Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 3 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 3 with Solutions

Time :3 hrs

Max. Marks: 80

Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Part-A has Accounting for Partnership Firms and Companies.

- Part-B has Analysis of Financial Statements.

- Questions Nos. 1 to 16 and 27 to 30 carries 1 mark each.

- Questions Nos. 17 to 20, 31 and 32 carries 3 marks each.

- Questions Nos. from 21, 22 and 33 carries 4 marks each

- Questions Nos. from 23 to 26 and 34 carries 6 marks each

-

There is no overall choice. However, an internal choice has been provided in 7 questions of

one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks.

Part A

(Accounting for Partnership Firms and Companies)

Question 1.

A company allotted 20,000 shares to applicants of 50,000 shares after rejecting 10,000 applications. The ratio in which company allotted the shares will be [1]

(a) 5 : 2

(b) 5 : 3

(c) 2:1

(d) 3:1

Or

When shares offered to public are completely subscribed, it is

(a) full subscription of shares

(b) under subscription of shares

(c) no subscription of shares

(d) None of the above

Answer:

(c) Applicants of 40,000 shares were allotted 20,000 shares. Ratio 40,000 20,000 i.e. 2: 1

Or

(a) full subscription of shares

![]()

Question 2.

If a share of 10 on which 8 has been paid up is forfeited, it can be reissued at the minimum price of ……………… [1]

(a) 10 pershare

(b) 8pershare

(c) 5 per share

(d) 2 per share

Answer:

(d) 2 per share

Question 3.

Which of the following is correct about loss on issue of debentures? [1]

(a) It is written-off out of securities premium reserve

(b) It is written-off out of general reserve and statement of profit and loss

(c) It is written-off out of both (a) and (b)

(d) It is written-off out of discount on issue of debentures account

Answer:

(c) It is written-off ovt of both (a) and (b)

Question 4.

In a firm, 10% of net profit after deducting all adjustments, including reserve is transferred to general reserve. The net profit after all adjustments but before transfer to general reserve is ₹ 88,000. Calculate the amount which is to be transferred to reserve. [1]

(a) ₹ 5,000

(b) ₹ 8,000

(c) ₹ 8,800

(d) ₹ 4,400

Answer:

(b) 10% of net profit after adjustments

= 88,000 x \(\frac{10}{110}\) = ₹ 8,000

![]()

Question 5.

Assertion (A) Calls-in- arrear is the amount which has not been called by the company but has been paid by the shareholders. [1]

Reason (R) Calls-in-arrear will be shown as a deduction from the subscribed but not fully paid up capital.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer:

(d) Calls-in-arrear is the amount which has not been paid by the shareholder till due date.

Question 6.

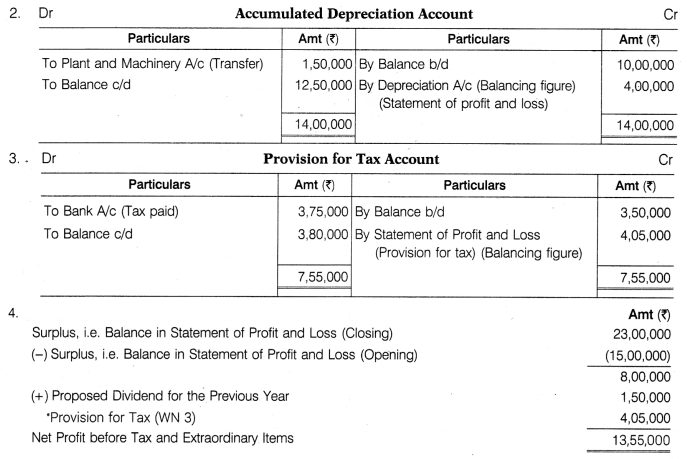

Emi, Nemi and Kimi are partners sharing profits in the ratio of 5 : 3 : 2. They have admitted Vimi into the partnership for 1/6th share. An extract of their balance sheet on 1st April, 2022 is as follows:

If the market value of investments is 2,90,000, then the investment fluctuation fund will be shown in the balance sheet of the firm at [1]

(a) 27,000

(b) 20,000

(c) 10,000

(d) 13,000

Answer:

(c) Difference between cost price and market value of investments is 10000(3,00.000 – 2,90,000 thus investment fluctuation fund will be shown at 10,000 in the balance sheet of new firm.

![]()

Question 7.

interest is to be charged on drawings from the partners in case of …………….. [1]

(a) no interest clause in deed

(b) absence of deed

(c) an oral agreement between partners including interest clause

(d) Both (a) and (b)

Or

A partner withdraws ………… on 30th September, 2022. Deed provides interest on drawings @ 10%. The total interest charged was ₹ 1,000.

(a) ₹ 1,000

(b) ₹ 5,000

(c) ₹ 10,000

(d) ₹ 20,000

Answer:

(d) Both (a) and (b)

Or

(d) Drawings =x x \(\frac{10}{100}\) x \(\frac{6}{12}\) =1,000

∴ x = ₹ 20,000

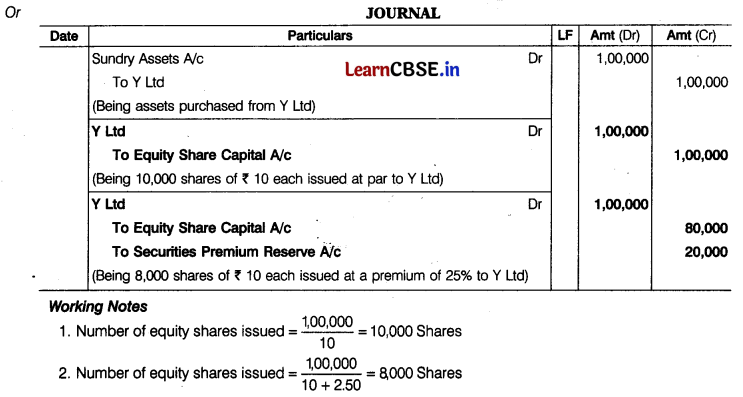

Question 8.

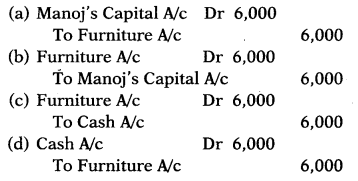

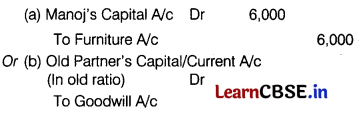

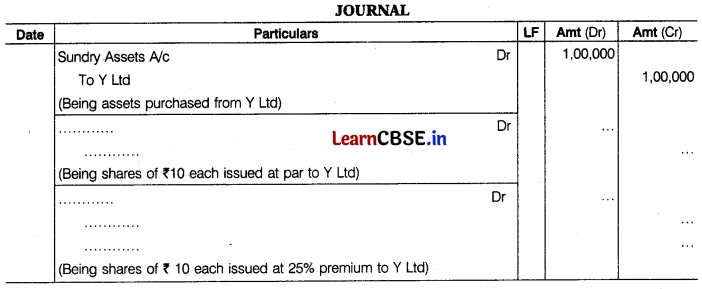

Pass the necessary entry for the following transaction. [1]

A furniture of ₹ 6,000 (book value) is taken by Manoj, who is a partner of Royals.

