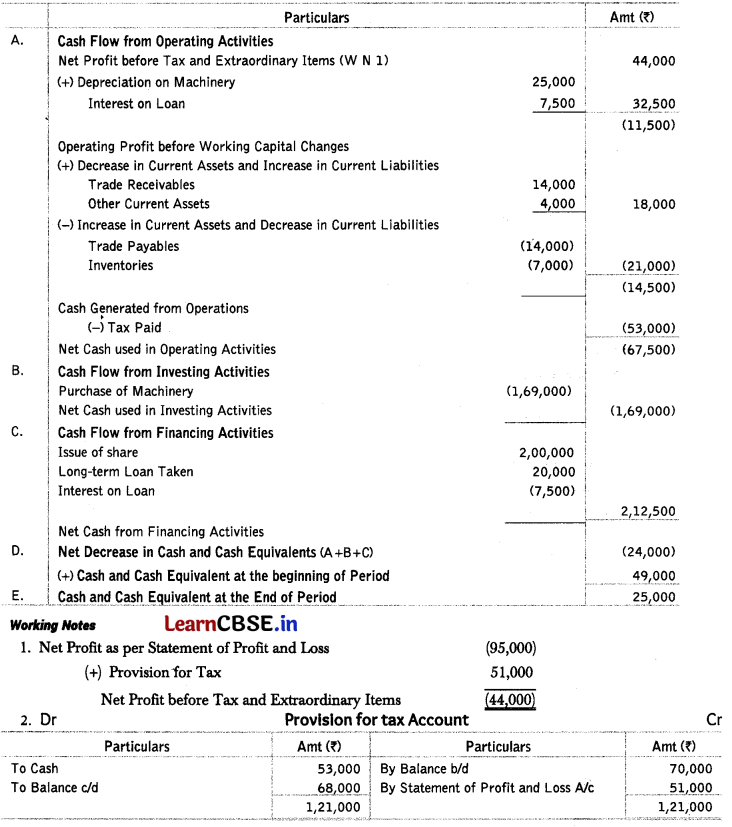

Following is the balance sheet of Wisben Ltd as on 31st March, 2012.

Additional Information

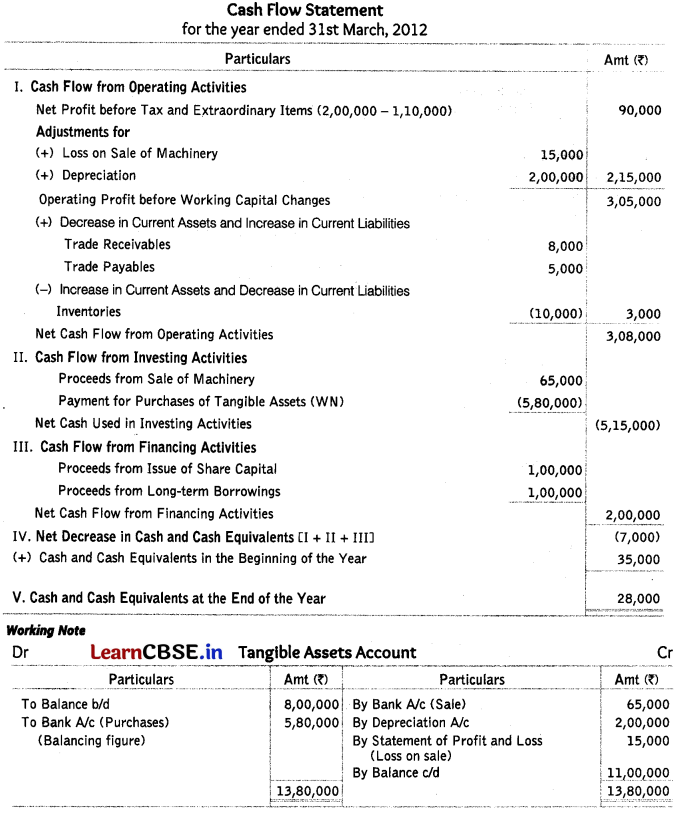

During the year, a piece of machinery of the book value of ₹ 80,000 was sold for ₹ 65,000. Depreciation provided on tangible assets during the year amounted to ₹ 2,00,000. Prepare a cash flow statement. (Delhi 2013)

Answer:

![]()

Question 101.