Or

What will be the entry for writing-off goodwill at the time of retirement?

Answer:

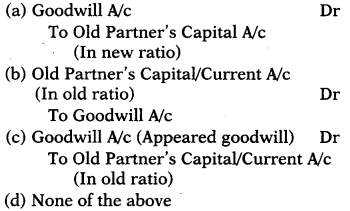

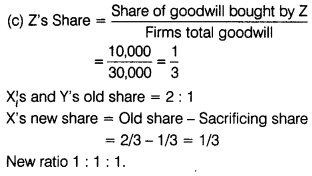

Question 9.

X and Y were in partnership sharing profits and losses in the ratio of 2: 1. They admitted Z as a new partner. Z brought 10,000 as her share of goodwill premium, which was entirely credited to X’s capital account. On the date of admission, good will of the firm was valued at 30,000. Calculate the new profit sharing ratio. [1]

(a) 1:2:1

(b) 2:1:1

(c) 1:1:1

(d) 3:2:1

Answer:

![]()

Question 10.

What will be the correct sequence of following events? [1]

(i) Forfeiture of shares

(ii) Default on calls

(iii) Reissue of shares

(iv) Amount transferred to capital reserve Codes

(a) (i), (iv), (ii), (iii)

(b) (ii), (iv), (i), (iii)

(c) (ii), (i), (iii), (iv)

(d) (iii), (iv), (i) (ii)

Answer:

(c) (ii), (i), (iii), (iv)

True

True

True

Question 11.

Upon the admission of Rohan, the sacrifice for providing his share of profits would be done by [1]

(a) only Raj

(b) only Taj

(c) Raj and Taj equally

(d) Raj and Taj in the ratio of 3: 2

Answer:

(d) Raj and Taj in the ratio of 3: 2

Question 12.

Rohan will be entitled to a remuneration of at the end of the year.

(a) ₹ 55,000

(b) ₹ 65,000

(c) ₹ 75,000

(d) ₹ 70,000

Answer:

(c) Remuneration =12,500 x 6 = ₹ 75,000

![]()

Question 13.

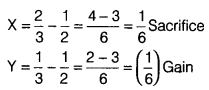

X and Y were partners in a firm sharing profits and losses in the ratio of 2: 1. With effect from 1st January, 2023, they decided to share profits and losses equally. Individual partner’s gain or sacrifice due to change in the ratio will be [1]

(a) Gain by X 1/6, Sacrifice by Y 1/6

(b) Sacrifice by X 1/6, Gain by Y 1/6

(c) Gain by X 1/2, Sacrifice by Y 1/2

(d) Sacrifice by X 1/2, Gain by Y 1/2

Answer:

(b) Sacrificing/Gaining Share = Old Share – New Share

Question 14.

Assertion (A) Interest on loan is recorded in profit and loss account. [1]

Reason (R) Interest on loan is a charge against profit.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

Question 15.

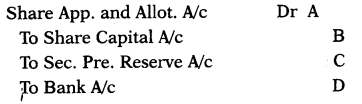

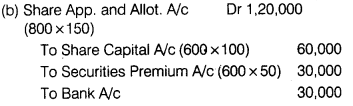

XYZ Ltd invited applications for issuing 600 shares of ₹ 100 each at a premium of ₹ 50 per share. The full amount was payable on application. Applications were received for 800 shares. Applications for 200 shares were rejected and application money was refunded. Shares were allotted to the remaining applicants. Journal entry for adjusting the application money received in the books of XYZ Ltd is as follows [1]

Here A, B, C, D are

(a) ₹ 1,20,000, ₹ 30,000 , ₹ 30,000 , ₹ 60,000 respectively

(b) ₹ 1,20,000, ₹ 60,000 , ₹ 30,000 , ₹ 30,000 respectively

(c) ₹ 60,000 , ₹ 30,000 , ₹ 15,000 , ₹ 15,000 respectively

(d) ₹ 60,000 , ₹ 15,000 , ₹ 15,000 , ₹ 30,000 respectively

Or

Neton Ltd has in its Memorandum of Association, capital clause stating that it is formed with 75,000 equity shares of ₹ 100 each. The company has issued the entire shares and the public has also subscribed and paid-up for the full amount on application itself. What will be the subscribed capital?

(a) ₹ 75,00,000

(b) ₹ 10,00,000

(c) ₹ 1,00,000

(d) ₹ 7,50,000

Answer:

Or

(a) Total authorised capital (75,000 x 100)

= ₹ 75,00,000

Since, complete capital has been subscribed by the public, thus subscribed capital is equal to authorised capital.

![]()

Question 16.

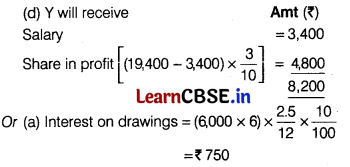

X, Y and Z are partners in the ratio of 5: 3: 2. Before Y’s salary of ₹ 3,400, firm’s profit is ₹ 19,400. How much in total, Y will receive from the firm?

(a) ₹ 3,400

(b) ₹ 8,000

(c) ₹ 4,800

(d) ₹ 8,200

Or

Ram is a partner in a firm. He withdraws regularly ₹ 6,000 at the end of every month for the six months ending 31st March, 2023. If interest on drawings is charged (a) 10% p.a., the interest charged will be

(a) ₹ 750

(b) ₹ 900

(c) ₹ 1,050

(d) ₹ 1,800

Answer:

Question 17.

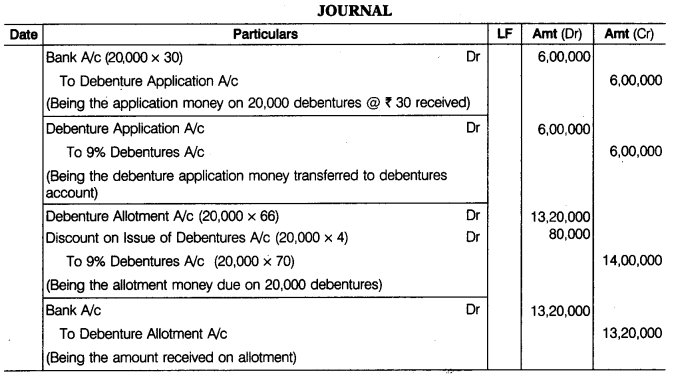

ABC Ltd issued 20,000, 9% debentures of loo each at a discount of 4% payable 30 on application and the balance on allotment. The debentures are redeemable after 5 years. Give necessary journal entries for the issue of debentures. Or Complete the missing information.

Answer:

Question 18.

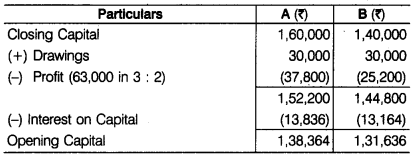

A and B are partners in the ratio of 3: 2. The firm maintains fluctuating capital accounts and the balance of the same as on 31st March, 2023 amounted to ₹ 1,60,000 and ₹ 1,40,000 for A and B respectively. Their drawings during the year were ₹ 30,000 each. As per partnership deed, interest on capital @ 10 % p.a. on opening capitals had been provided to them. Calculate opening capitals of partners given that their profits were ₹ 90,000.

Answer:

Calculation of Opening Capitals and Interest on Capital

![]()

Question 19.

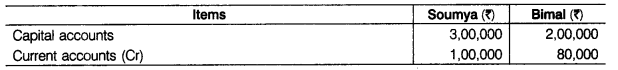

Soumya and Bimal are partners in a firm sharing profit and loss in the ratio of 3 : 2. The balances in their capital and current accounts as on 1st April, 2022 were as under

The partnership deed provides that Soumya is to be paid salary @ ₹ 500 per month whereas, Bimal is to get a commission of ₹ 40,000 for the year. Interest on capital is to be credited at 6 % per annum. The drawings of Soumya and Bimal for the year were ₹ 30,000 and ₹ 10,000, respectively. The net profit of the firm before making these adjustments was ₹ 2,49,000. Interest on Soumya’s drawings was ₹ 750 and Bimal’s drawings was ₹ 250. Prepare profit and loss appropriation account. [3]

Answer:

Question 20.

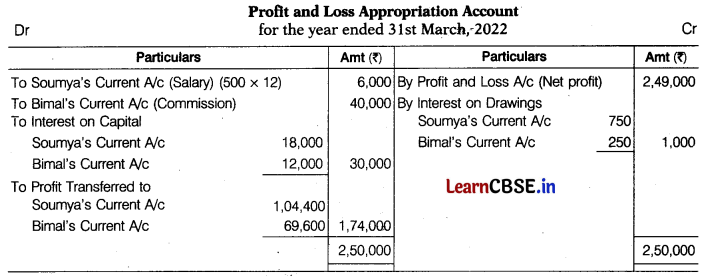

X, Y and Z are partners sharing profits and losses in the ratio of 2: 2: 1. Y retires from the firm on 31st March, 2020. On the date of Y’s retirement, the following balances appeared in the books of the firm

Advertisement suspense account — ₹ 25,000

Contingency reserve — ₹ 15,000

Workmen’s compensation reserve — ₹ 20,000

Loss in business account — ₹ 15,000

Pass the necessary journal entries for the adjustment of these items on Y’s retirement. [3]

Or

AK and BK are partners sharing profits and losses in the ratio of 5: 1. They agreed to admit CK as a partner. Profits will be shared equally in future. CK brought in ₹ 60,000 as a premium for his share in profits. Pass necessary journal entries in the books of the firm.

Answer:

Question 21.

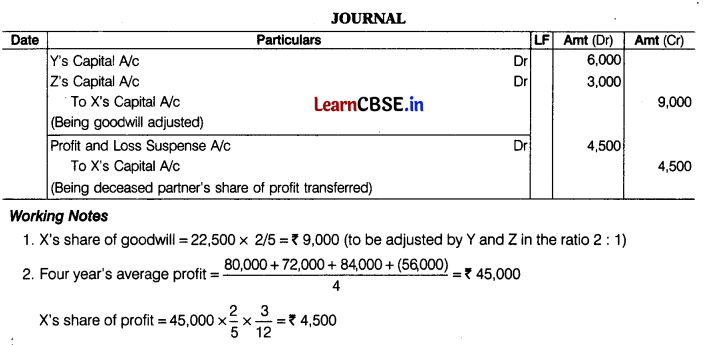

X, Y and Z were partners in a firm sharing profits in 2: 2: 1 ratio. X died on 1st July, 2022. On that date, the goodwill of the firm was valued at ₹ 22,500. On the death of a partner, his share of profit in the year of death was to be calculated on the basis of the average profits of the last four years. The profit for the last four years were

2018-19 — ₹ 80,000

2019-20 — ₹ 72,000

2020-21 — ₹ 84,000

2021-22 — ₹ 56,000 (Loss)

Pass necessary journal entries.

Answer:

![]()

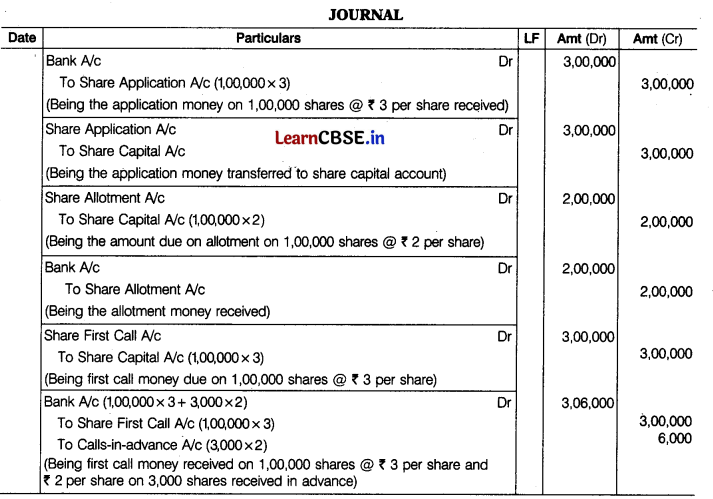

Question 22.

Geet Ltd with a registered capital of ₹ 25,00,000 in shares of ₹ 10 each issued 1,00,000 of such shares, payable ₹ 3 per share on application, ₹ 2 per share on allotment and ₹ 3 per share on first call. All the amounts payable on allotment were duly received. On the first call being made, one shareholder paid the entire balance in his holding of 3,000 shares. Give journal entries to record the transactions.

Answer:

![]()

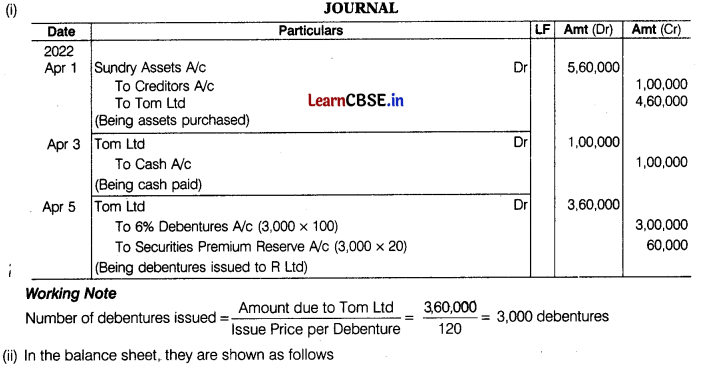

Question 23.

(i) Bob Ltd bought the business of Tom Ltd on 1st April, 2022 consisting of sundry assets of ₹ 5,60,000 and creditors of ₹ 1,00,000. ₹ 1,00,000 was paid in cash on 3rd April, 2022 and for the balance, 6 % debentures were issued at a premium of 20% on 5 th April, 2022. Pass necessary journal entries in the books of Bob Ltd for the above mentioned transactions.

(ii) Max Ltd has 10,000,9% debentures of ₹ 100 each outstanding in the books of accounts as on 31st March, 2018, to be redeemed on 31st March, 2023. Show how will you disclose debentures in the balance sheet.