Following is the balance sheet of Krishtec Ltd for the year ended 31st March, 2011 and 2012.

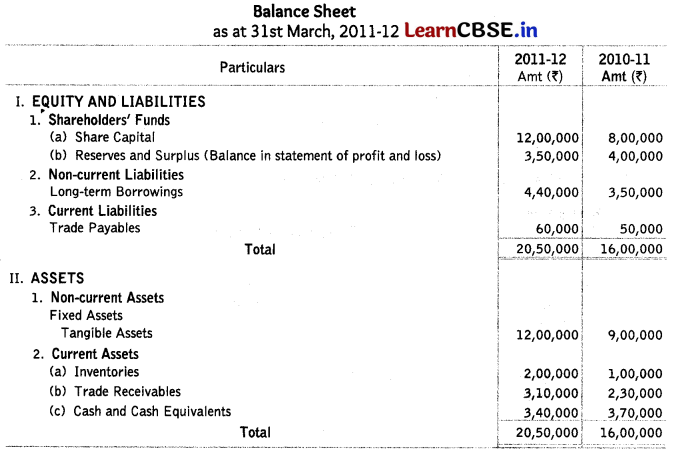

Prepare a cash flow statement after taking into account the following adjustments

(i) The company paid interest ₹ 36,000 on its long-term borrowings.

(ii) Depreciation charged on tangible fixed assets was ₹ 1,20,000. (All India 2013)

Answer:

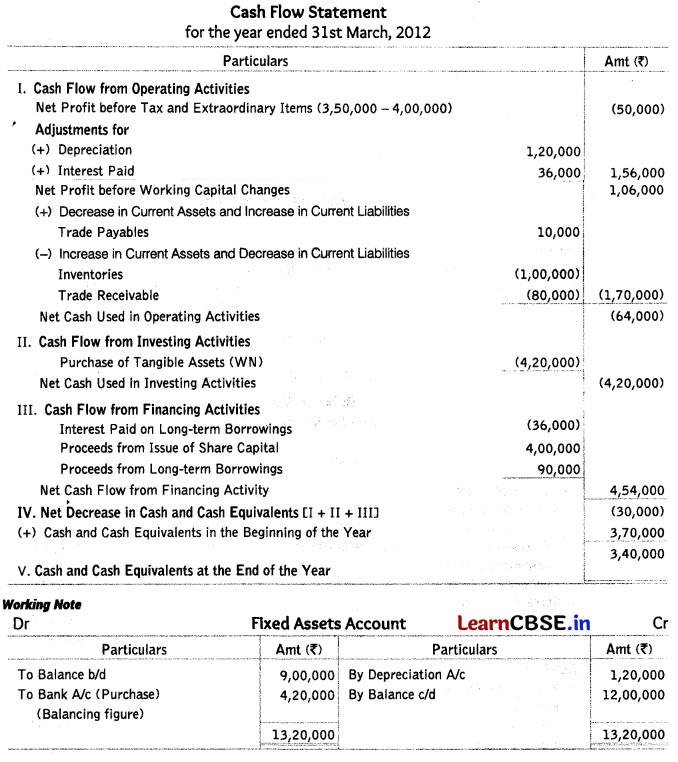

Question 102.