Answer:

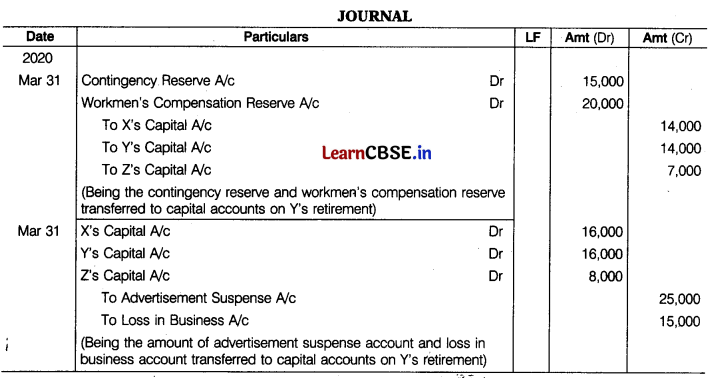

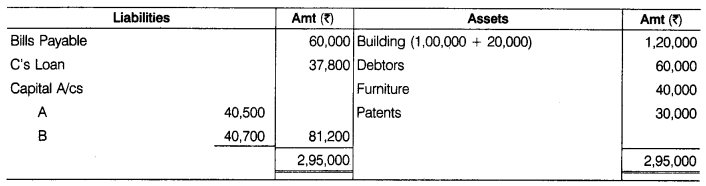

Question 24.

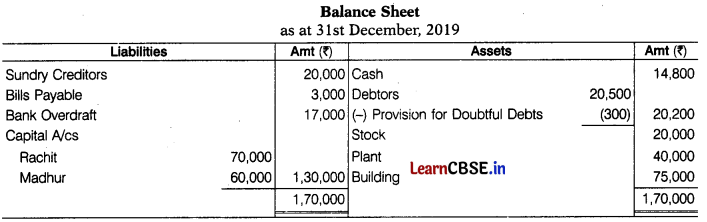

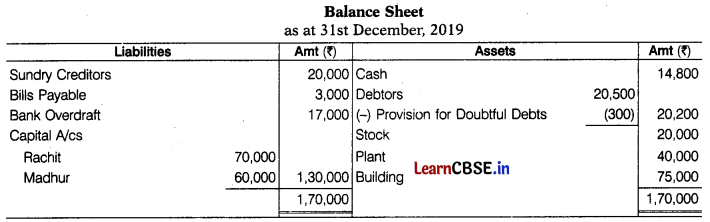

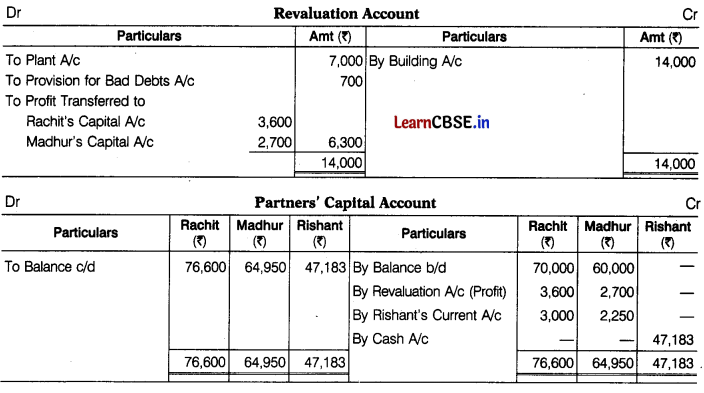

Rachit and Madhur were partners in a firm sharing profits and losses in the ratio of 4 : 3.

The following is the balance sheet of the firm as on 31st December, 2019.

They agreed to admit Rishant as a partner with effect from 1st January, 2020 for 1/4th share in profits on the following terms

(i) Rishant will bring in ₹ 47,183 as his capital.

(ii) Building is to be appreciated by ₹ 14,000 and plant to be depreciated by ₹ 7,000.

(iii) The provision on debtors is to be raised to ₹ 1,000

(iv) The goodwill of the firm has been valued at ₹ 21,000

Prepare revaluation account, partners’ capital account and balance sheet of the firm immediately after Rishant’s admission.

Or

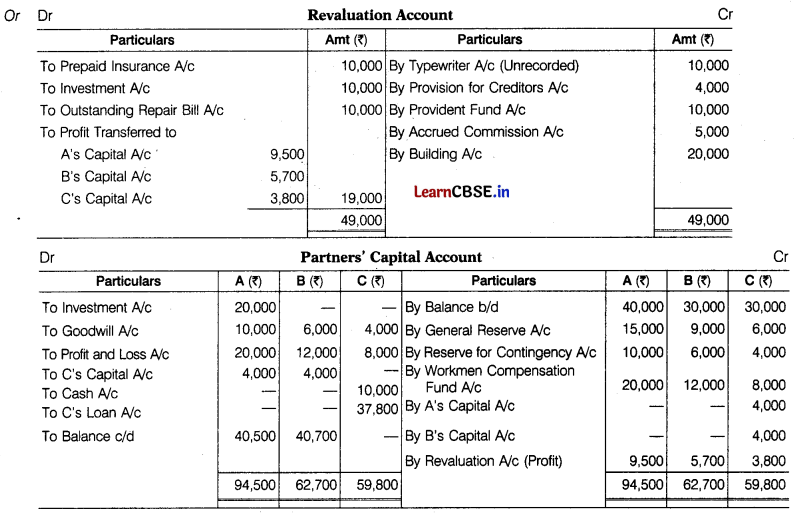

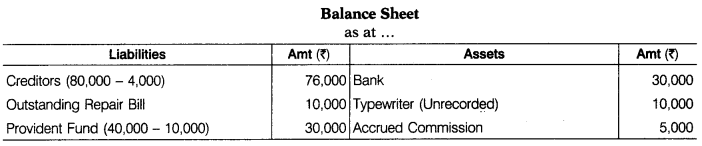

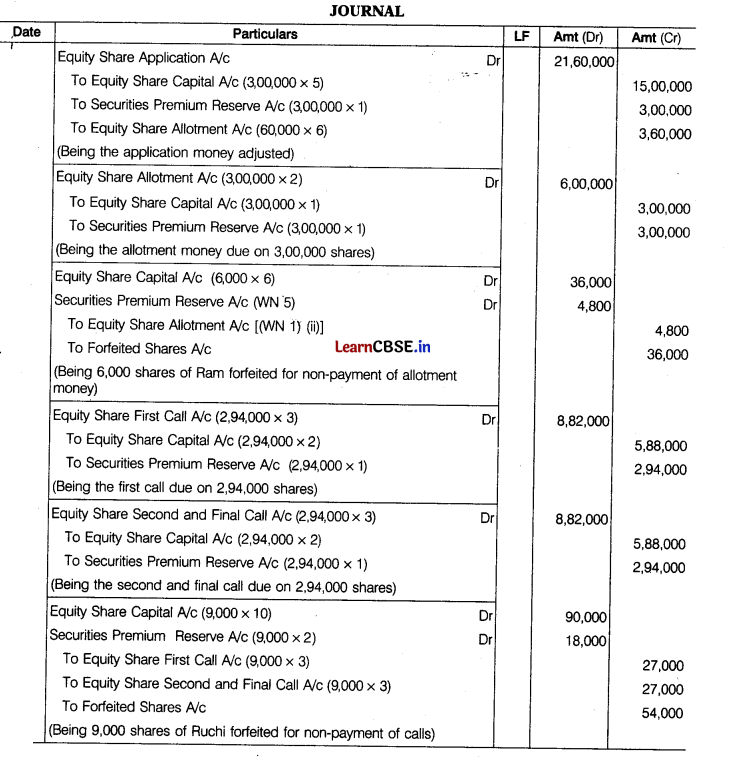

A, B and C are partners with profit sharing ratio 5: 3: 2. Their balance sheet is as follows

Additional Information

(i) C takes retirement, new ratio of A and B is 3: 2.

(ii) ₹ 10,000 given to C in cash and balance transferred to C’s loan account.

(iii) Prepaid insurance is no more required.

(iv) ₹ 10,000 unrecorded typewriter has to be shown in the balance sheet.

(v) Investment is valued at ₹ 20,000 and is taken over by A at this value.

(vi) Make 5% provision for discount on creditors.

(vii) Outstanding repair bills due ₹ 10,000

(viii) Provident fund decreased by ₹ 10,000

(ix) Accrued commission ₹ 5,000.

(x) Building increased by 20%.

(xi) Goodwill of the firm valued at ₹ 40,000.

Prepare necessary ledgers.

Answer:

![]()

Working Note

Rishant’s share of goodwill =21,000 x \(\frac{1}{4}\) =₹ 5,250

To be distributed among old partners in their sacrificing ratio, i.e. 4: 3.

Rachit’s gain =5,250 x \(\frac{4}{7}\) = ₹ 3,000

Madhur’s gain =5,250 x \(\frac{3}{7}\) = ₹ 2,250

![]()

Working Notes

1. Calculation of Gaining Ratio

Gaining ratio = New share – Old share

\(A=\frac{3}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\) ; \(\quad B=\frac{2}{5}-\frac{3}{10}=\frac{4-3}{10}=\frac{1}{10}\)

Gaining ratio = 1: 1

2. C’s Share in Goodwill

Goodwill = 40,000 x \(\frac{2}{10}\) = ₹ 8,000

₹ 8,000 given by continuing partners in gaining ratio, i.e. 1: 1

Question 25.

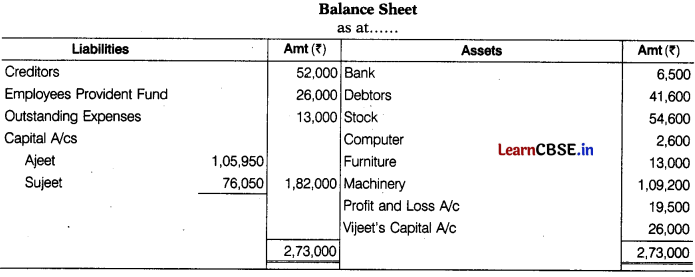

The balance sheet of Ajeet, Vijeet and Sujeet on the date of dissolution was as follows

Sujeet was appointed to realise the assets and pay the liabilities. He was entitled to receive 5% commission on the amounts realised from sale of assets. He was also to bear the expenses of realisation. Assets realised as follows Machinery -₹ 91,000; Debtors -₹ 26,000; Furniture -₹ 9,750; Stock at 60% of its book value. Expenses of realisation amounted to ₹ 1,950. An office typewriter realised ₹ 3,250 which was not shown in the books of accounts. There was a contingent liability of ₹ 6,500 for bills discounted for which ₹ 2,600 had to be paid. Prepare realisation account.[6]

Answer:

![]()

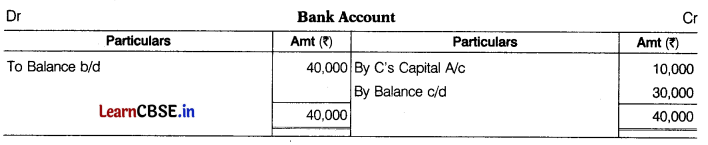

Question 26.

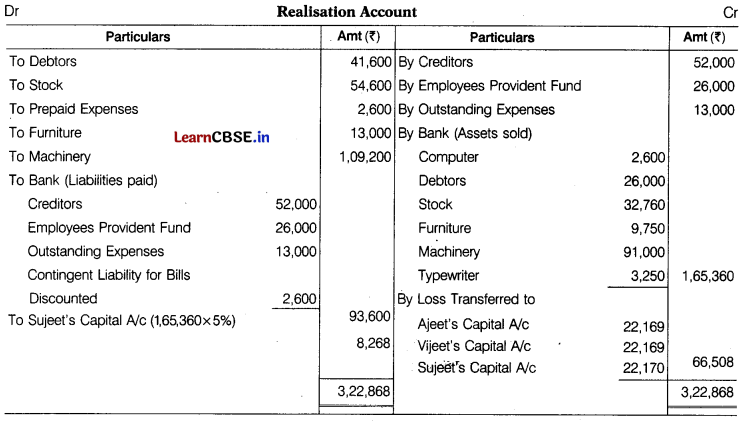

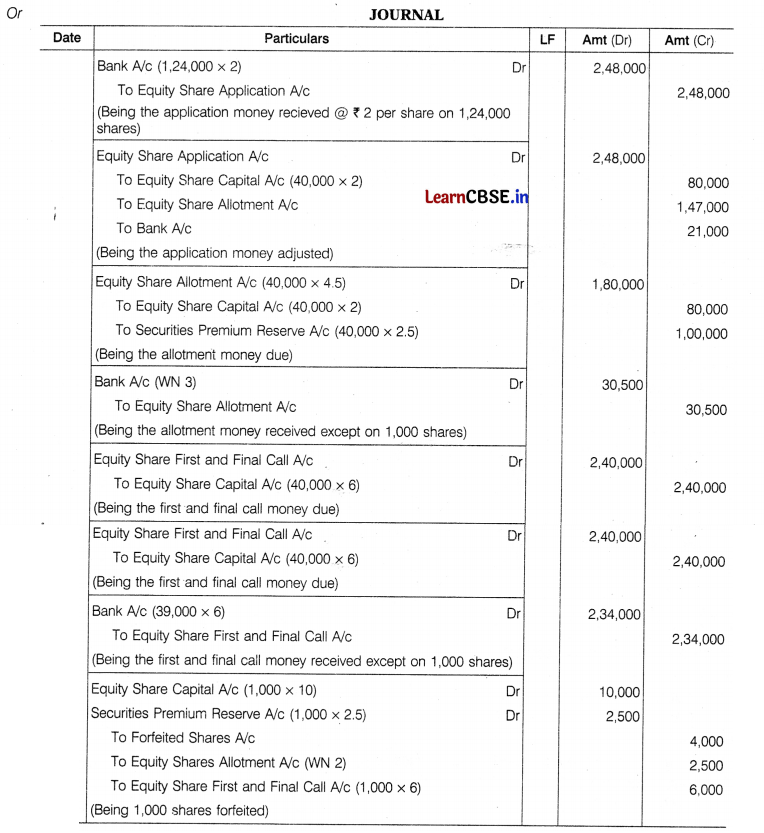

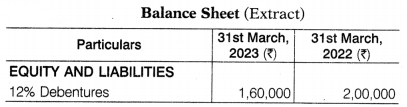

On 1st April, 2019, Ranjana Ltd made an issue of 3,00,000 equity shares of $₹ 10$ each at a premium of ₹4 per share, payable as follows

₹ 6 on application (including ₹ 1 premium); ₹ 2 on allotment (including ₹ 1 premium)

₹ 3 on first call (including ₹ 1 premium); ₹ 3 on second and final call (including ₹ 1 premium)

Applications were received for 4,50,000 shares, of which applications for 90,000 shares were rejected and their money was refunded. Rest of the applicants were issued shares on pro-rata basis and their excess money was adjusted towards allotment.