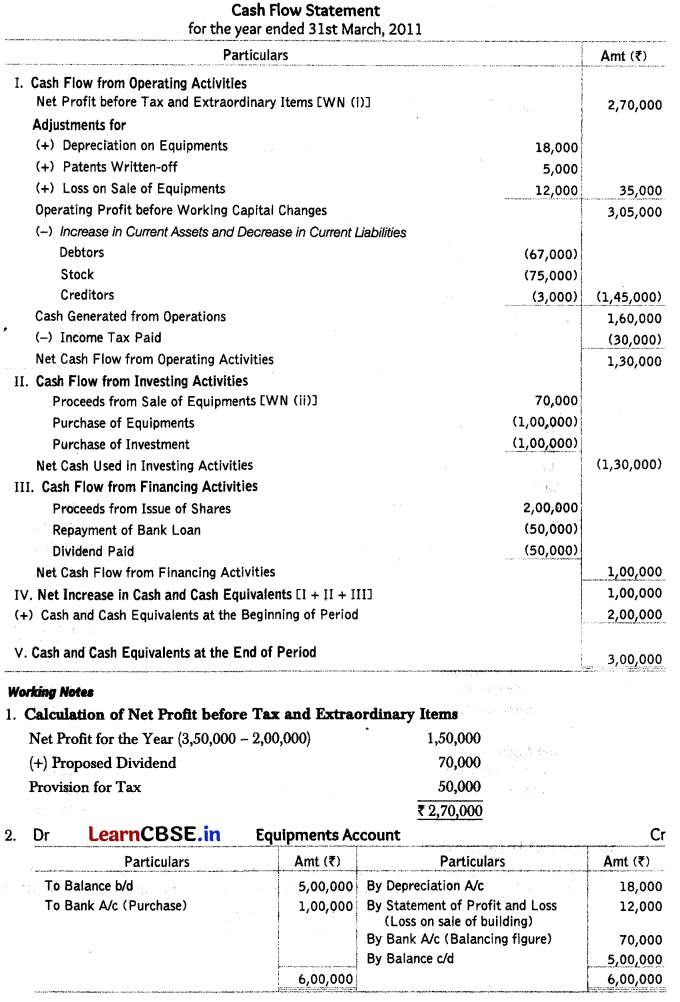

From the following balance sheet of BCR Ltd as at 31st March, 2010 and 2011. Prepare a cash flow statement.

Additional Information:

During the year, equipment costing ₹ 1,00,000 was purchased. Loss on sale of equipment amounted to ₹ 12,000. ₹ 18,000 depreciation was charged on equipment. (All India 2012, Modified)

Answer:

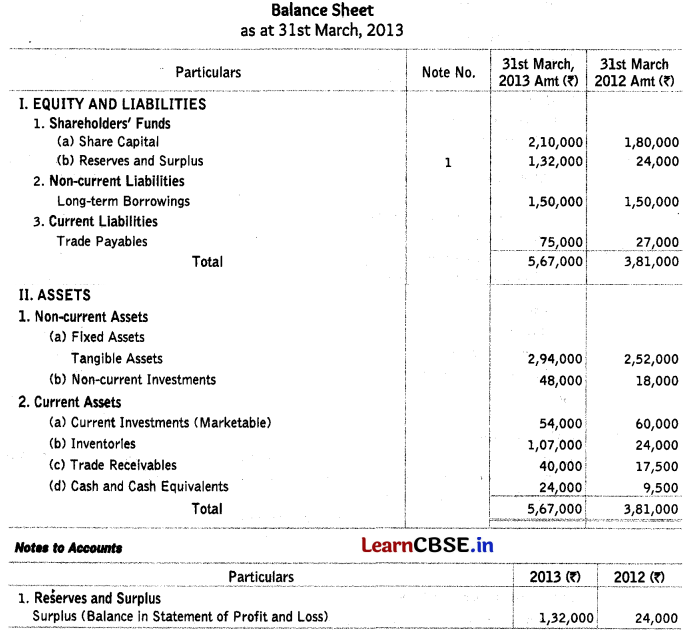

Question 103.

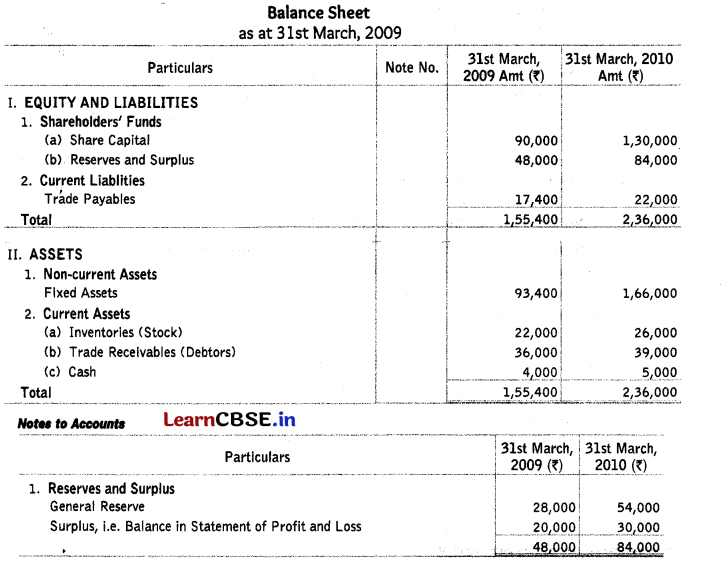

From the following balance sheet of Vikas Ltd as at 31st March, 2009 and 2010. Prepare the cash flow statement.

Additional Information:

(i) Depreciation charged on fixed assets for the year 2009-2010 was ₹ 20,000.

(ii) Income tax ₹ 5,000 has been paid in advance during the year. (All India 2011)

Answer:

![]()

Question 104.

‘Sale of marketable securities at par’ would result

(a) into cash outflow

(b) into cash inflow

(c) no flow

(d) None of these

Answer:

(c) no flow

Question 105.

‘Interest received by other than financial enterprise’ is shown in cash flow statement under

(a) operating activities

(b) investing activities

(c) financing activities

(d) No adjustment is made

Answer:

(b) investing activities

Question 106.

While calculating cash flow from operating activity, payment and receipts shown in profit and loss account are converted into payment and receipt in cash by eliminating

(a) non-cash expenses from expenses incurred

(b) non-cash revenue from revenue earned

(c) non-cash expenses from profit

(d) Both (a) and (b)

Answer:

(d) Both (a) and (b)

Question 107.

What will be the treatment of proposed dividend (current year) to calculate cash flow from operating activities?

(a) Add back to the next year’s profit

(b) Add back to the current year’s profit

(c) Both (a) and (b)

(d) None of these

Answer:

(b) Add back to the current year’s profit

Question 108.

Profit before tax of a company was ₹ 2,74,000. Calculate profit before working capital changes from the following information.

I. Depreciation on fixed asset ₹ 20,000

II. Transfer to general reserve ₹ 44,000

III. Loss on sale of furniture ₹ 1,000

IV. Profit on sale of machinery ₹ 6,000

Codes

(a) ₹ 2,89,000

(c) ₹ 2,95,000

(b) ₹ 3,01,000

(d) ₹ 2,99,000

Answer:

(a) ₹ 2,89,000

Question 109.

Rent received will be classified under

(a) financing activity

(b) operating activity

(c) investing activity

(d) All of these

Answer:

(c) investing activity

Question 110.

ABC Ltd has the investment @ 10%, opening balance of the investment was ₹ 5,00,000 and closing balance was ₹ 10,00,000. Half of the investment held in the beginning of the year was sold at 10% profit. Calculate purchase value of investment.

(a) ₹ (12,50,000)

(b) ₹ (12,75,000)

(c) ₹ (7,50,000)

(d) ₹ (8,75,000)

Answer:

(c) ₹ (7,50,000)

Question 111.

Opening balance and closing balance of machinery (at cost) was ₹ 8,00,000 and ₹ 8,40,000 respectively and depreciation opening and closing balance was ₹ 2,00,000 and ₹ 2,20,000. During the year, a machine costing ₹ 80,000 with its accumulated depreciation of? 48,000 was sold for ₹ 40,000. Calculate purchase value of machinery.

(a) ₹ 1,20,000

(b) ₹ 1,30,000

(c) ₹ 50,000

(d) ₹ 1,25,000

Answer:

(a) ₹ 1,20,000

Question 112.

Dividend paid by a company is classified under finance activity, whether it is non-finance or finance company because

(a) dividend is associated with share capital

(b) dividend is part of profit and loss account

(c) dividend is part of balance sheet

(d) None of the above

Answer:

(a) dividend is associated with share capital

Question 113.

ABC Ltd had opening and closing balance of equity shares of ₹ 20,00,000 and ₹ 30,00,000. Company issued bonus shares in the ratio of 2 : 1 by capitalising reserve. What will be net cash flow from this transaction?

(a) ₹ 10,00,000

(b) ₹ 20,00,000

(c) ₹ 30,00,000

(d) No cash flow

Answer:

(d) No cash flow

![]()

Question 114.

Ram Ltd is a financial company whose equity share capital in the year 2010 was ₹ 28,00,000 which got increased to ₹ 35,00,000 in the year 2011. Calculate the amount of issue of equity share capital.

(a) ₹ (7,00,000)

(b) ₹ 35,00,000

(c) ₹ 28,00,000

(d) None of these

Answer:

(a) ₹ (7,00,000)