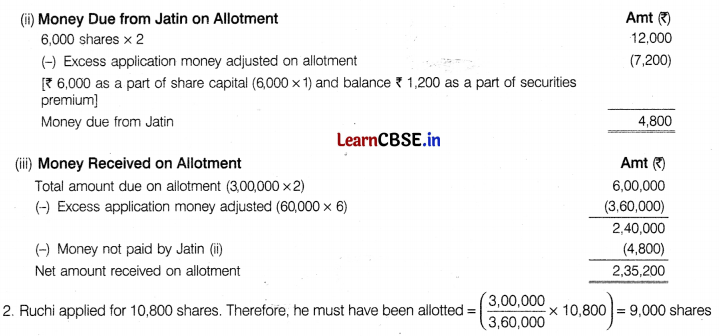

Jatin, to whom 6,000 shares were allotted, failed to pay the allotment money and his shares were forfeited after allotment. Ruchi, who applied for 10,800 shares failed to pay the two calls – and on her such failure, her shares were forfeited.

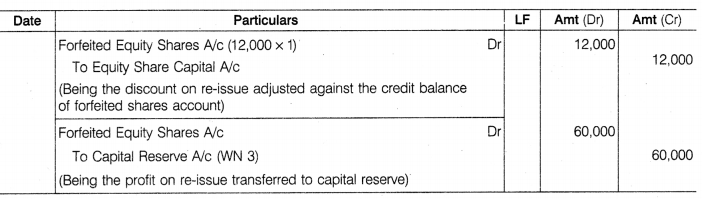

12,000 forfeited shares were re-issued as fully paid on receipt of ₹ 9 per share, the whole of Ruchi’s shares being included. Prepare the cash book and pass the necessary journal entries. [6]

Or

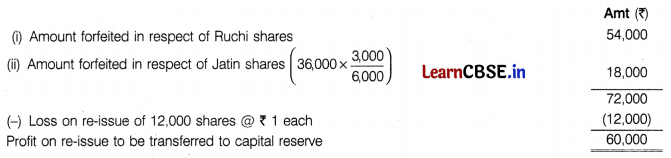

Or Krishna Ltd issued 40,000 equity shares of ₹ 10 each at a premium of ₹2.50 per share. The amount was payable as follows

On application ₹ 2per share, on allotment ₹ 4.50 per share (including premium) and on call ₹6 per share.

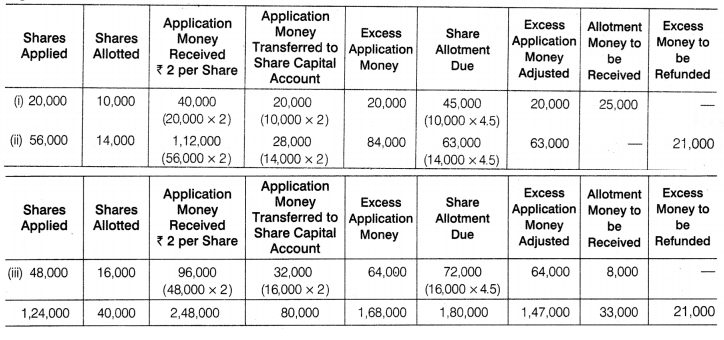

Owing to heavy subscription, the allotment was made on pro-rata basis as follows

(i) Applicants for 20,000 shares were allotted 10,000 shares.

(ii) Applicants for 56,000 shares were allotted 14,000 shares.

(iii) Applicants for 48,000 shares were allotted 16,000 shares.

It was decided that the excess amount received on applications would be utilised on allotment and the surplus would be refunded.

Riya, to whom 1,000 shares were allotted and who belongs to category (i), failed to pay allotment money. Her shares were forfeited after the call. Pass the necessary journal entries in the books of Krishna Ltd for the above transactions.

Answer:

Working Notes

1. (i) Excess Amount Received from Jatin on Application

6,000 shares were allotted to Jatin. Therefore, he must have applied for

\(\left(\frac{3,60,000}{3,00,000} x 6,000\right)\) = 7,200 shares

Excess application money received from Jatin (7,200-6,000)=1,200 shares x 6 = ₹ 7,200

She has not paid best and second call money. As such,

- First call money will be received on (294,o0o — 9000 shares of Ruchi) = 2,85000 shares

- Second call money will be received on (2,94000 — 9,000 shares of Ruchi) = 2,85000 shares

3. Amount Transferred to Capital Reserve

12,000 shares have been re-issued which include 9,000 shares of Ruchi and the balance 3,000 of Jatin

4. Balance in Forfeited Shares Account

Profit on 6,000 shares of Jatin ₹ 36,000.

Therefore, the balance of forfeited shares accounts on 3,000 unissued shares \(\left(\frac{36,000}{6,000} x 3,000\right)\) is ₹ 18,000.

![]()

False

False

Working Notes

Note After adjustment of excess application money on allotment, there is still balance, in case of category (ii),

₹ 21,000 (i.e. 84,000 – 63,000 ). This balance will be refunded to the shareholders.

Money Due from Riya on Allotment Category (i) applicants for 20,000 shares were allotted 10,000 shares. Riya was allotted 1,000 shares She applied for \(\left(\frac{20,000}{10,000} \times 1,000\right) \) =2,000 shares

Therefore, application money paid by Riya (2,000 x 2) = ₹ 4,000

Part B

(Financial Statement Analysis)

Question 27.

Which of the following is not an item of sub-head ‘other current liabilities’ in balance sheet?

(a) Creditors

(b) Outstanding expenses

(c) Advance income

(d) Both (b) and (c)

Or

If debt-equity ratio is 2: 1, which of the following will have no effect on it?

(i) Purchase of fixed assets by taking loan

(ii) Sale of fixed assets at a loss

(iii) Issue of bonus shares

(iv) Declaration of final dividend Codes

(a) (i) and (ii)

(b) Only (iv)

(c) Only (iii)

(d) (i), (ii) and (iv)

Answer:

(a) Creditors

Or

(c) Only (iii)

![]()

Question 28.

Statement I Bills receivable endorsed to trade payables will have no effect on current ratio.

Statement II Issue of new shares/ debentures for cash will improve current ratio.

Alternatives

(a) Both the statements are true

(b) Both the statements are false

(c) Statement I is true and Statement II is false

(d) Statement II is true and Statement I is false

Or

Financial statement analysis includes and of financial statements.

(a) analysis, preparation

(b) preparation, interpretation

(c) preparation, analysis

(d) analysis, interpretation

Answer:

(d) Statement II is true and Statement I is false

Or

(d) analysis, interpretation

Question 29.

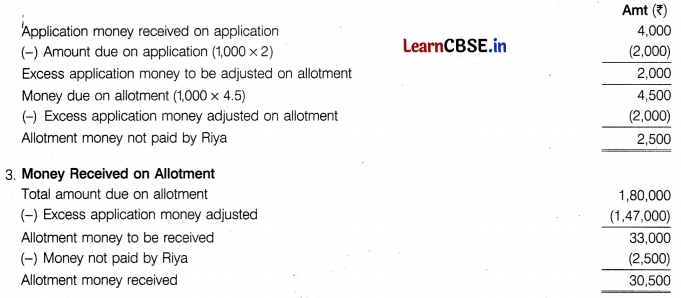

Additional Information

Interest on debentures is paid on half yearly basis on 30th September and 31st March each year. Debentures were redeemed on 30th September, 2022. How much amount (related to above information) will be shown in financing activity for cash flow statement prepared on 31st March, 2023?

(a) Outflow ₹ 40,000

(b) Inflow ₹ 42,600

(c) Outflow ₹ 61,600

(d) Outflow ₹ 64,000

Answer:

(c) Cash Flow from Financing Activity

Question 30.

The net amount of source or use of cash when a fixed asset (having book value ₹ 1,20,000 ) is sold at a loss of ₹ 40,000 in terms of cash flow will be

(a) ₹ 1,20,000

(b) ₹ 40,000

(c) ₹ 80,000

(d) ₹ 1,60,000

Answer:

(c) Source of cash =1,20,000-40,000=₹ 80,000 (Cash inflow through investing activities by selling of fixed assets)

Question 31.

Explain any three items of reserves that are shown under the heading ‘reserves and surplus’ in the balance sheet of a company as per Schedule III of the Companies Act, 2013. [3]

Answer:

The three items shown under the heading ‘reserves and surplus’ are

(i) Capital Reserve Capital reserve is the main sub-heading of reserve and surplus which is created from capital profits/gains of the business and retained for writing-off the losses of the company.

: (i) Securities Premium Reserve (SPR) Securities Premium Reserve (SPR) is that reserve which is created/collected by issuing shares more than its face value by a company. (ii) Securities Premium Reserve (SPR) Securities Premium Reserve (SPR) is that reserve which is created/collected by issuing shares more than its face value by a company.

True

![]()

Question 32.

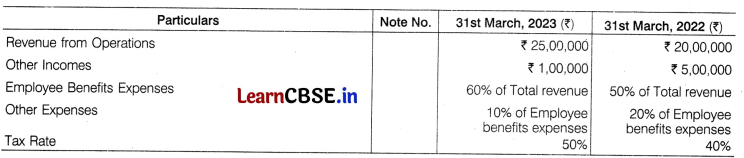

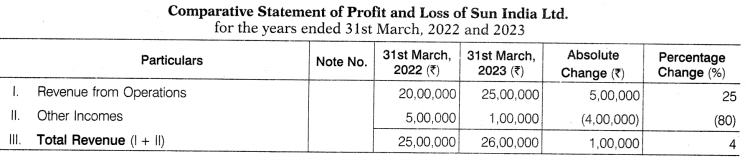

Following is the statement of profit and loss of Sun India Ltd. for the year ended 31st March, 2023.

You are required to prepare a comparative statement of profit and loss of Sun India Ltd. from the given statement of profit and loss. [3]

Answer:

Question 33.

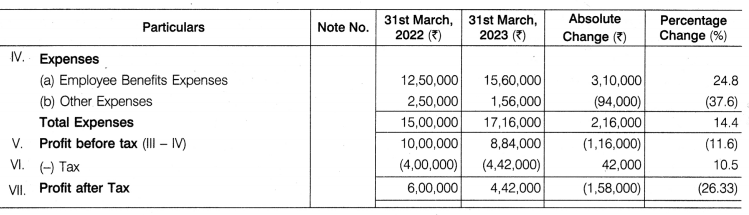

From the following information, calculate any two of the following ratios

(i) Debt to equity ratio

(ii) Working capital turnover ratio

(iii) Return on investment

Additional Information

Equity share capital ₹ 25,000, general reserve ₹ 2,500, balance of statement of profit and loss after interest and tax ₹ 7,500,9 % debentures ₹ 10,000 , creditors ₹ 7,500, land and building ₹ 32,500, equipments ₹ 7,500, debtors ₹ 7,250, cash ₹ 2,750, revenue from operations, i.e. sales for the year ended 31st March, 2019 was ₹ 25,000, tax rate is 50 \%.

Or

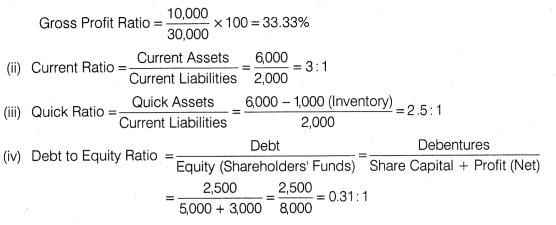

From the following data, calculate Gross Profit Ratio, Current Ratio, Quick Ratio and Debt to Equity Ratio.

Revenue from Operations ₹ 30,000, Cost of Revenue from Operations (Cost of Goods Sold) ₹ 20,000; Net Profit ₹ 3,000; Current Assets ₹ 6,000; Inventory ₹ 1,000; Current Liabilities ₹ 2,000; Share Capital ₹ 5,000 and Debentures ₹ 2,500.

Answer:

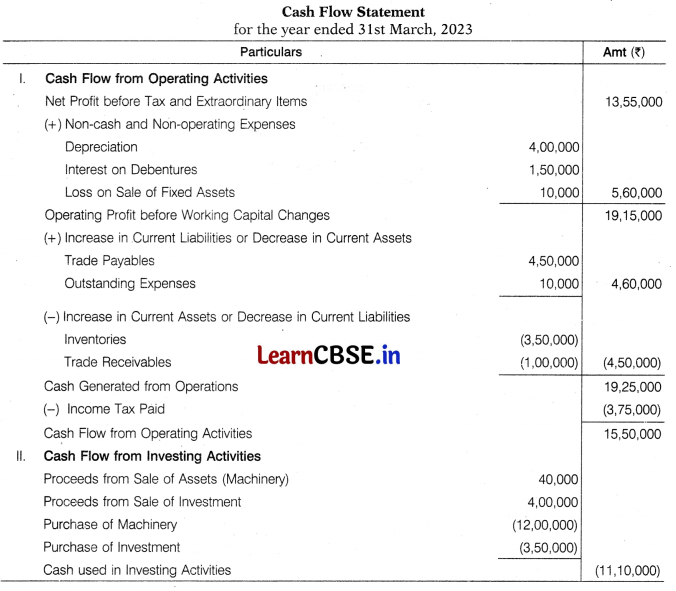

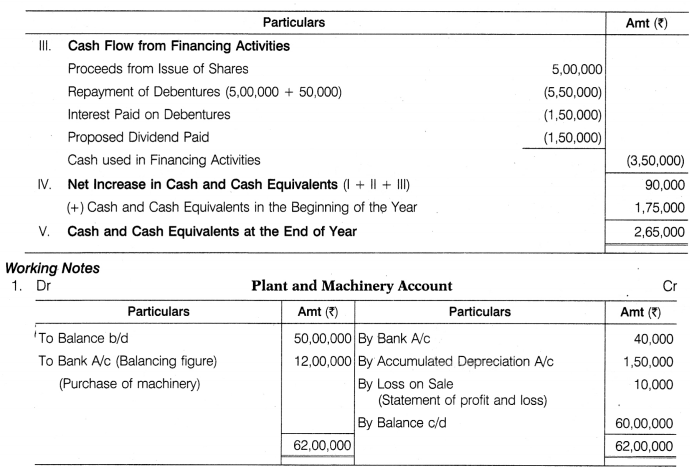

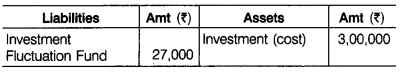

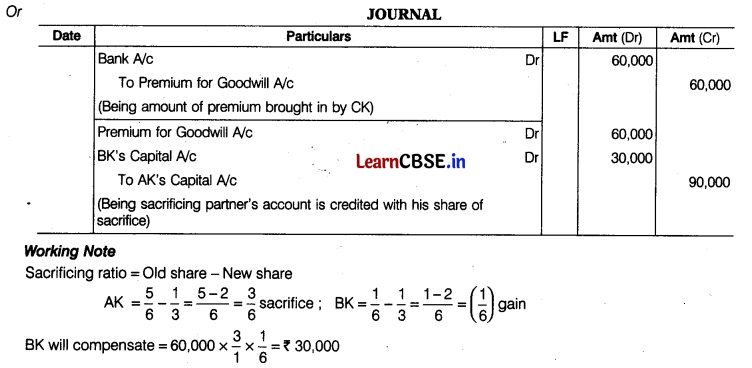

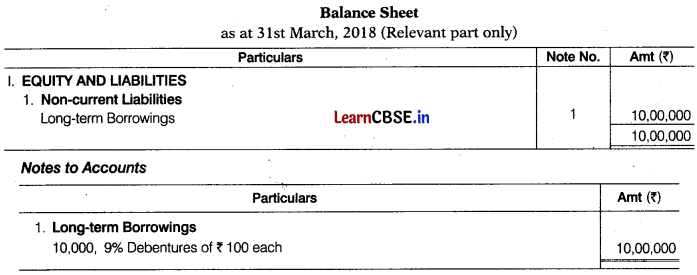

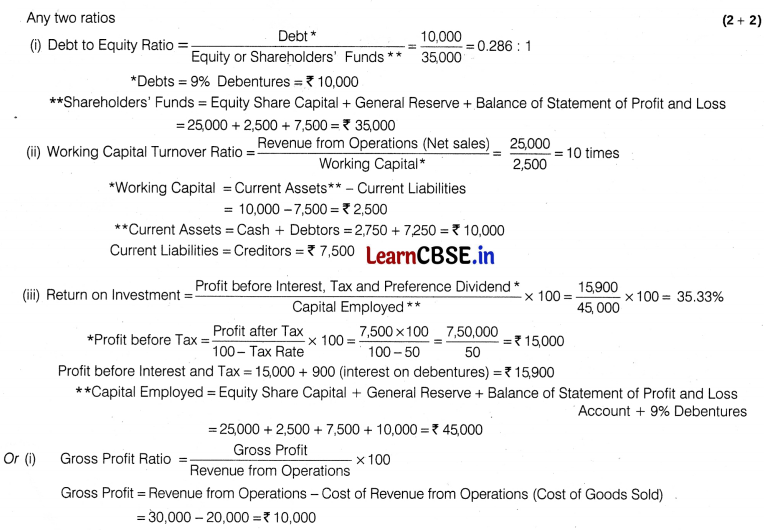

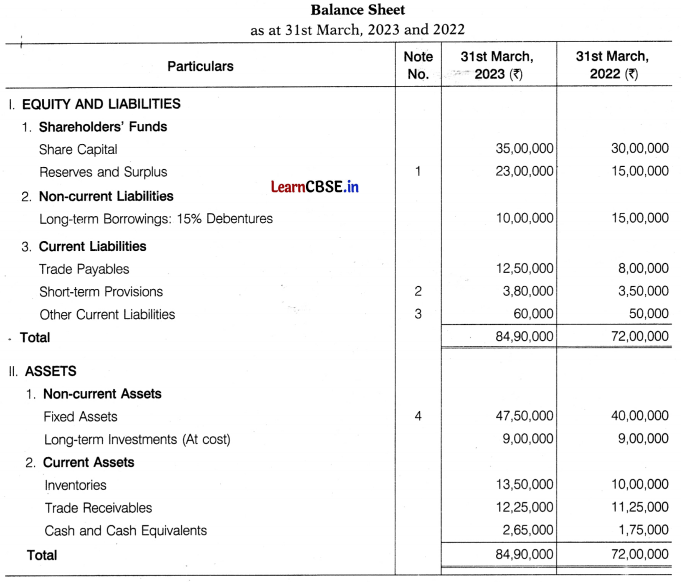

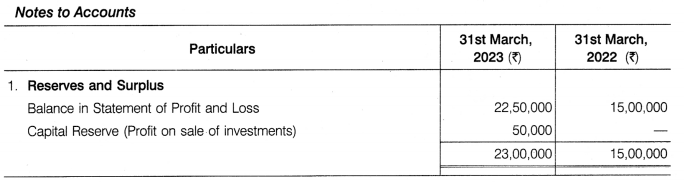

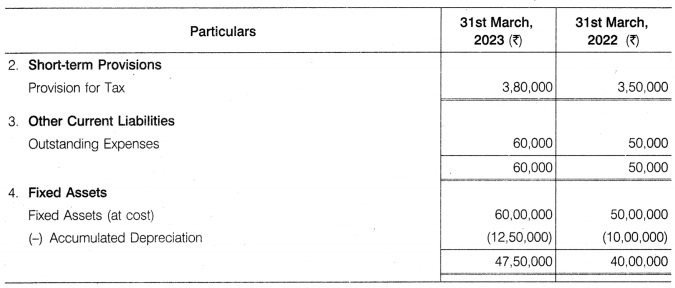

Question 34.

From the following summarised balance sheets of PQR Ltd as on 31st March, 2022 and 2023, you are required to prepare the cash flow statement.

![]()

Additional Information

(i) During the year ended 31st March, 2023, fixed assets with a net book value of ₹ 50,000 (accumulated depreciation ₹ 1,50,000 ) were sold for ₹ 40,000

(ii) During the year ended 31st March, 2023, investments costing ₹ 4,00,000 were sold.

(iii) Debentures were redeemed at a premium of 10%.

(iv) Tax of ₹ 3,75,000 was paid.

(v) Debenture interest paid during the year ended 31st March, 2023 was ₹ 1,50,000.

(vi) Proposed dividend for the year 2022 ₹ 1,50,000 and 2023 ₹ 1,70,000

Answer: